How Changing Analyst Sentiment Is Reshaping Banco Macro’s Investment Story

November 15, 2025

The consensus analyst price target for Banco Macro has jumped significantly from ARS 12,062 to ARS 16,878, reflecting growing market optimism. This shift is supported by analysts pointing to stronger fundamentals and a more stable macroeconomic outlook in Argentina. For investors tracking the evolving landscape, stay tuned to find out how to keep informed on these narrative shifts moving forward.

Stay updated as the Fair Value for Banco Macro shifts by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Banco Macro.

Recent analyst commentary reflects a noticeable shift in sentiment around Banco Macro, with several major research firms updating their views as Argentina’s economic landscape evolves. Below is a summary of the key themes highlighted in the latest research notes.

🐂 Bullish Takeaways

-

Goldman Sachs initiated coverage with a Buy rating and a $111 price target, citing Banco Macro’s leading capital ratio among Argentine banks, stable net interest margin, and lower asset quality risks. The analyst also noted a more balanced perspective following share rallies driven by lower inflation and economic growth prospects.

-

Citi upgraded Banco Macro to Buy from Neutral, sharply raising its price target to ARS 18,000 from ARS 7,700. The firm pointed to a reduction in political risk following recent elections, which could support a “virtuous credit cycle” and broader growth momentum in the sector.

-

Itau BBA moved Banco Macro up to Outperform from Market Perform with a $78 price target. The firm highlighted that Argentine banks appear “back on track” post-election, reinforcing a more positive near-term outlook.

-

JPMorgan upgraded Banco Macro to Overweight from Neutral, noting the bank’s robust capital position (30% CET1 ratio) and reduced exposure to riskier consumer loans. The price target was revised to $79 from $89 amid a more defensive sector stance.

🐻 Bearish Takeaways

-

Earlier, Citi had downgraded Banco Macro to Neutral from Buy with a significant cut in its price target to ARS 7,700 from ARS 14,000. Their analyst expressed concerns about a potential negative feedback loop from unfavorable macroeconomic developments, emphasizing heightened funding costs and increased uncertainty that could weigh on credit demand and net interest margins.

-

Citi’s sector-wide reduction to Neutral reflected broader caution. The firm noted that unexpected electoral outcomes could override previous guidance and increase near-term risks to banks’ fundamentals.

Overall, while recent upgrades point to improved sentiment and recognition of Banco Macro’s execution quality and capital strength, some analysts continue to highlight important risks, especially around valuation and macroeconomic uncertainty. Investors should weigh both the promising developments and the lingering concerns as sentiment continues to shift.

Do your thoughts align with the Bull or Bear Analysts? Perhaps you think there’s more to the story. Head to the Simply Wall St Community to discover more perspectives or begin writing your own Narrative!

-

Banco Macro’s Board of Directors has scheduled a meeting for November 12, 2025, to consider the payment of a cash dividend to shareholders.

-

The company has launched a major share repurchase program. It has authorized the buyback of up to 30,000,000 shares, equivalent to 10% of its issued share capital. The program has a total allocation of ARS 225,000 million and sets a maximum purchase price of ARS 7,500 per share. It will remain active for 60 calendar days from its official publication on the Buenos Aires Stock Exchange.

-

On October 8, 2025, the Board of Directors approved the share buyback plan, reinforcing Banco Macro’s focus on capital management.

-

A Board Meeting held on September 10, 2025, reviewed the payment of the fourth instalment of the cash dividend to shareholders, highlighting the company’s continued commitment to returning value.

-

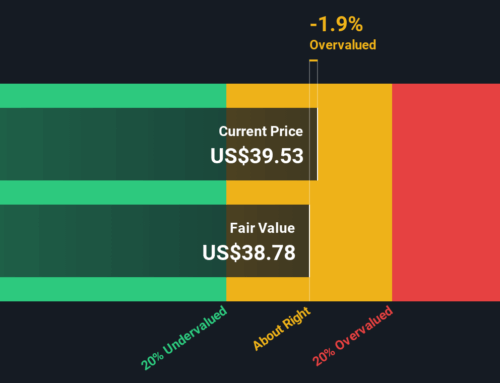

Consensus Analyst Price Target (Fair Value) has increased substantially from ARS 12,062 to ARS 16,878, which indicates heightened market optimism.

-

Discount Rate has edged lower from 29.92% to 29.37%, reflecting slightly reduced perceived risk or improved macroeconomic stability.

-

Revenue Growth forecast has risen modestly, with projected growth up from 32.86% to 33.56%.

-

Net Profit Margin expectation has decreased slightly, moving from 21.30% to 20.97%.

-

Future P/E ratio has climbed from 11.03x to 15.24x, suggesting that a higher valuation multiple is being applied to forward earnings.

Narratives on Simply Wall St let investors connect the dots between the numbers and the story behind a company’s performance. A Narrative explains the “why” behind forecasts and fair value by combining a company’s business context, estimated growth, and earnings outlook. Millions of investors use Narratives in the Community to judge when the price makes sense, and each one updates automatically when new information arrives so you never fall behind.

Read the original Banco Macro Narrative to see what’s shaping the outlook, and follow along for:

-

Sector-leading capital strength and digital expansion that drive resilience and growth, even as Argentina’s economy stabilizes.

-

Balanced analysis of both opportunities such as rapid loan and fee income growth, and risks from tight margins and macro uncertainty.

-

Dynamic updates whenever earnings, news, or macro shifts change the fair value, helping you stay informed about key changes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include BMA.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Terms and Privacy Policy

Search

RECENT PRESS RELEASES

Related Post