Global Energy Transition Investment Grew in 2025 Despite Major Obstacles; Here Are the Nu

January 29, 2026

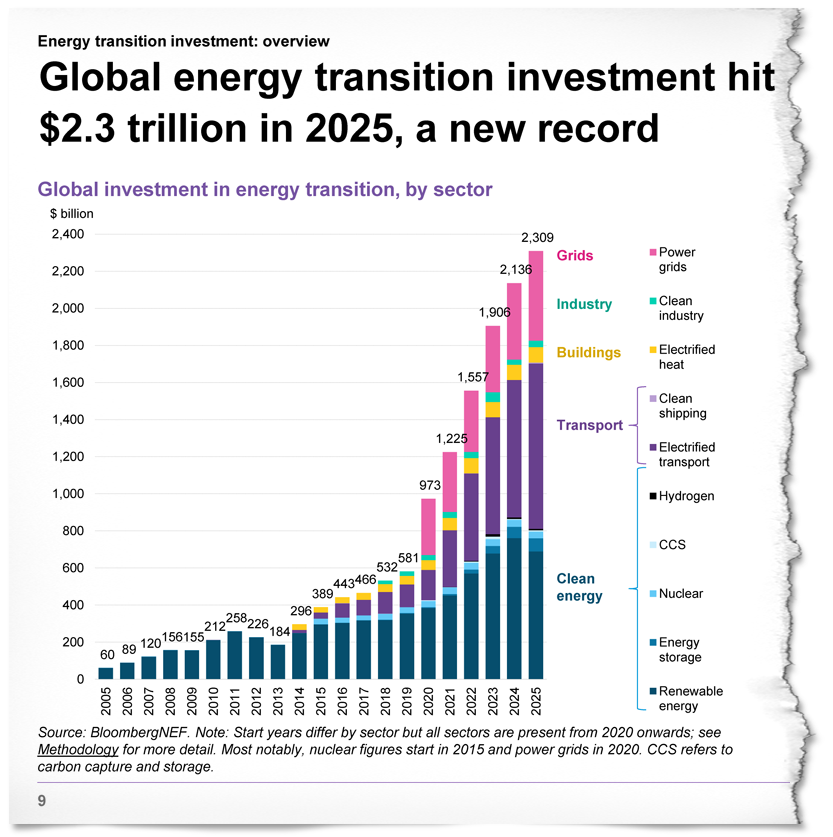

Global investment in the energy transition rose to $2.3 trillion last year, an 8 percent increase from the prior year, demonstrating resilience amid policy changes in the United States and China.

This figure, from the new edition of an annual report from BloombergNEF, provides encouraging signs of the clean energy economy’s ability to overcome obstacles. But this is somewhat offset by the view, held by many climate scientists and economists, that investment needs to grow much faster for the world to avoid severe costs related to climate change.

Electrified transportation was the largest category of global investment, with $893 billion, a 21 percent increase. Next was renewable energy, with $690 billion, a 9.5 percent decrease.

