How AI Can Be Used in Investing

May 1, 2025

(Image credit: Getty Images)

Artificial intelligence (AI) has seamlessly integrated into our daily digital interactions. Take ChatGPT, for instance — its user base reportedly surpassed one billion in April 2025, doubling in just a few weeks, according to OpenAI CEO Sam Altman.

Despite this widespread adoption, many individuals still prefer traditional methods for financial decision-making. A recent survey by the FINRA Investor Education Foundation of over 1,000 U.S. adults found that 63% consult financial professionals and 56% rely on advice from friends and family. Only a modest 5% turn directly to AI tools. Interestingly, about 25% use financial apps that often incorporate AI features like automated budgeting and portfolio suggestions, perhaps without realizing the extent of AI’s involvement.

In contrast, professional investors are rapidly embracing AI. A global survey conducted by Mercer found that 91% of investment management firms are either using AI or planning to do so. Some of the categories for this powerful technology include stock selection, asset allocation and risk assessment.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail.

Profit and prosper with the best of expert advice – straight to your e-mail.

Looking ahead, it’s hard to imagine a future where AI doesn’t play a central role in how we invest, whether you’re managing billions or just starting your 401(k). The technology is evolving fast, and so is its potential impact.

So, what exactly can AI do in the investing world? Where is it making the biggest difference? And just as important — what are the risks? Let’s take a closer look.

Can I use AI to predict the stock market?

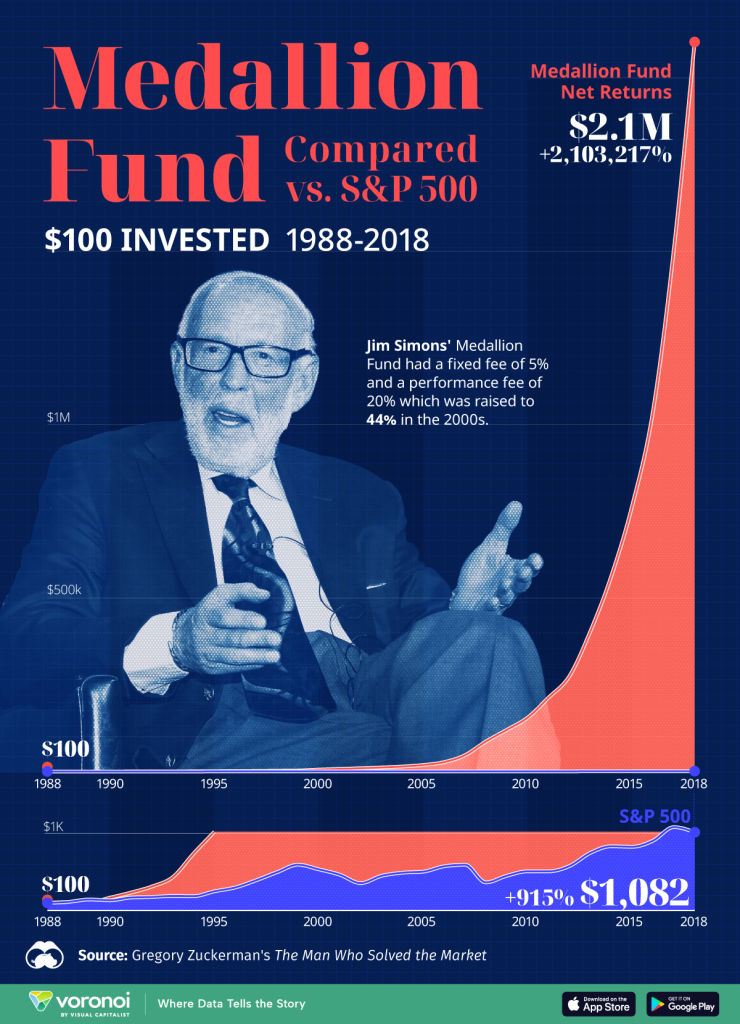

The late Jim Simons made his name as a brilliant mathematician and codebreaker before turning his attention to the financial world. In 1978, he launched Monemetrics, which would later become Renaissance Technologies — a firm now legendary in quantitative investing circles. By 1988, Simons had introduced the Medallion Fund, a vehicle that would go on to reshape how many viewed market analysis and trading.

What set Medallion apart was its early and aggressive use of complex algorithms, machine learning and artificial intelligence to sift through enormous volumes of data. Rather than relying on traditional valuation metrics, Simons and his team focused on uncovering subtle, short-term inefficiencies in the market — patterns that might escape human detection. This tech-driven approach allowed the fund to adapt rapidly to market shifts and execute trades with exceptional speed and accuracy.

