Historic Record: Ethereum ETFs Surpass 4 Billion Dollars

June 25, 2025

13h05 ▪

5

min read ▪ by

Mikaia A.

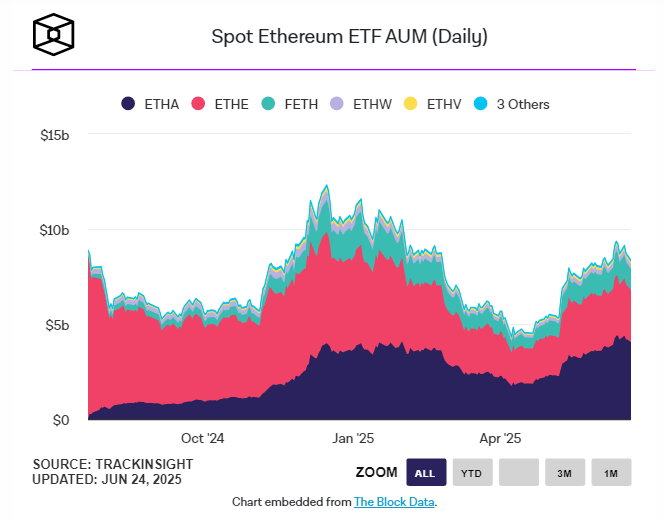

Far behind the giants backed by Bitcoin, Ethereum ETFs still had a card to play. And the last few weeks seem to be proving them right. The $4 billion net flow threshold has been crossed, in a market that, visibly, has not yet said its last word. The mechanism is well known: the more an asset becomes democratized, the more financial products backed by it explode. And Ethereum, despite its existential doubts, is once again attracting the spotlight.

In Brief

- Ethereum ETFs have surpassed $4 billion after a rapid surge in fifteen sessions.

- BlackRock captures most of the flows thanks to its low fees and allocator network.

- ETH price falls but flows remain positive, signifying a long-term institutional bet.

- Grayscale declines, Fidelity settles in, and multi-asset arbitrages support the movement of Ethereum funds.

BlackRock, clever fees and billions at stake

In the Ethereum ETF match, BlackRock decided not to play small. Its fund iShares Ethereum Trust (ETHA) shows $5.31 billion in gross inflows. Opposite, Grayscale and its two products (ETHE, ETH) are struggling with a cumulative $4.28 billion outflow since ETF conversion.

The strategy? Simple, but deadly. BlackRock and Fidelity offer management fees of 0.25%, when Grayscale remains stuck at 2.5%. A gap that hurts, especially in a period of aggressive institutional flows. “Wealth managers don’t want to pay for the old guard anymore,” notes a CoinShares analyst.

And then there’s the tactical momentum: flows accelerated starting May 30, marking a real turning point. Over $160 million absorbed on June 11 alone, and five days with more than $100 million in 15 sessions. It’s not a euphoric surge, but a steady, almost surgical rise.

Start your crypto adventure safely with Coinhouse

This link uses an affiliate program.

The paradox is that Ethereum as a blockchain seems to be in an identity crisis. Its price has dropped 25% since January, and the failure of the post-ETF approval “momentum” remains a thorn in the side. The CEO of DYOR sums it up:

After the initial approval of the ETH ETF without a price spike, institutional investors began to build positions quietly.

Translation? No hype, but strategic positioning.

Circle’s successful IPO, the resurgence around stablecoins, and the restructuring of the Ethereum Foundation give a breath of fresh air. But Solana looms. And Ethereum ecosystem revenues have been down since its last technical update. Proof that the perceived value of the infrastructure remains fragile, even though some see beyond the short term.

“The market looks like an electrocardiogram, but buyers are betting on the infrastructure,” adds Ben Kurland.

A phrase that sums up this stage well: volatile in the short term, promising fundamentally.

Crypto: the silent battle between Ethereum and Bitcoin

While Ethereum is strengthening, Bitcoin is soaring. BTC ETFs total $46.7 billion in net inflows, compared to barely $4 billion for ETH. The gap is wide, but beware: the dynamic could shift. For nine consecutive days, Bitcoin ETFs have still recorded positive flows. But the gap is closing.

The latest alert? On June 21, Ethereum faced a $19.7 million withdrawal on ETHA, but paradoxically, overall inflows this month remain positive: $840 million net since early June. And this despite ETH falling below $2,400.

Some key numbers to remember:

- ETH ETFs reached $4.01 billion in 231 trading days;

- 1 billion added in just 15 sessions (i.e., 6.5% of the time for 25% of the flows);

- BlackRock: $5.31 billion in gross inflows; Fidelity: $1.65 billion;

- Grayscale: $4.28 billion in cumulative withdrawals;

- Ethereum lost 5% in one week but maintains net inflows.

Is this catch-up sustainable? Maybe. The next hot point: declarations from major asset managers in mid-July (13F filings). If they also put ETH in their long-term portfolios, the curve could reverse.

Statistics around Bitcoin, Ethereum, and their ETFs increasingly interest governments. Japan recently even considers a tax reform favorable to digital assets and opening up to crypto ETFs. This could offer calmer skies to a sector still shaken by volatility, but whose foundations are strengthening step by step.

Maximize your Cointribune experience with our “Read to Earn” program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.

Search

RECENT PRESS RELEASES

Related Post