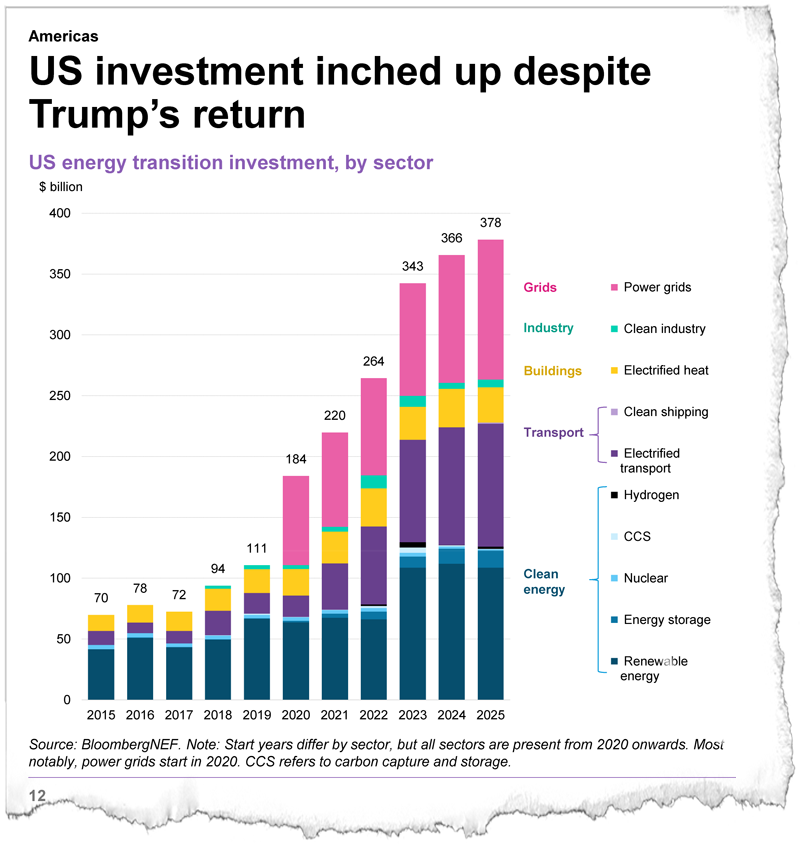

U.S. investment in the energy transition was $378 billion, a 3.5 percent increase, according to the report.

The growth in the United States came mainly from investments in the electricity grid and electrified transportation, which was enough to offset a small decrease in spending on renewable energy, said Trina White, an analyst for BloombergNEF, a research firm.

The closest precedent for 2025 in terms of U.S. investment was 2017, which was also the first year of a Trump term in the White House, she said.

Get Inside Clean Energy

Today’s Climate

Tuesdays

A once-a-week digest of the most pressing climate-related news, written by Kiley Price and released every Tuesday.

Get Today’s Climate

Breaking News

Don’t miss a beat. Get a daily email of our original, groundbreaking stories written by our national network of award-winning reporters.

Get Breaking News

ICN Sunday Morning

Go behind the scenes with executive editor Vernon Loeb and ICN reporters as they discuss one of the week’s top stories.

Get ICN Sunday Morning

Justice & Health

A digest of stories on the inequalities that worsen the impacts of climate change on vulnerable communities.

Get Justice & Health

But there are some key differences. The biggest one, she said, is that energy transition technologies and businesses are more mature and less dependent on subsidies than they were in 2017.

Also, U.S. investment decreased in 2017 compared to the prior year, as opposed to 2025 when there was a small increase.

“It’s not necessarily shocking that there’s greater resilience now than there was then,” she said.

The report tracks funding for technology and infrastructure that support a transition to net-zero emissions, along with additional data on spending on clean energy supply chains and buying stock and issuing debt related to the energy transition.

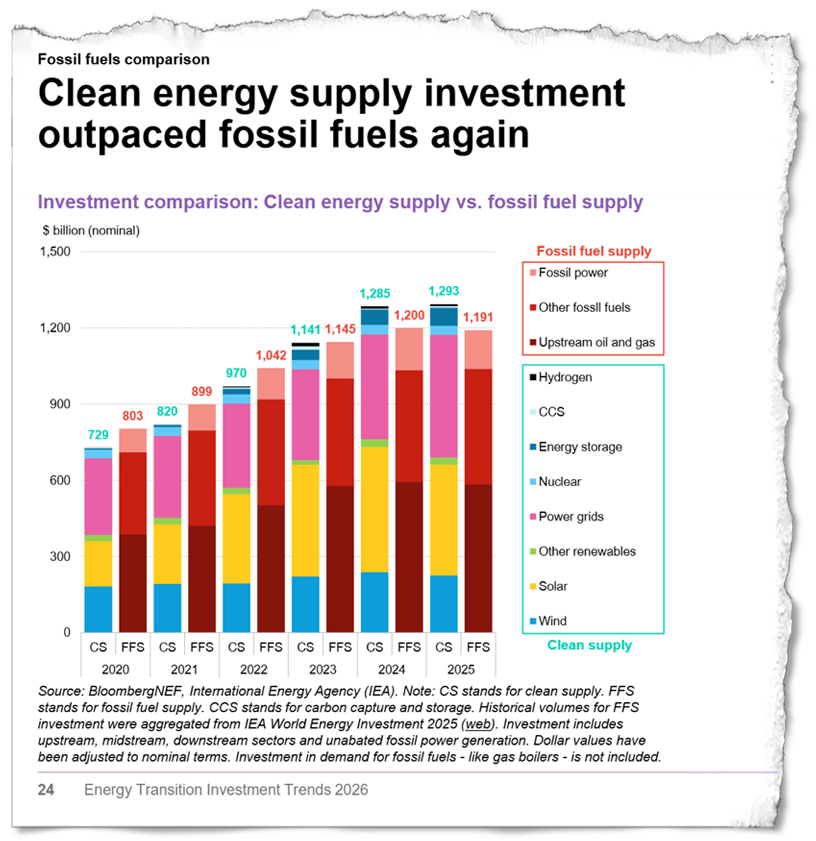

One thing I look for in the report is how investment in clean energy resources compares with an estimate of the equivalent figure for fossil fuel resources. In 2025, spending on clean energy supply totaled $1.293 trillion, which exceeded the $1.191 trillion spent on fossil fuel supply.

