Here’s why Ethereum stalled despite strong ETF inflows and record-low exchange reserves

June 4, 2025

- US spot Ethereum ETFs have seen 12 consecutive days of net inflows totaling $743.8 million.

- Ethereum exchange reserves plunged by 450,000 ETH in one week, reaching its lowest since 2016.

- Increased short positions across ETH futures on CME and Binance have weighed on Ethereum’s price.

- ETH sees rejection again at a rising trendline resistance, extending its multi-week consolidation.

Ethereum (ETH) trades around $2,600 on Wednesday, maintaining its consolidation despite intense buying pressure across ETH exchange-traded funds and crypto exchanges. The flat prices potentially stem from rising short positions neutralizing the impact of buying pressure in the spot market.

US spot Ethereum ETFs extended their streak of inflows to twelve consecutive days after recording net inflows of $109.43 million on Tuesday — their second-highest since February 4. During the twelve days, the products have seen $743.88 million in inflows, per SoSoValue data.

BlackRock’s iShares Ethereum Trust (ETHA) led the pack on Tuesday with a single-day net inflow of $77 million. Notably, BlackRock’s ETHA has accumulated 214,000 ETH since May 11, according to data posted by on-chain wallet tracker Lookonchain.

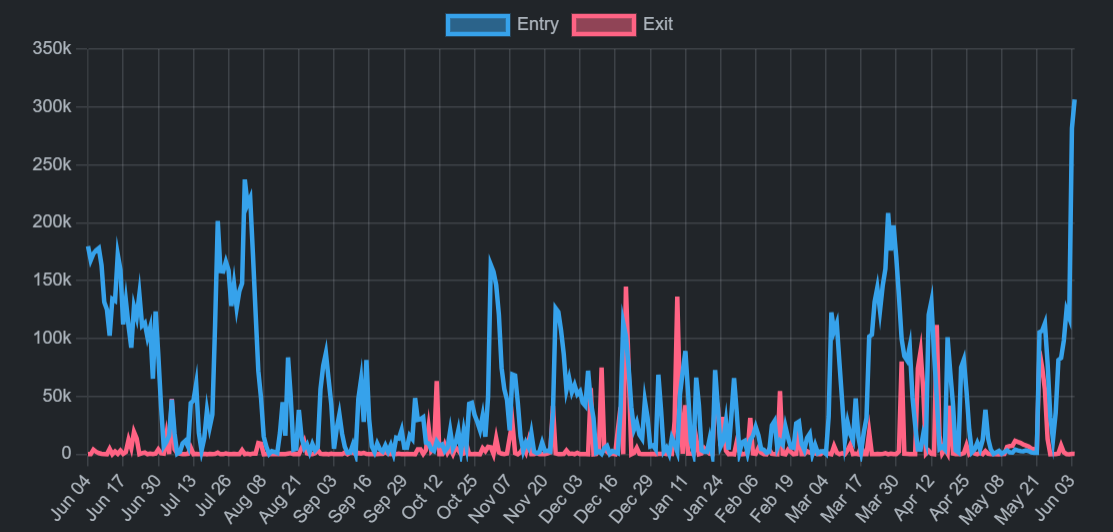

Ethereum has also seen intense buying pressure on crypto exchanges, with investors withdrawing nearly 450,000 ETH to private wallets for potential long-term holding. The large withdrawals have sent Ethereum’s exchange reserve to an all-time low of 18.65 million ETH — discounting its first two years of launch.

-1749079530690.png)

ETH Exchange Reserve. Source: CryptoQuant

Most of the withdrawals potentially flowed to staking protocols as ETH’s total value staked has risen by 255,000 ETH in the past eight days. However, that value is understated, considering more than 306,438 ETH are waiting in the Ethereum validator activation queue, the highest in over a year, per data from Beaconcha.in. Additionally, 340,533 ETH are in the entry queue, with an average wait time of over five days.

