How Do NextEra’s Renewable Energy Moves Impact Its 2025 Stock Value?

October 31, 2025

- Ever find yourself wondering if NextEra Energy is a hidden bargain or already priced to perfection? Let’s break down what’s really going on with this utility giant’s stock value.

- This year, the stock has climbed 13.7% and is up 3.5% over the last month, though it dipped 3.6% in the past week. That kind of movement grabs attention from growth-focused and risk-aware investors alike.

- Recent headlines about NextEra’s push into renewable energy projects and strategic investments have sparked investor interest, fueling optimism about its long-term prospects. At the same time, shifting regulatory environments and evolving energy market dynamics have added a note of caution to the market’s outlook.

- If you look at standard valuation checks, NextEra Energy scores just 1 out of 6 for being undervalued. That basic score only tells part of the story, though, so let’s dive into different valuation approaches. Be sure to stick around for a smarter way to gauge fair value at the end.

NextEra Energy scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Advertisement

Approach 1: NextEra Energy Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) is a popular way to estimate a stock’s fair value by projecting its future dividend payments and discounting them back to today’s dollars. This approach is particularly useful for established companies like NextEra Energy that have a strong record of paying dividends.

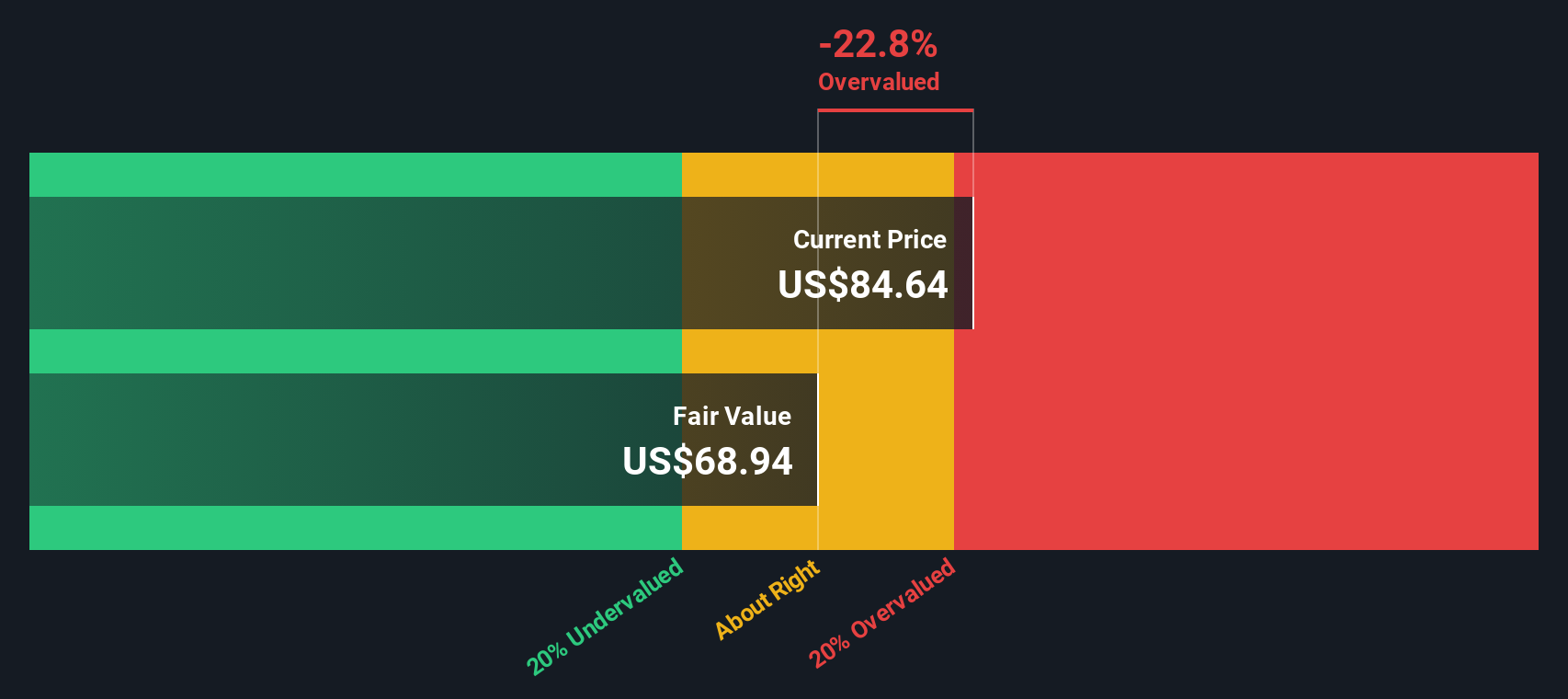

NextEra Energy currently pays out an annual dividend per share of $2.57, with a payout ratio of 61%. The company is posting a return on equity of 9.5%, suggesting it is efficiently generating profits relative to shareholder equity. The projected dividend growth rate has been capped at 3.08%, in line with recent company performance and analyst expectations.

