Gold Investing Shouts ‘Crisis’ at Record Prices

November 4, 2025

Gold Investing Shouts ‘Crisis’ at Record Prices | Gold News

Gold News

Tuesday, 11/04/2025 12:57

Strongest first-time gold investing since GFC peaked…

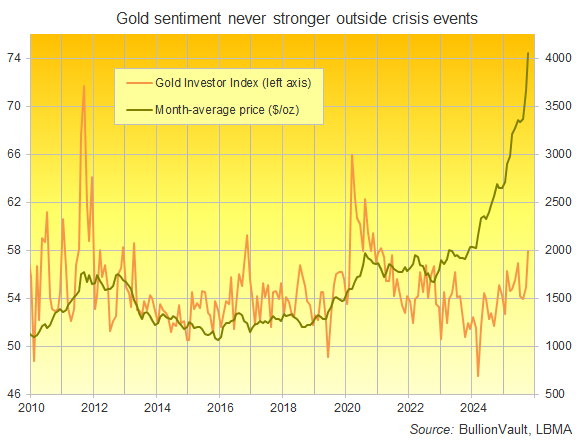

GOLD INVESTING sentiment has leapt to levels only seen during extreme crisis events, writes Adrian Ash at BullionVault, as gold’s record spike to fresh record prices spurs a near-record number of private investors to start buying precious metals for the first time.

Gaining and then losing $500 per Troy ounce in October, the price of gold continued to trend higher, setting its 9th new month-average record in 2025 so far above $4,000.

Worldwide web traffic to BullionVault − now caring for $7.6 billion of precious metal (£5.8bn, €6.6bn, JPY1.4 trillion) for its clients, 9-in-10 of whom live in Western Europe or North America − hit the heaviest since October 2008, when the collapse of Lehman Brothers triggered the all-out panic phase of the global financial crisis.

The number of new account openings meantime tripled from the previous 12-month average − already the strongest since the pandemic − rising 194.3% to reach the most ever outside of August 2011. That month saw global stock markets tumble as the Eurozone debt crisis spread to Spain and Italy, US government bonds lost their ‘risk-free’ credit rating, and England suffered its worst rioting in over 200 years.

Simply put, and since BullionVault opened 20 years ago, gold investing sentiment has only been stronger during the global financial crisis, the shock of Trump’s first election win, and the Covid pandemic.

Because 2025 lacks any clear and present panic, it’s easy to cast gold as a bubble, fuelled by FOMO at new record gold prices. But while the fear-of-missing-out undoubtedly pulled in some hot money at gold’s recent highs, the underlying uptrend signals a deeper crisis of confidence in the established order, from the Dollar to Western debt and geopolitical dominance.

What’s also different today is that private investors in the West, as a group, now hold large stockpiles of gold which they built during the past two decades’ crises.

That means profit-taking, like new buying, is running at historic levels, capping net demand overall and curbing the sense of a mania or gold rush.

Last month’s record-high gold prices drew a record number of sellers on BullionVault, rising 28.2% from September’s figure to reach the most ever in the West London fintech’s two decades of enabling private investors to trade securely stored gold for instant settlement 24/7.

The number of people choosing to buy gold rose faster, jumping by 44.0% to the most since the pandemic lockdown crisis of March 2020.

Together that put the Gold Investor Index − a unique measure of sentiment built solely from revealed preference − 3.0 points higher at 57.9, the strongest reading since February 2021, with its sharpest rise in eight months.

The Gold Investor Index would read 50.0 if the number of net buyers exactly matched the number of net sellers across the month. It set a series peak of 71.7 in September 2011, peaked at 65.9 in March 2020, and hit a low of 47.5 in March 2024.

By weight last month, net demand for gold reversed the previous two months of light liquidation to take BullionVault client holdings back up to 44.0 tonnes, now worth a record $5.6 billion (£4.3bn, €4.9bn, JPY1.1 trillion).

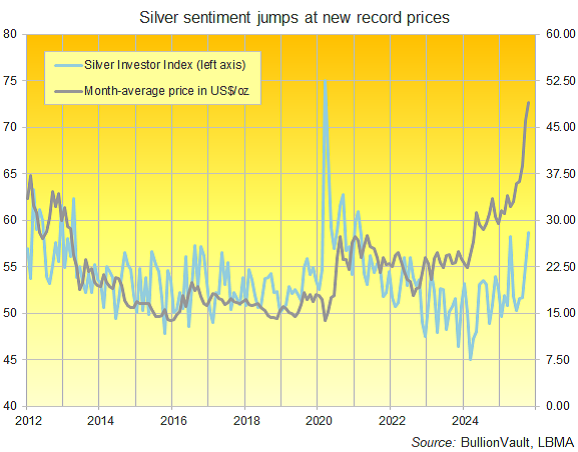

Silver, in contrast, saw net selling shrink the total quantity of silver now belonging to BullionVault users by just less than 1.0 tonne (820kg), down to a 3-month low of 1,154 tonnes worth a new record $1.8bn (£1.3bn, €1.5bn, JPY279bn).

October saw silver priced in Dollars set a 2nd new month-average record in a row, again topping April 2011 to trade at $49.43 per Troy ounce across the month.

The Silver Investor Index jumped 3.6 points to 58.7, its highest since February 2021, as a record number of sellers was more than offset by the most buyers since that month marked the peak of the #silversqueeze ramp on social media.

Now, and as with gold, the pace of new silver investing is easing back from October’s surge. But it remains sharply higher year-over-year as precious metals slip from the headlines but continue to move into the mainstream among investors.

Please Note: All articles published here are to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it. Please review our Terms & Conditions for accessing Gold News.

Follow Us

◀

⬤

⬤

⬤

⬤

⬤

⬤

▶

Market Fundamentals

Save your cookie preferences

We use cookies to remember your site preferences, record your referrer, improve the performance of our site and to make any adverts we show on 3rd party sites more relevant. For more information, see our cookie policy.

Please select an option below and ‘Save’ your preferences.

Secure auto-logout warning

You have not been active for some time.

For your security you will be logged out in minutes unless you take action.

Search

RECENT PRESS RELEASES

How Should Investors Value Sezzle After Recent Payment Partnership and Wild Price Swings?

SWI Editorial Staff2025-11-04T13:52:26-08:00November 4, 2025|

Is Rising Earnings Optimism Changing the Investment Narrative for Triple Flag Precious Met

SWI Editorial Staff2025-11-04T13:51:47-08:00November 4, 2025|

REITs Poised for Comeback as Market Dynamics Shift

SWI Editorial Staff2025-11-04T13:51:15-08:00November 4, 2025|

US stocks slide as investors fret over high valuations for AI companies

SWI Editorial Staff2025-11-04T13:50:35-08:00November 4, 2025|

The Best Mid-Cap ETFs to Buy

SWI Editorial Staff2025-11-04T13:49:54-08:00November 4, 2025|

Axon Enterprise earnings missed by $0.35, revenue topped estimates By Investing.com

SWI Editorial Staff2025-11-04T13:49:24-08:00November 4, 2025|

Related Post