Here’s how a stock market crash could help investors retire 10 years earlier

March 15, 2025

The idea of a stock market crash can be quite scary. After all, no one enjoys seeing their portfolio going into freefall. However, for investors who know how to keep their cool in a time of crisis, sudden downturns in the market can be quite lucrative in the long run, boosting investment returnsbyCapitalising on a crash could even be the key to enjoying an earlier retirement!

During a market crash or correction, most investors enter panic mode, selling off everything to avoid taking on losses. And this flight to safety often results in phenomenal businesses seeing their valuations tank, often for no good reason. This is the behaviour smart investors seek to exploit.

While investing in a down market can be tough, sucessfully identifying and buying sold-off, high-quality businesses can unlock pretty phenomenal returns both in the short and long term. Case in point: Let’s take a look at what happened at Games Workshop (LSE:GAW) in 2020.

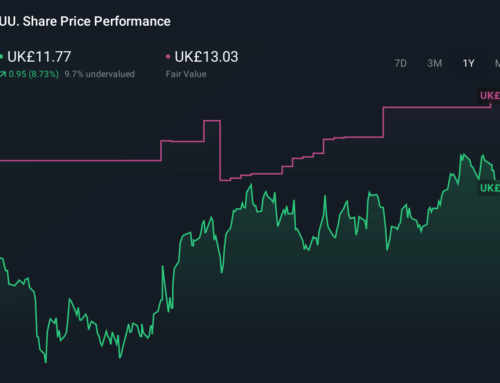

When Covid-19 hit the financial markets, stocks worldwide collapsed. Among these was Games Workshop, whose valuation crumbled by over 50% in the space of a few short weeks. That’s obviously scary. But it seems investors were overly focused on the short-term, and they overlooked the fact that global lockdowns meant far more time at home to get obsessed with the Warhammer hobby.

What followed was almost five years of record-breaking results and an exploding stock price to boot! But that’s not all. With the shares taking a nosedive, investors were able to lock in a higher 4% yield. And with rapidly expanding financials paving the way to dividend hikes, that yield’s now grown to a massive 14.6%!

In total, opportunistic investors have reaped more than 260% gains so far compared to the FTSE 100’s 95% return (including dividends) over the same period.

Earning a 95% return with a FTSE 100 index fund over a five-year period is pretty impressive. It’s the equivalent of earning a 14% annualised return. This is almost double what the UK’s flagship index has historically offered. But even at this rate, it pales by comparison to the 29% annualised return the Games Workshop shares have generated.

For reference, over 15 years, it’s the difference between a £1,000 investment being transformed into £8,067 and £73,572! In this scenario, index investors would have to wait a total of 31 years to catch up, demonstrating how picking top-notch stocks in a time of crisis can lead to a much earlier retirement.

Of course, even terrific businesses like Games Workshop have their weak spots. International expansion’s adding considerably more currency exchange risk to its earnings. Meanwhile the rise of at-home 3D printing is putting pressure on its pricing power.

Nevertheless, with such an impressive track record, it’s a stock I’ll be buying more of in the next stock market crash.

Search

RECENT PRESS RELEASES

Related Post