Ford Motor Company (F): Among Incredibly Cheap Dividend Stock to Buy Now

March 18, 2025

We recently published a list of 12 Incredibly Cheap Dividend Stocks to Buy Now. In this article, we are going to take a look at where Ford Motor Company (NYSE:F) stands against other incredibly cheap dividend stocks to buy now.

Value investing has long been a preferred strategy among investors, largely influenced by Warren Buffett, who continues to seek out stocks he believes are trading below their intrinsic value. While growth stocks have recently captured more market attention, value stocks have demonstrated strong long-term performance.

Investment experts such as Josef Lakonishok and David Dreman have emphasized the importance of patience and a disciplined approach, arguing that steady, well-researched investments often yield better results than chasing rapid growth. Their research suggests that value investing outperforms growth strategies about 70% of the time, regardless of a company’s size. Examining businesses across different market capitalizations, they found that, over extended periods, value stocks consistently delivered average annual returns exceeding 7%, outperforming their growth counterparts.

READ ALSO: Dividend Contenders List: Top 15

Lowell Miller’s book, Single Best Investment, explored the principles of value investing, drawing on the research of Fama and French published in the Journal of Finance. The book explained that when a growth stock fails to meet investors’ high expectations, its price often experiences a steep drop as the market reassesses its true worth. On the other hand, value stocks, which typically start with lower expectations, have the potential to surpass forecasts, leading to upward price adjustments. However, the book also underscored the importance of diversification, cautioning against concentrating too much capital on a single investment. Historically, a well-diversified portfolio has proven to be a safer strategy for investors.

A report by BlackRock highlighted that value stocks can provide stability in volatile market conditions. This was evident during the 2022 market downturn when growth stocks suffered heavy losses, while value stocks experienced comparatively smaller declines. By nature, value stocks tend to trade at lower price levels than growth stocks, though the size of this discount has fluctuated over time.

Market analysis suggests that value stock valuations would need to rise by over 40% to return to their historical median, signaling potential upside if they regain investor favor. With growth stocks trading at high valuations, investors may increasingly shift their focus toward value stocks, particularly as the market broadens beyond mega-cap companies. While past performance does not guarantee future outcomes, history provides some perspective. BlackRock noted that the last time the valuation gap between the Russell Growth and Russell Value indexes was as wide as it is today—back in December 2000—value stocks went on to outperform growth stocks over the subsequent one-, three-, and five-year periods.

Dividend-paying value stocks can appeal to investors looking for a combination of steady income and growth potential. These stocks are often associated with well-established companies that, despite being undervalued by the market, continue to demonstrate solid financial strength. In this article, we will take a look at some of the best dividend stocks that are incredibly cheap.

For this list, we used a Finviz screener and identified dividend companies with forward P/E ratios below 11, as of March 14. The low price-to-earnings ratio shows that they are traded below their intrinsic value. From the resultant dataset, we selected 12 companies with strong dividend histories and solid balance sheets. The stocks are ranked according to their forward P/E ratios.

At Insider Monkey, we are obsessed with hedge funds. Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 373.4% since May 2014, beating its benchmark by 218 percentage points (see more details here).

A close-up of an auto assembly line, revealing the complexity of the manufacturing process.

Forward P/E Ratio as of March 14: 7.01

Ford Motor Company (NYSE:F) ranks among the largest global automakers, producing a wide range of vehicles, including traditional gasoline-powered models, hybrids, and electric vehicles (EVs), under both its Ford and luxury Lincoln brands. The company is undergoing a significant transformation, focusing heavily on EVs, autonomous technology, and software-based services. Through its ‘Ford+’ strategy, it is rapidly expanding EV production, with high-demand models such as the F-150 Lightning and Mustang Mach-E playing a key role in its growth.

As part of its restructuring efforts, Ford Motor Company (NYSE:F) has streamlined its global operations by exiting underperforming markets such as Brazil and India while scaling back its presence in Europe. This strategic realignment has allowed the company to concentrate more on expanding its electric vehicle initiatives. The stock has surged modestly by nearly 1% since the start of 2025.

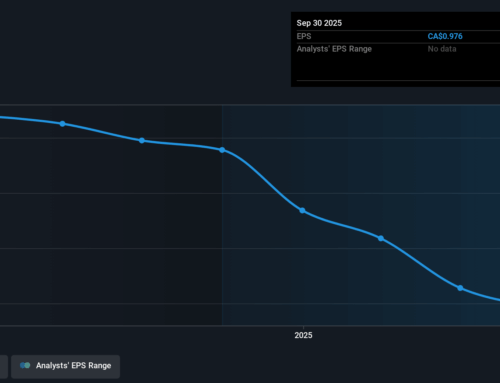

In the fourth quarter of 2024, Ford Motor Company (NYSE:F) reported $48.2 billion in revenue, reflecting a 5% year-over-year increase. Throughout the year, the automaker maintained strong cash flow, generating $15.4 billion in operating cash flow and $6.7 billion in free cash flow. Looking ahead to 2025, the company expects adjusted EBIT to be between $7.0 billion and $8.5 billion, with adjusted free cash flow projected in the range of $3.5 billion to $4.5 billion. Capital expenditures for the year are estimated between $8 billion and $9 billion. Currently, it offers a quarterly dividend of $0.15 per share and has a dividend yield of 6.17%, as of March 14.

Overall, F ranks 3rd on our list of incredibly cheap dividend stocks to buy now. While we acknowledge the potential for F as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than F but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: 20 Best AI Stocks To Buy Now and 30 Best Stocks to Buy Now According to Billionaires

Disclosure: None. This article is originally published at Insider Monkey.

Terms and Privacy Policy

Search

RECENT PRESS RELEASES

Related Post