Gold, Silver Hit New Highs as Bitcoin Trades Flat Ahead of Key Macroeconomic Events

January 12, 2026

In brief

- Gold and silver have hit new all-time highs, with the DOJ’s lawsuit against Fed Chair Powell sparking immediate demand for safe-haven assets.

- Precious metals rallied while Bitcoin stagnated, marking a clear divergence and classic rotation into traditional hedges.

- The rally’s sustainability hinges on this week’s U.S. inflation data, which will shape expectations for Federal Reserve rate cuts.

Gold and silver surged to record highs Monday as investors sought shelter from a political crisis at the Federal Reserve and braced for a pivotal week of U.S. inflation data.

Silver sharply outperformed, jumping nearly 7% from Friday’s close to trade near $85. Gold, up 2.2%, set a new record high of $4,600. Bitcoin, in contrast, remained flat, down 0.2% over the past 24 hours according to CoinGecko data.

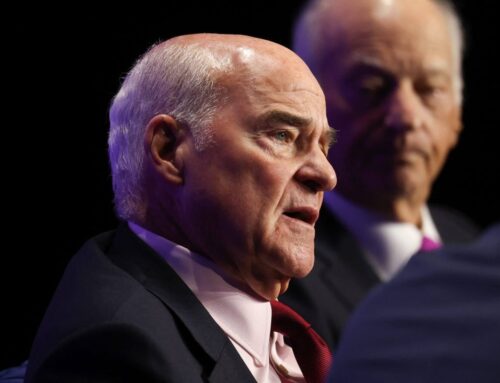

The rally in precious metals was catalyzed by an unprecedented political crisis at the Federal Reserve, following the Department of Justice’s lawsuit against Chair Jerome Powell, as noted in a previous Decrypt report.

“Gold and silver moved higher as markets leaned back into safe-haven positioning amid rising geopolitical risk and renewed uncertainty around U.S. monetary policy credibility,” Wenny Cai, COO at Synfutures, told Decrypt. The DOJ’s move has added “unusual political risk, raising concerns around central bank independence,” driving the rotation into metals, she said.

Market sentiment is visibly shifting, with users on prediction market Myriad, owned by Decrypt’s parent company Dastan, now assigning a 79% chance that gold reaches $5,000 before Ethereum—a conviction level that has risen from 70% at the start of the week.

Yaroslav Patsira, Fractional Director at CEX.IO, echoed Cai’s take, citing additional drivers including renewed geopolitical tensions and soft labor data, which strengthen the case for rate cuts—a bullish environment for non-yielding assets, he told Decrypt.

All eyes now turn to Tuesday’s U.S. Consumer Price Index (CPI) and Producer Price Index (PPI) inflation readings, which will test the rally’s durability.

“The most impactful data this week are likely the U.S. CPI and PPI inflation releases,” Patsira explained. “Downside surprises could reinforce rate cut expectations and provide additional support for gold and silver.”

Cai concurred, stating that softer inflation and labor market readings “would reinforce expectations for future rate cuts, which tends to support non-yielding assets like gold and silver.”

The rally places precious metals at a pivotal juncture. Whether they hold these record levels will now depend on cold, hard inflation data, testing the durability of their safe-haven appeal against fresh macroeconomic reality.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Search

RECENT PRESS RELEASES

Philippines Sees $600 Million Investments from Lufthansa, FedEx

SWI Editorial Staff2026-02-05T02:51:59-08:00February 5, 2026|

Iconiq VC Ryan Koh shares his advice for ambitious young investors

SWI Editorial Staff2026-02-05T02:51:10-08:00February 5, 2026|

Why a $15 billion CIO says be wary of buying gold and other commodities

SWI Editorial Staff2026-02-05T02:50:29-08:00February 5, 2026|

Fortune Tech: Alphabet’s unstoppable capex

SWI Editorial Staff2026-02-05T02:49:43-08:00February 5, 2026|

Ethereum Whales And HODLers Follow Vitalik’s Cue As $1,800 Risk Grows

SWI Editorial Staff2026-02-05T02:48:55-08:00February 5, 2026|

Ethereum scalers vow to soldier on after Vitalik’s about-face on Ethereum growth

SWI Editorial Staff2026-02-05T02:48:15-08:00February 5, 2026|

Related Post