This framing covers the supply side for clean energy and fossil fuels, but doesn’t include investment in vehicles or uses of energy beyond production or delivery. The goal, White said, is to provide a near apples-to-apples comparison of clean energy and fossil fuels.

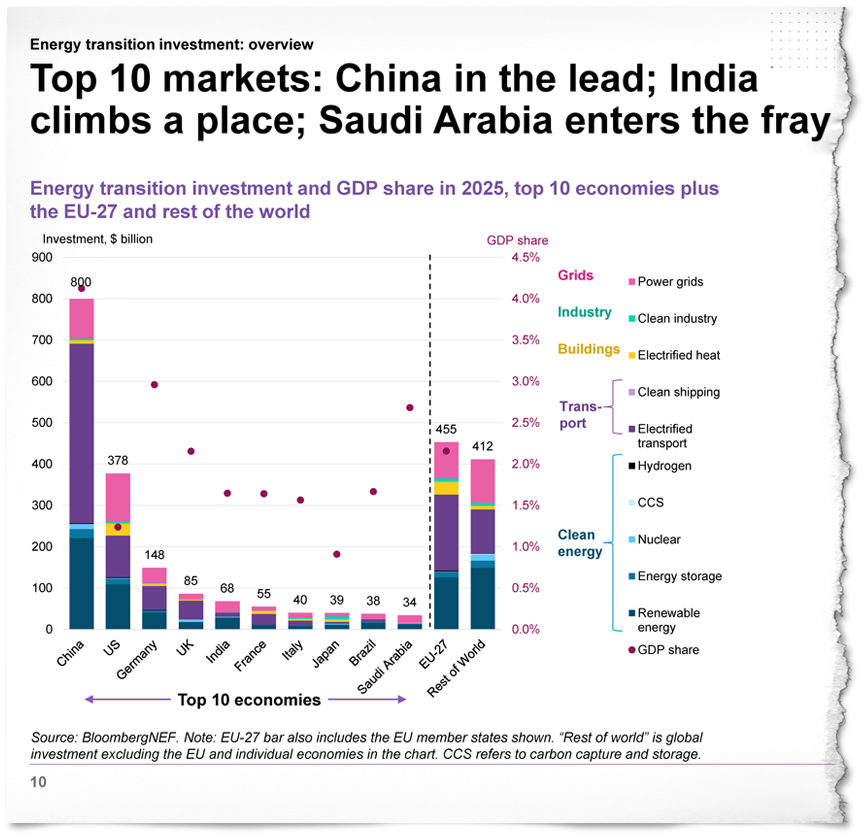

China led the world in energy transition investment with $800 billion, down 4 percent from the prior year. The decrease was primarily due to government-imposed reforms in renewable energy that aimed to expand the use of competitive markets, the report said.

China’s total was more than double that of the runner-up, which was the United States, and Germany ranked a distant third.

I spoke with two researchers who were not involved with the report to get a sense of what they see in the findings.

Gernot Wagner, an economist at Columbia Business School, said an increase in investment shows that the energy transition has gained enough momentum to ram through policy obstacles.

“We are in a world where the underlying technological forces and the economic forces point in one and only one direction,” he said. “While the political pendulum swings back and forth, especially in this country, there is very little doubt that we are, in fact, racing in the right direction at an increasing speed.”

Wagner’s greatest concern is that the growth isn’t significant enough to effectively respond to climate change.

He co-wrote an article in September that touched on similar trends, finding that the energy transition has momentum that makes it a near-certainty that the world will decarbonize by about 2100. Decarbonization is a good thing, but an extended timetable would be disastrous, leading to trillions of dollars in avoidable costs tied to warming.

So, while $2.3 trillion is a lot, annual investment needs to be double that much or more, he said.

Femke Nijsse, deputy director of Exeter Climate Policy at the University of Exeter in the United Kingdom, summed up the report’s findings as “moderately positive.”

Her main critique is that BloombergNEF’s analysis doesn’t include key decarbonization factors, such as investment in walking infrastructure, public transportation and other measures that can help lower demand for fossil fuels.

