How Bitcoin Could Help You Retire a Multimillionaire

December 22, 2025

The flagship cryptocurrency could add considerable upside to your savings if wielded responsibly.

Cryptocurrencies have gained significant popularity during the past decade. Millennials and Gen Z investors are more willing than previous generations to incorporate cryptocurrencies into their long-term investment plans.

Of course, this probably wouldn’t be the case today if it weren’t for Bitcoin (BTC +2.33%), the first crypto, and the largest by market cap today. Those who bought Bitcoin early and held have enjoyed life-changing returns. Bitcoin’s price has increased by a staggering 18,500% during the past decade alone.

While it may not be too late for Bitcoin to help you retire a multimillionaire, it does take some strategy to invest in it responsibly.

Here is what you need to know.

Image source: Getty Images.

Bitcoin’s success as digital gold

Bitcoin’s creator, identified by the pseudonym Satoshi Nakamoto, published Bitcoin’s white paper in 2008. Bitcoin helped pioneer the concept of a decentralized, secure, digital ledger system, known as a blockchain.

Advertisement

Despite Bitcoin’s $1.7 trillion market cap, it has less than $500 million in total value locked (TVL) on its blockchain. That means that people aren’t using its network very much. In fact, Bitcoin isn’t even in the top 10, and pales in comparison to the $121 billion TVL on the Ethereum blockchain.

Instead, investors primarily value Bitcoin as a scarce digital store of value, like an electronic version of gold. Society has increasingly acknowledged Bitcoin as the leading cryptocurrency, with some corporations beginning to accumulate it, and the U.S. government announcing plans for a Strategic Bitcoin Reserve earlier this year.

Bitcoin’s fixed maximum supply and dollar-denominated price have made it an effective hedge against inflation. As the fiat currency’s per-dollar value erodes over time and society’s demand for Bitcoin as a digital store of value increases, its price has skyrocketed.

Why Bitcoin is best in a supporting role, and not the lead

The crypto’s increasing acceptance and years of strong returns go a long way to instill confidence in owning it. Still, Bitcoin has its skeptics.

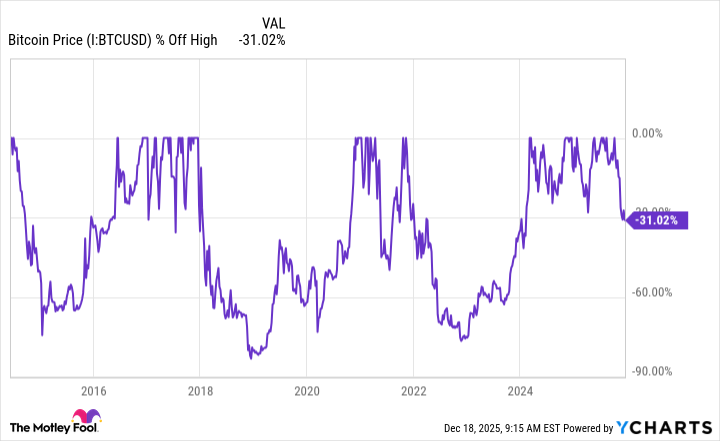

Bitcoin has been highly volatile throughout its history. You can see how Bitcoin’s price frequently drops by 30% to 60%, and even falls much lower on occasion. Remember, these swings have occurred in a bull market for stocks. Investors have yet to see how Bitcoin performs in a prolonged bear market — even the 2020 pandemic crash was brief.

Bitcoin Price data by YCharts

That’s why you probably don’t want to invest more in Bitcoin or other cryptocurrencies than you can afford to lose. Just because Bitcoin has done well, and there are reasons to believe that it can continue, it doesn’t guarantee that Bitcoin’s price will go up forever.

How Bitcoin could help you retire a multimillionaire

Bitcoin

Today’s Change

(2.33%) $2054.93

Current Price

$90082.00

The best way to utilize Bitcoin in your portfolio is to slowly and steadily buy it to hold for the long term. In other words, treat it like you would any other stock in a diversified portfolio. If you invested, say, 5% of your portfolio in Bitcoin over time, that could be enough to make a tremendous difference in your overall returns over a decade or two.

For example, suppose you managed to invest $10,000 in Bitcoin. If Bitcoin’s price rose by 5,000% over the next 20 years, far less than the 18,500% it has risen over the past 10 years, that investment would grow to about $500,000.

Keep in mind that the most popular stock market index, the S&P 500, has generated an annualized 8% return throughout history, so that’s a nice spark for your portfolio. If something happens to Bitcoin and it doesn’t work out, the exposure wouldn’t be enough to risk catastrophic losses.

By incorporating Bitcoin’s upside potential while mitigating its downside risk with the proper portfolio construction, the flagship cryptocurrency can help you retire a multimillionaire — that’s generational wealth for most investors.

Search

RECENT PRESS RELEASES

Related Post