Hoskinson’s Backing of American Bitcoin Triggers Mixed ADA Market Reaction

November 15, 2025

Key Notes

- Cardano’s Charles Hoskinson joins a $200 million round backing American Bitcoin, a mining and AI infrastructure firm linked to the Trump family.

- ADA price slid 2% before stabilizing above $0.50 amid weaker demand, falling volumes, and declining derivatives activity.

- Despite short-term weakness, positioning data indicate that traders are defending the $0.50 support with a mildly bullish long-to-short ratio.

Cardano slipped 2% on Saturday, November 15, before stabilizing just above the $0.50 mark as investors absorbed news of Charles Hoskinson’s strategic participation in American Bitcoin’s latest $200 million funding round. Hoskinson highlighted the company’s dual focus on large-scale Bitcoin mining and advanced AI infrastructure as the core rationale behind his investment. Posting on X on Saturday, Hoskinson emphasizes these factors, positioning the firm for considerable revenue streams in the long term.

American Bitcoin, co-led by Eric Trump and Donald Trump Jr., previously secured a $220 million pre-IPO round in July, with Solari Capital contributing more than $100 million. The latest round extends that trajectory, drawing in Hoskinson alongside Grant Cardone and Peter Diamandis.

Despite Anthony Scaramucci’s public break with Donald Trump, his son, AJ Scaramucci, structured Solari’s stake, reflecting capital flows increasingly detached from political narratives and centered on hard-asset accumulation.

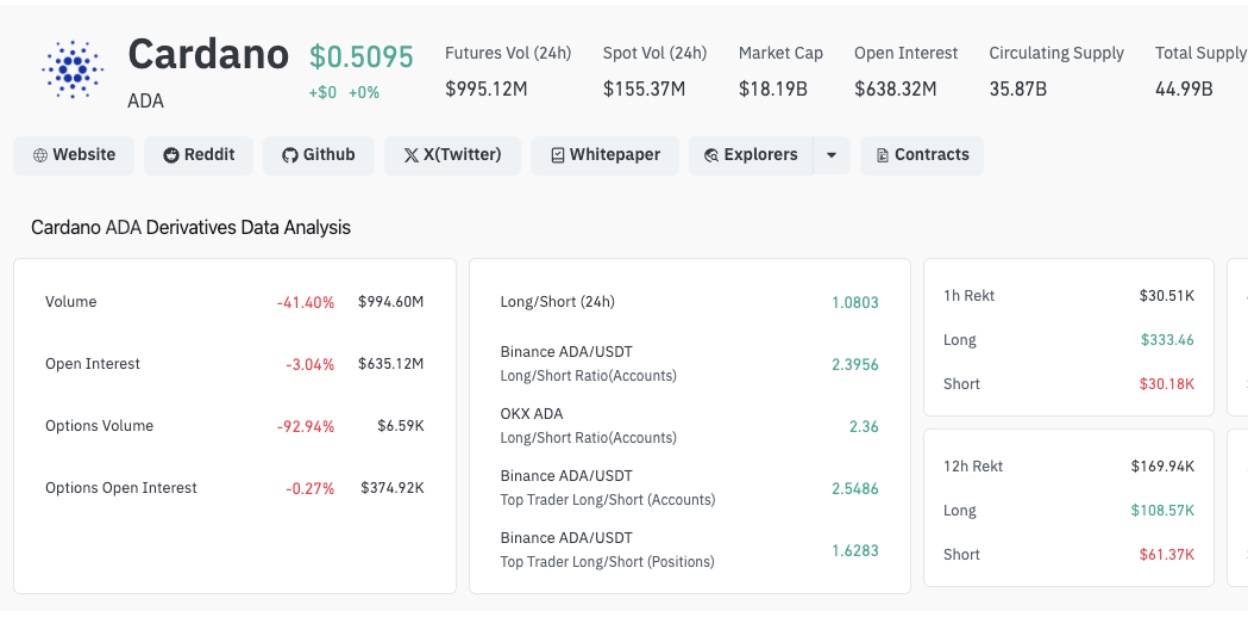

Cardano (ADA) Derivative Market Analysis | Source: Coinglass

Still, ADA’s short-term reaction skewed negative, according to Coinglass data. Cardano fell to 14th place in intraday demand, with volumes dropping 41% to $994 million. Open interest declined 3% to $635 million, marking roughly $20 million in closed ADA futures positions over 24 hours. This contraction reflects traders reducing exposure amid volatility surrounding U.S. political news cycles and the Trump-linked narratives around the American Bitcoin raise.

Yet, a considerable number of Cardano traders are moving to avert a decisive breakdown below the critical $0.50 support level. ADA’s long-to-short ratio of 1.08 suggests new long covering positions outpaced new short exposure on Saturday, potentially marking a price-floor formation.

ADA trades at $0.5075 after a week-long decline that pushed prices toward the lower boundary of its mid-November range.

The daily chart shows ADA moving firmly below the 50-day, 100-day, and 200-day moving averages at $0.6703, $0.7658, and $0.7344, respectively, reinforcing a well-established downtrend. Until ADA reclaims at least the 50-day average, any upside attempt remains structurally limited.

Parabolic SAR dots continue to print above the daily candles, confirming persistent downward pressure as sellers maintain control.

Cardano (ADA) Price Analysis | Source: TradingView

The RSI at 34.23 sits near oversold territory but has yet to form a bullish divergence, suggesting that the price may drift sideways or test lower support levels before any rebound attempt gains strength. The BBP at –0.0899 indicates that bearish pressure remains dominant and counters rebound attempts.

The market structure provides immediate support at $0.50, with a deeper liquidity pocket near $0.47 if momentum weakens further. A daily close below $0.50 would expose ADA to a deeper retracement toward $0.45.

However, if bulls hold the current level and reclaim $0.53, ADA could attempt a recovery toward $0.60, near the 50-day average.

For now, ADA trades in a fragile zone where sentiment, macro narratives, and positioning flows converge. Traders appear determined to defend the psychological $0.50 floor, but without renewed volume and a shift in trend indicators, upside prospects remain uncertain.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Altcoin News,Cryptocurrency News,News

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.

Search

RECENT PRESS RELEASES

Related Post