Hampton Roads leaders, businesses fear loss of clean energy tax credits

May 9, 2025

About a decade ago, retired Navy doctor Doug McNeill started getting online advertisements from residential solar companies and decided to do some research.

After weighing the costs and benefits of installing a solar system, he chose to put up a 28-panel array on a detached garage at his home in Chesapeake.

One big financial factor in McNeill’s calculation was the Solar Investment Tax Credit, which saved him almost $8,000 in upfront costs.

“That brought it down by at least a quarter, which made it an easy decision,” he said.

The panels now cut McNeill’s energy bills by about $1,000 each year.

The system “reduces our expenses individually but also collectively, so it makes no sense not to put in solar. I’d like to see everybody do it in some fashion.”

The solar credit McNeill used is one of many that were expanded through the Biden administration’s signature climate legislation, the Inflation Reduction Act, which Congress passed in 2022.

The credits reward everyone from individual homeowners and small businesses to local governments and major corporations that invest in clean energy such as electric cars, energy efficiency upgrades and renewable infrastructure.

Congressional Republicans are now deciding whether or not to sunset all or most of these tax credits, in line with President Donald Trump’s directives against the clean energy industry.

That could impact ongoing and future projects in Hampton Roads, local leaders say.

“The Inflation Reduction Act’s clean energy tax credits are lowering energy costs for families, helping Hampton Roads build new, cleaner energy sources, and boosting our local economy,” Democratic Congressman Bobby Scott said in a statement. “If Republicans cut these tax credits, they are jeopardizing thousands of good-paying jobs and billions of dollars in investments in Hampton Roads.”

Many Republicans also support keeping the credits. More than two dozen House Republicans recently signed onto a letter asking for colleagues to spare at least some of the subsidies.

Since the IRA’s passage, about 80% of the $289 billion invested in clean energy manufacturing happened in districts currently represented by Republicans, according to Time magazine.

Congresswoman Jen Kiggans, a Republican representing Virginia Beach, testified in January that the tax credits are key to an “all of the above approach to energy development.”

“While the Inflation Reduction Act contained countless harmful provisions that led to our conference wholly opposing its passage, some of the energy tax credits included in the bill have led to a significant increase in domestic manufacturing and energy production across the country, including in my district,” Kiggans said.

That includes more than $445 million in IRA-supported clean investments that have been announced so far, she said.

In addition, the IRA and infrastructure laws filtered nearly $5 billion in grant funding into Virginia. (Many of those grants are also in jeopardy.)

Kiggans’ office did not respond to a request for comment for this story.

In Chesapeake, a South Korean company called LS Greenlink just broke ground on a $700 million factory that will manufacture high-voltage underwater cables used in offshore wind projects. It will be the biggest investment in the city’s history and the largest such facility in the world.

The company was approved for a $99 million tax credit from the federal government. Managing director Patrick Shim said that helped attract them to the U.S.

The legislation “definitely played a big role,” he said. “Also indirectly, there are a lot of other projects that we work with that were also receiving incentives through the IRA. It kind of created a whole new industry around it.”

He noted that it’s not “free money.” LS Greenlink will only receive the credit when the project’s up and running in a few years, after demonstrating the promised investment and job creation.

“We are doing exactly what the administration wants to do: bringing jobs to the U.S.,” Shim said. “We don’t want to be penalized for coming to the U.S.”

He said they chose Chesapeake because of its proximity to the port, an available workforce and support from local leaders.

Ryan Murphy

/

WHRO News

In a recent opinion column for The Virginian-Pilot, Chesapeake Mayor Rick West said the facility “exemplifies how federal incentives for energy investments can revitalize local economies.”

“To continue this trajectory, it is imperative that we uphold policies that attract and sustain such investments,” West wrote.

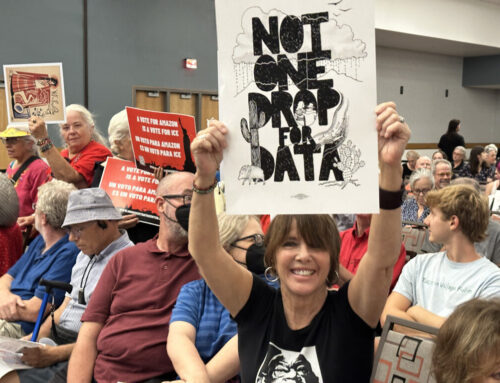

Jack Pratt, who works in political engagement for the nonprofit Environmental Defense Fund, said Virginia is expecting an explosion in energy demand over the next few decades, in large part because of power-hungry data centers.

“If we’re going to meet the demand, we need to make sure that we’re doing all we can to incentivize these clean energy projects,” he said.

Businesses planning long-term investments need some market certainty, Pratt said. “It makes it very challenging, if Congress is messing with the tax code every couple years, for any business to try and take advantage of those incentives.”

House Republicans are expected to finalize their tax package early next week, which will then have to pass the wider chamber before heading to the Senate.

Search

RECENT PRESS RELEASES

Related Post