The performance was nothing short of historic. Between 1988 and 2018, Medallion produced an average gross annual return of about 66%, and roughly 39% after fees — returns that place it at the top of hedge fund performance rankings.

(Image credit: Visual Capitalist via Getty Images)

The fund’s success sparked a wave of interest in quant strategies, where portfolios began to be built not just by MBAs and CFAs, but by data scientists, AI specialists and physicists. Yet this is not to imply that AI is somehow a silver bullet for predicting markets.

“While it can help with very short-term predictions, it’s less effective beyond this,” said Arjun Bali, who is a staff data scientist at Rocket Mortgage. “Markets tend to self-correct over time, especially in liquid asset classes. As information gets priced in, the edge from predictive models goes down, making it hard for AI to consistently exploit patterns beyond the near-term. Then there are the structural breaks, policy shifts and COVID-like unpredictable events that can render historical patterns irrelevant.”

So while AI might be able to identify certain patterns and market inefficiencies, it can’t predict the future. This was demonstrated handily as Kiplinger’s senior investing editor Karee Venema tried out AI vs the stock market.

How will AI impact investing?

One of the clearest validations of AI’s growing role in the financial world is the flood of new apps designed to help retail investors harness AI for stock picking, portfolio optimization and market analysis.

These tools promise to bring institutional-level insights to the fingertips of everyday investors. Here are some examples:

- WallStreetZen: A stock research platform whose Zen Ratings AI model evaluates over 115 factors to assign ratings from A (Strong Buy) to F (Strong Sell). “Our system is trained on the things that pointed to outperformance since 2003,” said Steve Reitmeister, WallStreetZen’s editor-in-chief. “This helps eliminate the bias to what is working now with greater focus on what works over the long haul.”

There is a free version with limited features and a premium plan for $19.50 per month, which provides access to comprehensive stock ratings, forecasts from top-performing analysts and detailed explanations for stock price movements. - Magnifi: This service leverages AI to help optimize portfolios. It is done by using a chat interface. Magnifi is integrated with services from firms like Fidelity, Robinhood, and Schwab. There is a free plan and a premium option for $14 per month or $132 per year.

- Danelfin: An AI-powered stock-ratings engine that can help improve the odds of beating the market over the next three months. “We distill thousands of noisy market signals into an objective, explainable probability score and daily idea lists, so you spend less time hunting for alpha and more time acting on it,” said Tomas Diago, founder and CEO. The service has a PLUS plan for $25 per month and a Pro version for $70 per month.

The risks of using AI in investing

(Image credit: Getty Images)

There are certainly plenty of risks with using AI in investing.

“LLMs are getting better rapidly, but math is not their strong suit,” says Nick Holeman, director of financial planning at Betterment. “That is highly problematic in a field like finance that is heavily reliant on math.”

Data bias is another concern, as AI models depend on the quality of their training data. Inaccurate or biased data can lead to flawed investment decisions. Moreover, as AI systems incorporate alternative data sources — such as credit card transactions and social media activity — issues of data privacy and governance in AI become increasingly significant.

Cybersecurity is also a critical consideration. The integration of AI into trading platforms and financial systems raises the potential for breaches, particularly in fintech firms handling sensitive information.

Despite these challenges, AI continues to evolve rapidly, introducing innovations like AI agents. While caution is advisable, AI is poised to play a significant role in shaping future investment decisions.

Learn more about AI

TOPICS

Profit and prosper with the best of Kiplinger’s advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Search

RECENT PRESS RELEASES

China’s green tech revolution will outlast geopolitics: Arif Aga

SWI Editorial Staff2025-12-13T20:14:43-08:00December 13, 2025|

Column: Virginia’s future growth depends on energy diversity

SWI Editorial Staff2025-12-13T20:14:09-08:00December 13, 2025|

Want to Start the New Investing Year Off Right? 3 Warren Buffett-Inspired Moves to Make Be

SWI Editorial Staff2025-12-13T19:23:38-08:00December 13, 2025|

Risk-loving Korean investors made to watch training video before trading

SWI Editorial Staff2025-12-13T19:23:06-08:00December 13, 2025|

Pinnapuram Integrated Renewable Energy Project transforms barren land into world’s largest

SWI Editorial Staff2025-12-13T18:20:39-08:00December 13, 2025|

Athena Bitcoin Highlights the Power of Decentralization as the World Reflects on Satoshi N

SWI Editorial Staff2025-12-13T18:19:37-08:00December 13, 2025|

Related Post