Fidelity Buys $35.9M Ethereum Amid Network Growth

April 27, 2025

- Fidelity’s $35.9M ETH purchase reflects rising institutional demand.

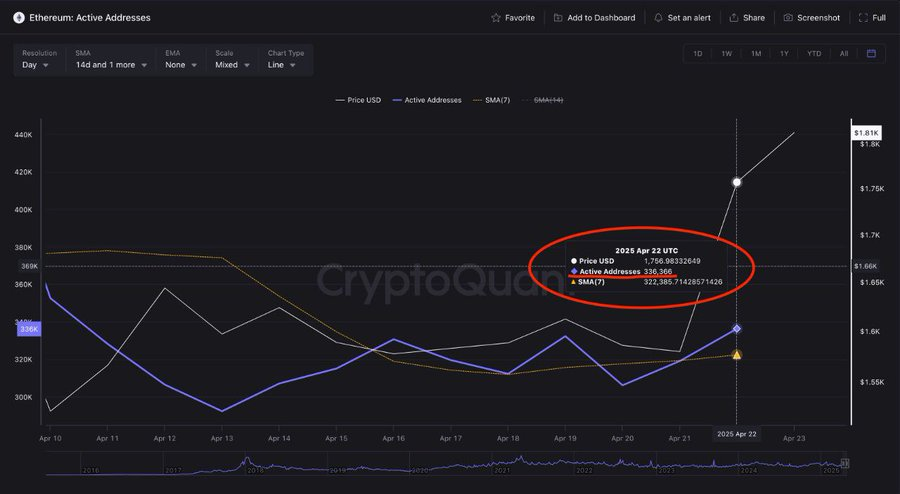

- Ethereum’s active addresses surge 10%, indicating growing adoption.

- Bullish market indicators point to a potential Ethereum price rally.

Fidelity has made a strategic investment by purchasing $35.9 million in Ethereum (ETH). This signaled a surge in institutional demand for the cryptocurrency.

Ethereum’s network activity surged alongside this move. Over 48 hours, active addresses jumped by 10%, highlighting increased engagement.

The recent purchase by Fidelity underscores the growing interest from institutional investors in ETH. The $35.9 million purchase continues a trend of institutional investment in digital assets. Major financial institutions are expanding their portfolios with cryptocurrency holdings.

Fidelity is a major financial institution with strong support for cryptocurrencies and blockchain technology. Its latest move reinforced confidence in Ethereum. This signals growing institutional interest in digital assets.

This acquisition also aligns with the rising institutional demand for ETH. Over recent months, the top altcoin has attracted considerable attention from large-scale investors.

This signaled a broader shift toward digital assets as a legitimate asset class. As institutional investors enter the market, the demand for Ethereum is expected to increase. This further supported its price and market position.

Larger institutional investors are not how ETH has grown recently. The other evidence that Ethereum is growing organically is a drastic increase in the number of active addresses on the network.

A boost in network activity was revealed from just 48 hours, as active addresses gained 10% on the momentum.

More people are engaging with ETH as active addresses rise. This increase may indicate a growing developer and user base. It also reflects higher investor interest in Ethereum’s capabilities.

This activity is likely tied toEthereum’s smart contract functionality and its role in decentralized finance (DeFi) applications. The rise of active addresses isn’t just a reflection of Ethereum’s rise. It’s a sign of the ecosystem’s growing adoption because it’s likely going to make it grow even more.

