Grayscale Ethereum ETFs Are First in US to Add Staking

October 6, 2025

In brief

- Grayscale has added staking functionality to its two spot Ethereum ETFs in the United States.

- It also added staking to its Solana Trust, which has yet to be approved for an ETF conversion.

- Investors will be able to earn ETH staking rewards from the exchange-traded products.

U.S. investors in exchange-traded funds tracking Ethereum’s spot price can receive staking rewards for the first time.

Grayscale has introduced this functionality to its Ethereum Trust ETF (ETHE), the second-largest such fund on Wall Street with assets of $4.82 billion, as well as its Ethereum Mini Trust ETF (ETH).

The firm, which filed its staking addendum with the SEC on Monday, will rely on institutional custodians like Coinbase and a “diversified network of validator providers” to stake its Ethereum.

Staking has also been activated within the Grayscale Solana Trust, which is awaiting regulatory approval to be turned into an ETF. The move is a significant development, given that institutional investors have only been able to capitalize on ETH’s price gains until now.

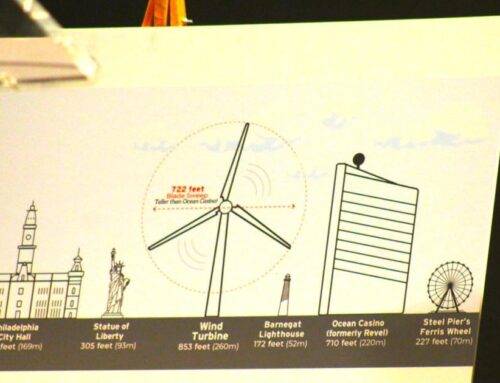

Ethereum made an ambitious upgrade to a proof-of-stake blockchain in 2022, meaning validators voluntarily lock ETH away and receive rewards for taking a role in securing the network. It’s a much less energy-intensive approach than the previous proof-of-work consensus model, which Bitcoin and some other chains still use.

Grayscale’s Ethereum exchange-traded products were among the first to hit the traditional financial market, with its trust-style product ETHE dating back to 2017. Last year, after Ethereum spot ETFs gained SEC approval, the firm successfully converted its products into spot Ethereum ETFs in July.

The absence of staking rewards in ETFs have been cited as a key factor in the slower adoption of Ethereum funds since they launched in the summer of 2024.

Data from SoSoValue shows the total net assets in Bitcoin ETFs currently stands at $164.5 billion—equivalent to 6.7% of its market capitalization. Ethereum ETFs lag behind with net assets of $30.5 billion, 5.6% of this cryptocurrency’s valuation.

However, demand has been growing in recent months—driven by ETH’s outperformance in the crypto market. Ethereum has surged by 156% over the past six months, compared with BTC’s gains of about 50%, and set a new all-time high price mark shy of $5,000 in September.

In a statement, Grayscale CEO Peter Mintzberg said staking was “exactly the kind of first-mover innovation” that the company was designed to deliver.

“As the #1 digital asset-focused ETF issuer in the world by AUM, we believe our trusted and scaled platform uniquely positions us to turn new opportunities like staking into tangible value potential for investors,” he added.

Grayscale says it plans to roll out staking to more of its products “as the digital asset ecosystem evolves.” The unique selling point could help Grayscale close the gap with BlackRock, whose Bitcoin and Ethereum ETFs dominate the market.

Crypto exchange-traded products just capped off a record week, pulling in a total of $5.95 billion worth of investments last week, according to CoinShares. That tally included $1.48 billion worth of inflows into Ethereum funds, with both Bitcoin and ETH funds rebounding after being in the red the previous week.

Additional reporting by Logan Hitchcock

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Search

RECENT PRESS RELEASES

‘Ballard’ Renewed for Season 2 at Amazon

SWI Editorial Staff2025-10-06T13:47:40-07:00October 6, 2025|

‘Ballard’ Officially Renewed By Prime Video For Season 2

SWI Editorial Staff2025-10-06T13:47:18-07:00October 6, 2025|

‘Ballard’ Renewed for Season 2 as Prime Video Keeps ‘Bosch’-Verse Rolling

SWI Editorial Staff2025-10-06T13:46:50-07:00October 6, 2025|

The best Prime Day deals from Apple to Yeti: Save up to 75% during Amazon Big Deal Days

SWI Editorial Staff2025-10-06T13:46:22-07:00October 6, 2025|

Trump’s use of the National Guard sets up a legal clash testing presidential power

SWI Editorial Staff2025-10-06T13:45:53-07:00October 6, 2025|

Bitcoin Roars To More All-Time Highs Above $125,000

SWI Editorial Staff2025-10-06T13:45:19-07:00October 6, 2025|

Related Post