HK Asia Holdings Buys More BTC in Hedge Against Depreciation of Fiat Currencies

March 21, 2025

BTC

$83,806.48

–

0.95%

ETH

$1,950.94

–

1.08%

USDT

$0.9996

–

0.02%

XRP

$2.3829

–

2.35%

BNB

$635.35

+

1.92%

SOL

$126.42

–

1.84%

USDC

$1.0001

–

0.01%

ADA

$0.7057

–

2.63%

DOGE

$0.1658

–

2.33%

TRX

$0.2367

+

2.25%

WBTC

$83,621.98

–

0.87%

LINK

$13.92

–

3.04%

LEO

$9.7478

–

0.77%

TON

$3.5602

–

3.76%

XLM

$0.2776

–

1.30%

HBAR

$0.1840

–

3.25%

AVAX

$18.53

–

1.27%

SHIB

$0.0₄1249

–

2.22%

SUI

$2.2562

–

5.68%

LTC

$93.26

+

1.82%

By James Van Straten, AI Boost|Edited by Sheldon Reback

Mar 21, 2025, 3:19 p.m. UTC

- HK Asia Holdings bought another 10 BTC, taking its total bitcoin holdings to 18.88 BTC

- The purchase was funded from internal cash reserves.

- The company cited bitcoin’s potential as a hedge against fiat depreciation and a strategic move to diversify assets and embrace blockchain technology.

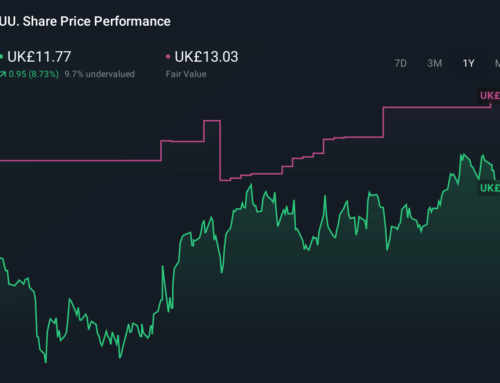

HK Asia Holdings (1723) said it bought another 10 bitcoin (BTC) for $858,581.

The Thursday purchase took the Hong Kong-listed company’s total to around 18.88 BTC at a cost of roughly $1.72 million. The acquisitions were made via open market transactions and funded through internal cash reserves.

Story continues

In a statement, the company said it views bitcoin as a viable store of value amid global economic uncertainty, inflation concerns and expanding use of cryptocurrencies in investment strategies as well as “its potential to act as an effective hedge against depreciation of fiat currencies.”

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

James Van Straten is a Senior Analyst at CoinDesk, specializing in Bitcoin and its interplay with the macroeconomic environment. Previously, James worked as a Research Analyst at Saidler & Co., a Swiss hedge fund, where he developed expertise in on-chain analytics. His work focuses on monitoring flows to analyze Bitcoin’s role within the broader financial system.

In addition to his professional endeavors, James serves as an advisor to Coinsilium, a UK publicly traded company, where he provides guidance on their Bitcoin treasury strategy. He also holds investments in Bitcoin, MicroStrategy (MSTR), and Semler Scientific (SMLR).

Search

RECENT PRESS RELEASES

Related Post