Fidelity Let’s You Go Full YOLO On Ethereum, but Should You?

January 8, 2026

Crypto speculation has moved from exchanges to brokerage accounts. Spot Ethereum ETFs let investors bet on the second-largest cryptocurrency without managing wallets or private keys. But easy access doesn’t mean you should add Ethereum exposure.

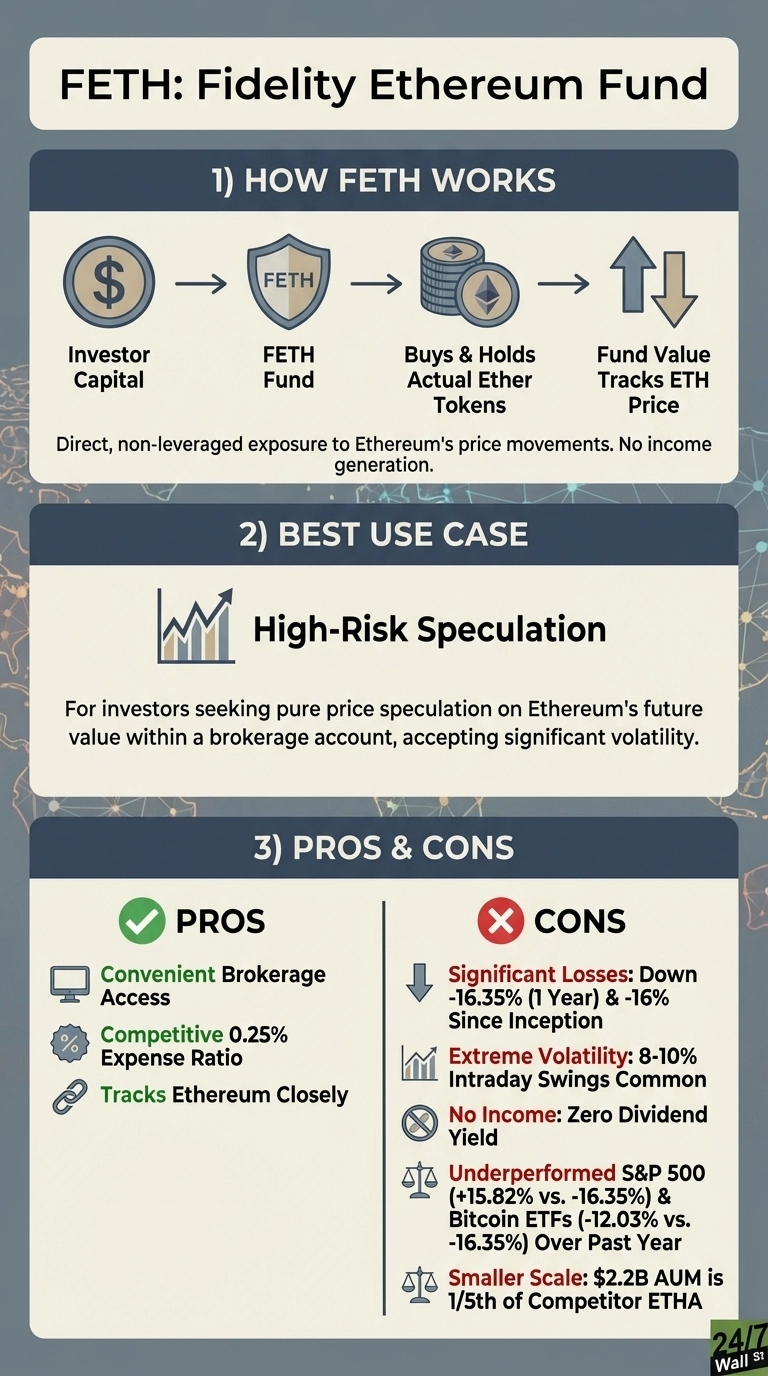

What FETH Actually Does

Fidelity Ethereum Fund (NYSE:FETH) holds actual Ether tokens and tracks their price. When Ethereum rises or falls, so does your investment. No leverage, no options overlay, no income generation. The fund charges 0.25% annually to warehouse crypto in your brokerage account. It launched in July 2024 with $2.2 billion in assets.

The return engine is pure price speculation. Ethereum’s value depends on network activity, developer adoption, and market sentiment around smart contracts and decentralized applications. Unlike dividend stocks or bonds, there’s no cash flow, no earnings, no fundamental anchor. You’re betting someone will pay more for ETH tomorrow than you paid today.

The Performance Reality

FETH has delivered a 16% loss since inception. Investors who bought at launch are underwater after five months. The fund tracks Ethereum nearly perfectly, capturing every stomach-churning swing. In the past 60 days alone, Ethereum experienced four separate days with 8% to 10% intraday price swings.

The S&P 500 gained 16% over the same period FETH lost 16%, a 32-percentage-point gap. Even within crypto, Bitcoin ETFs have outperformed, with iShares Bitcoin Trust (NASDAQ:IBIT) down just 12% versus FETH’s 16% decline.

The Tradeoffs You’re Accepting

Volatility is the primary cost. Five percent daily swings are normal for Ethereum. Major selloffs correlate with volume spikes, meaning panic selling drives the worst declines. You’re exposed to regulatory uncertainty, network technical risks, and competitor blockchains that could erode Ethereum’s market position.

You’re also paying 0.25% annually for something tech-savvy investors can buy directly on exchanges for lower fees. The convenience of holding crypto in a brokerage account costs you basis points every year, with no tax advantages unless held in a Roth IRA.

Who Should Avoid This

Retirees seeking income or capital preservation should stay away. FETH pays no dividends and offers no downside protection. Investors with short time horizons face sequence-of-returns risk. If you need to sell during a crypto winter, you’ll lock in losses with no recovery mechanism.

The Bigger Alternative

iShares Ethereum Trust (NASDAQ:ETHA) offers identical Ethereum exposure at the same 0.25% expense ratio but with five times the assets at $11.1 billion. That scale advantage translates to deeper liquidity and tighter bid-ask spreads. ETHA’s seven times higher trading volume makes it safer for selling substantial positions without slippage.

For investors determined to hold Ethereum in a portfolio, ETHA’s institutional scale provides better execution on both entry and exit. The tracking accuracy is identical, but the trading infrastructure is more robust.

FETH offers convenient Ethereum exposure for speculation, but you’re accepting casino-level volatility with no income and significant underperformance versus both stocks and Bitcoin.

Search

RECENT PRESS RELEASES

Related Post