Has Progressive’s Recent Slide Created an Opportunity for Investors in 2025?

October 26, 2025

Have you found yourself staring at Progressive’s stock chart, wondering if it’s finally time to make your move or sit tight a little longer? It’s the kind of question that even seasoned investors wrestle with, especially when you see a household name like Progressive swing noticeably this year. After an impressive run over the past three to five years, with the share price up 74.0% and 163.1% respectively, its recent stumble may be turning heads. The stock is down 2.9% in the last seven days, off 10.0% this month, and now 9.0% since the start of the year. One-year returns are also in the red at 8.3%.

What is behind these moves? Recent news impacting the insurance industry, such as regulatory updates and shifting risk perceptions for auto insurers, has prompted some cautious sentiment across the sector. Investors are recalibrating what they’re willing to pay for premium growth as questions swirl around inflation-driven claims costs and the effectiveness of pricing strategies. All this activity sets the stage perfectly for a deep dive into valuation. Just how much is Progressive worth, and what should investors really focus on right now?

Progressive scores a 3 out of 6 on our value checklist, meaning it is undervalued according to half of the measures we track. But as any good analyst will tell you, numbers only tell part of the story. Next, let’s dig into how each valuation approach stacks up. Also, we’ll share which method might cut through the noise to offer the clearest picture for this unique stock.

Why Progressive is lagging behind its peers

The Excess Returns valuation method evaluates how much value a company creates for shareholders over and above its cost of equity. In other words, it measures whether a business can consistently generate returns from its investments that are higher than what it would cost to raise that capital. This is especially relevant for financial companies, where book value, earnings, and return on equity drive shareholder value over the long run.

For Progressive, the numbers stack up impressively. The company’s Book Value is $60.45 per share, with a stable Earnings Per Share (EPS) projection of $20.01. These are based on weighted future Return on Equity estimates from 13 analysts. The Cost of Equity stands at $4.92 per share, meaning Progressive is producing a sizable Excess Return of $15.09 per share. Its average Return on Equity is a robust 27.57%, outpacing industry norms. The Stable Book Value, projected at $72.56 per share, further confirms shareholder value is likely to keep growing.

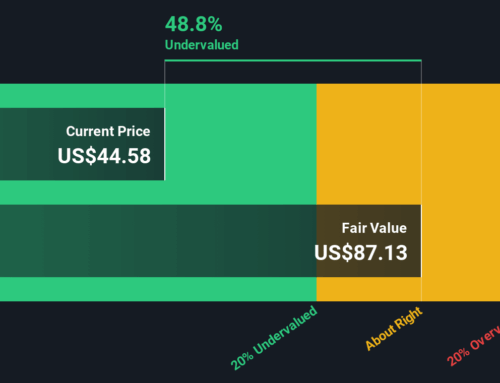

The Excess Returns analysis produces an intrinsic value estimate significantly above Progressive’s current share price, suggesting a 54.4% undervaluation. This points to a unique stock that the market may be overlooking.

Result: UNDERVALUED

Our Excess Returns analysis suggests Progressive is undervalued by 54.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies like Progressive because it relates a company’s share price to its earnings, which are a key measure of business performance. The PE ratio helps investors gauge what the market is willing to pay today for a dollar of future earnings, especially relevant for companies with consistent profitability.

Several factors shape what is considered a “normal” or “fair” PE ratio, such as how quickly a company is expected to grow and the risks involved in its business model or industry. Higher growth usually justifies a higher PE, while greater risk may drag it down. For Progressive, the current PE ratio stands at 12.0x. This compares favorably to both the peer average of 9.9x and the broader insurance industry average of 13.5x, placing Progressive in the middle of the pack.

To bring more nuance, we use Simply Wall St’s Fair Ratio. This proprietary measure determines the “right” PE for a specific company, using factors such as its growth prospects, risk profile, profit margins, market cap, and industry context. This approach goes beyond simple peer or industry comparisons by ensuring that all the relevant fundamentals unique to Progressive are considered. The Fair Ratio for Progressive is 11.8x, nearly identical to its actual PE ratio of 12.0x. This shows the stock is priced appropriately relative to its potential and risks.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

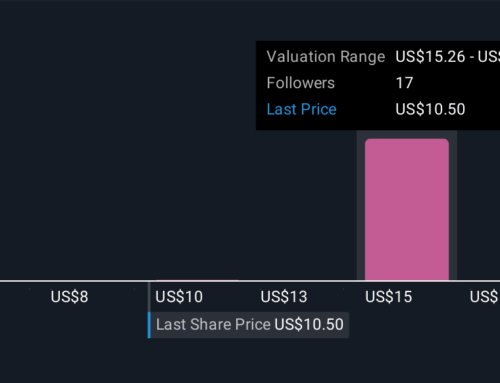

Earlier, we mentioned that there’s an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply the story you believe about Progressive, expressed through your own view of its future growth, profits, risks, and, ultimately, what you think the stock is really worth. Narratives connect what’s happening in the business, such as new competition, regulatory changes, or technological advantages, with financial forecasts and a clear Fair Value estimate. This makes it easy for anyone, not just professional analysts, to form an opinion about when to buy or sell by comparing their Narrative Fair Value to the current price. On Simply Wall St’s Community page, Narratives are quick to build, update automatically when news or earnings arrive, and are widely used by millions of investors. For example, one Narrative for Progressive might see technology and direct-to-consumer trends driving strong future growth and value the stock as high as $344, while a more cautious view could focus on margin pressure and competition, putting fair value closer to $189. Narratives let you test your investment thesis with real numbers and adapt it as the story evolves.

Do you think there’s more to the story for Progressive? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include PGR.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Terms and Privacy Policy

Search

RECENT PRESS RELEASES

Related Post