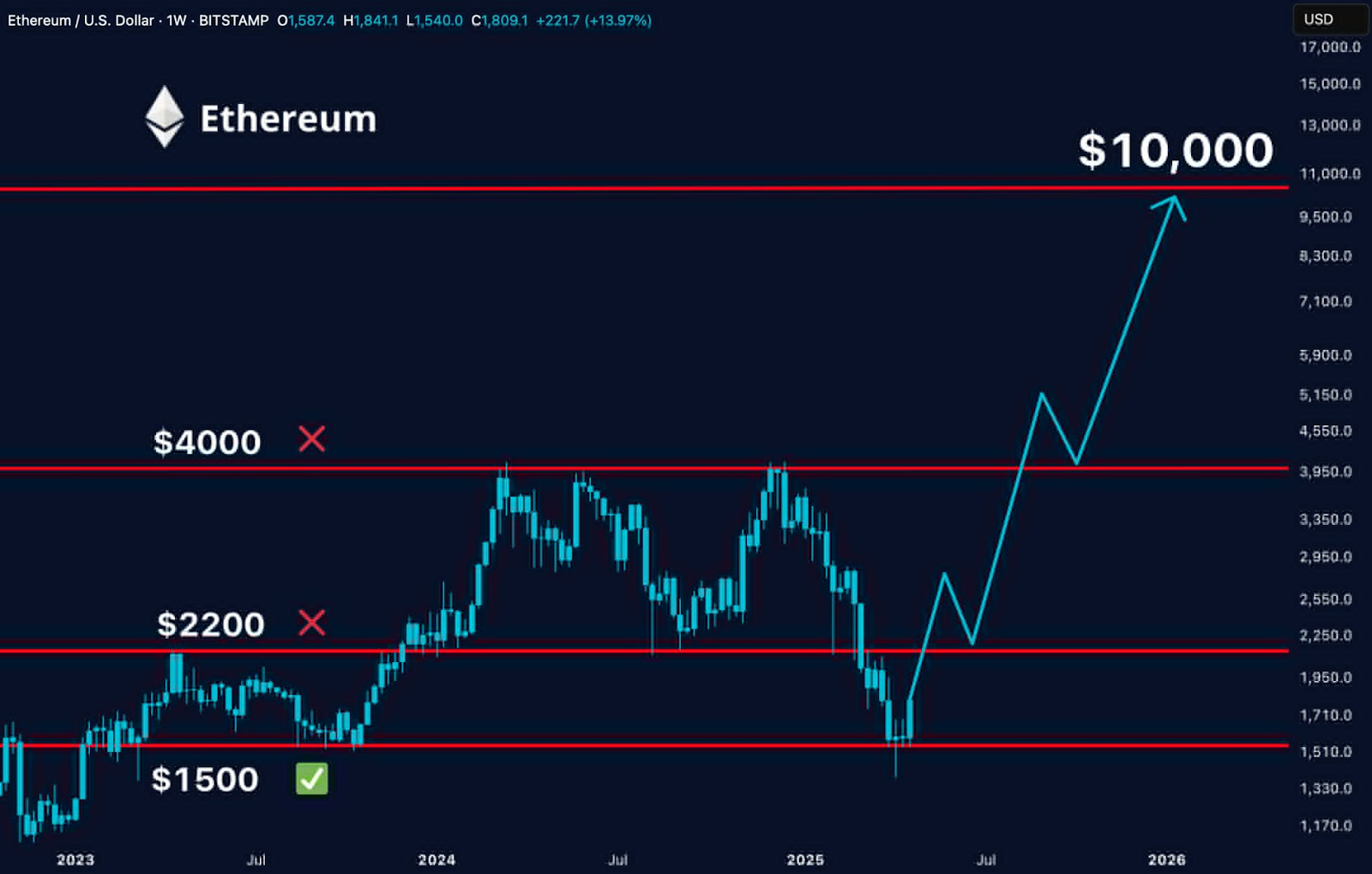

Multiple technical indicators point to Ethereum entering a bullish phase. Analysts have identified the Three Drives pattern in its price movement, reinforcing this outlook.

This pattern involves three downward moves, each deeper than the last. Traditionally, the Three Drives pattern signals a potential reversal and a shift toward an upward price trend.

After completing the third leg of the decline, the price has shown signs of a bounce. This suggests that downward pressure is subsiding.

As buying interest increases, the ETH price could rally. With the reduction in selling pressure and growing buying volume, the conditions for a breakout appear favorable. Sellers are exhausted, signaling increased buying pressure.

However, the long-term outlook of Ethereum is solid, despite its short-term price moving up and down. Strong retail and institutional demand drive ETH’s potential to reach $10,000 this cycle.

Additionally, expected network growth further supports this bullish outlook. The recent breakout above key resistance levels like $2,200 and $4,000 has strengthened the bullish sentiment surrounding the asset.

ETH has proven a resilient asset, with support levels of around $1,500 and consistently acting as a price floor. The asset has seen strong traction, with its use cases steadily growing. This expansion could drive it to new price levels in the coming months.

In this article, the views, and opinions stated by the author, or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.

Olivia Stephanie is a FinTech enthusiast with a keen understanding of financial markets. Her passion for economics and finance has led her to explore emerging blockchain technology and cryptocurrency markets.

Search

RECENT PRESS RELEASES

Related Post