But she acknowledged that this spending is difficult to estimate, which is why it’s often not included in a financial analysis.

This story is funded by readers like you.

Our nonprofit newsroom provides award-winning climate coverage free of charge and advertising. We rely on donations from readers like you to keep going. Please donate now to support our work.

I asked her if she was surprised that electrified transportation has grown to the point that its investment far exceeds that of renewable energy. She said this was expected and shows the EV market has reached a positive tipping point.

“The price of electric vehicles for the last five years, over the lifetime of a vehicle, has been cheaper, but most consumers care more about upfront costs, and we’ve seen that tipping point in upfront costs in quite a few regions now as well,” she said.

EVs have become affordable enough in much of the world that market share is growing even in countries, such as Brazil, without significant consumer subsidies, she said.

I’m going to take some comfort in the resilience of the energy transition. It’s also true that investment is not nearly large enough, but, especially at such a chaotic time for geopolitics, moderate progress will have to do.

Other stories about the energy transition to take note of this week:

What’s Killing Onshore Wind Power? While the Trump administration has taken high-profile actions to hinder offshore wind, a much larger problem is brewing: a slowdown in onshore wind development. Onshore wind was the country’s largest source of renewable energy in 2024, the most recent full year available, but the pace of growth is slowing because of community opposition and the phaseout of subsidies, as Anika Jane Beamer and I report for ICN. We went to Shenandoah, Iowa, to look at the long struggle to develop a wind farm, which helps to explain a reluctance to build even in states with rich wind resources.

Texas’ Grid Perseveres in Winter Storm: As much of the country continues to recover from a severe storm, Texas residents can be thankful that their electricity grid appears to have handled inclement weather much better than five years ago, as my colleague Arcelia Martin reports. Early indications are that the reforms instituted after the 2021 storm helped to reduce power plant outages due to freezing and other weather issues.

The Revamped Chevrolet Bolt Will Only Be Available for a Brief Time: In a head-scratching move, General Motors has indicated it will only produce a redesigned version of the Chevrolet Bolt EV for about 18 months before discontinuing the model to open up factory capacity to make two SUVs, as Caleb Miller reports for Car and Driver. GM has already started producing the new Bolt and it is set to go on sale later this year. The decision to designate the Bolt as a limited-run vehicle is partly because the assembly plant in Kansas City, Kansas, needs room to make the top-selling Chevrolet Equinox and a next-generation Buick SUV. The Bolt is a highly anticipated model that is named after an EV that was a strong seller and won plaudits from reviewers from 2016 to 2023.

Denmark and Germany Reach Agreement to Fund ‘Energy Island’ Project: Leaders of Denmark and Germany said they are moving forward with a joint investment in offshore wind and transmission lines centered on Bornholm, an island in the Baltic Sea that is part of Denmark, as Edgar Meza reports for Clean Energy Wire. I reported from Denmark in 2023 and found the Bornholm Energy Island project to be an exciting opportunity to expand renewable energy and demonstrate how multiple nations collaborate on a major initiative. But, as I wrote then, the project has also faced delays, so this agreement on funding is a significant step.

Inside Clean Energy is ICN’s weekly bulletin of news and analysis about the energy transition. Send news tips and questions to [email protected].

About This Story

Perhaps you noticed: This story, like all the news we publish, is free to read. That’s because Inside Climate News is a 501c3 nonprofit organization. We do not charge a subscription fee, lock our news behind a paywall, or clutter our website with ads. We make our news on climate and the environment freely available to you and anyone who wants it.

That’s not all. We also share our news for free with scores of other media organizations around the country. Many of them can’t afford to do environmental journalism of their own. We’ve built bureaus from coast to coast to report local stories, collaborate with local newsrooms and co-publish articles so that this vital work is shared as widely as possible.

Two of us launched ICN in 2007. Six years later we earned a Pulitzer Prize for National Reporting, and now we run the oldest and largest dedicated climate newsroom in the nation. We tell the story in all its complexity. We hold polluters accountable. We expose environmental injustice. We debunk misinformation. We scrutinize solutions and inspire action.

Donations from readers like you fund every aspect of what we do. If you don’t already, will you support our ongoing work, our reporting on the biggest crisis facing our planet, and help us reach even more readers in more places?

Please take a moment to make a tax-deductible donation. Every one of them makes a difference.

Thank you,

Search

RECENT PRESS RELEASES

Related Post