ETH Validator Queue. Source: Validatorqueue.com

Despite the intense bullish pressure across ETH ETFs and crypto exchanges, Ethereum has traded largely sideways since May 13, hovering between $2,450 and $2,700.

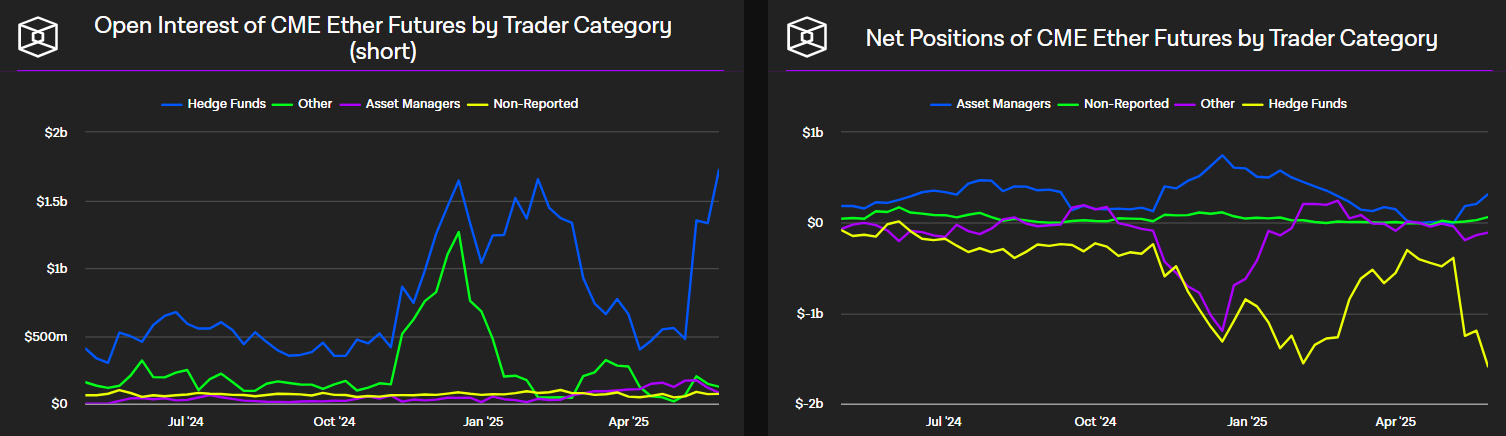

A potential reason for the lag in price is the rise in short positions across Ethereum futures, with US-based hedge funds on the Chicago Mercantile Exchange (CME) expanding their short positions by $1.25 billion in the past three weeks, far outpacing long positions on the exchange, according to CFTC data compiled by The Block.

CME Ethereum Futures. Source: The Block

A similar downside positioning is visible across Binance, where short positions have risen to levels similar to those seen in February, before the post-tariffs market crash that filled those positions.

Investors are potentially leveraging ETH ETFs and staked ETH to run a delta-neutral strategy, similar to the decentralized finance (DeFi) platform Ethena, earning from staking yields, funding rates, or price premiums while using shorts to hedge their bets.

Ethereum saw $52.39 million in futures liquidations over the past 24 hours, per Coinglass data. The total amount of long and short liquidations is $26.95 million and $25.44 million, respectively.

ETH bounced off the 50-period Simple Moving Average (SMA) and retested the resistance of a rising trendline from May 18. If ETH sustains the rejection at the rising trendline, it could find support at the lower boundary of the rising wedge — near the $2,500 key level — if the 50-period SMA support fails.

On the upside, the top altcoin could rise to tackle the upper boundary of a slightly rising wedge if it clears the rising trendline and $2,750 key resistance levels.

ETH/USDT 8-hour chart

The Relative Strength Index (RSI) and Stochastic Oscillator are above their neutral levels but trending downwards, indicating a weakening bullish momentum.

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum’s roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.

Share:

Cryptos feed

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Search

RECENT PRESS RELEASES

Related Post