By projecting these dividends into the future and calculating how much they are worth today, the DDM estimates an intrinsic share value of $69.51. However, when compared with the current market price, this result signals the stock is 17.1% overvalued by this method. In other words, the market’s optimism about future growth and dividend sustainability appears already priced in, and possibly more.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests NextEra Energy may be overvalued by 17.1%. Discover 833 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: NextEra Energy Price vs Earnings (PE) Analysis

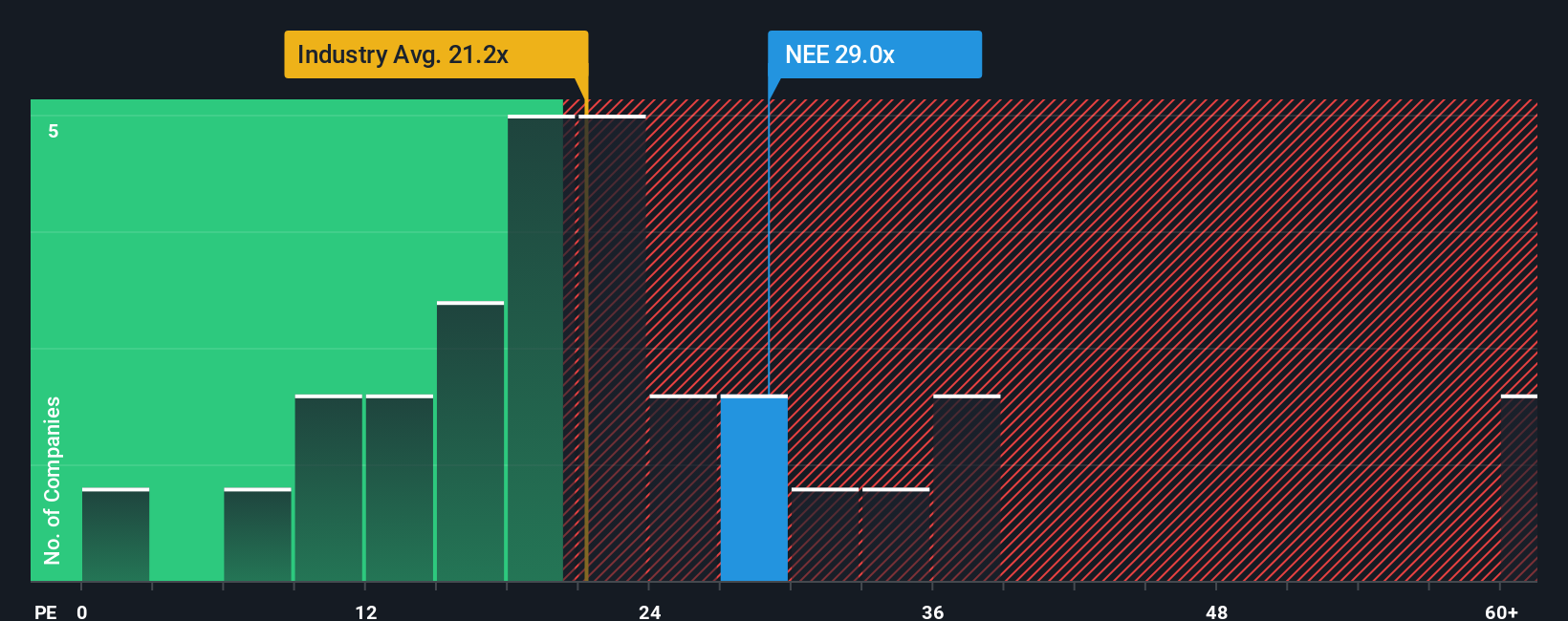

For established, profitable companies like NextEra Energy, the price-to-earnings (PE) ratio is a classic way to gauge if the stock’s price aligns with the company’s underlying earnings power. A PE ratio helps investors compare what the market is willing to pay today for a dollar of future earnings. This makes it a popular metric for utilities and other consistent earners.

Growth expectations and risk play a significant role in shaping what investors see as a “normal” or fair PE ratio. Companies with higher expected earnings growth or lower risk profiles typically command higher PE multiples. Slower growers or companies facing big uncertainties tend to trade at discounted ratios. For context, NextEra Energy’s current PE ratio sits at 26.1x. This is higher than both the electric utilities industry average of 21.3x and the peer average of 25.1x.

Simply Wall St’s proprietary “Fair Ratio” for NextEra Energy stands at 27.6x. This Fair Ratio gives a more nuanced benchmark, factoring in not just industry averages or peer comparisons but also the company’s expected growth, risk profile, profit margins, and size. By weighing these elements, the Fair Ratio is designed to reflect the premium or discount investors should expect for NextEra’s specific qualities rather than relying solely on broad averages.

Comparing NextEra’s actual PE of 26.1x to the Fair Ratio of 27.6x shows the stock is valued about right at current levels. The small difference means the market is not pricing in excessive optimism or discounting for major threats.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your NextEra Energy Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a way for investors to link their own story about a company to the numbers that matter, turning future estimates of revenue, profits, and margins into a fair value based on their personal expectations or research.

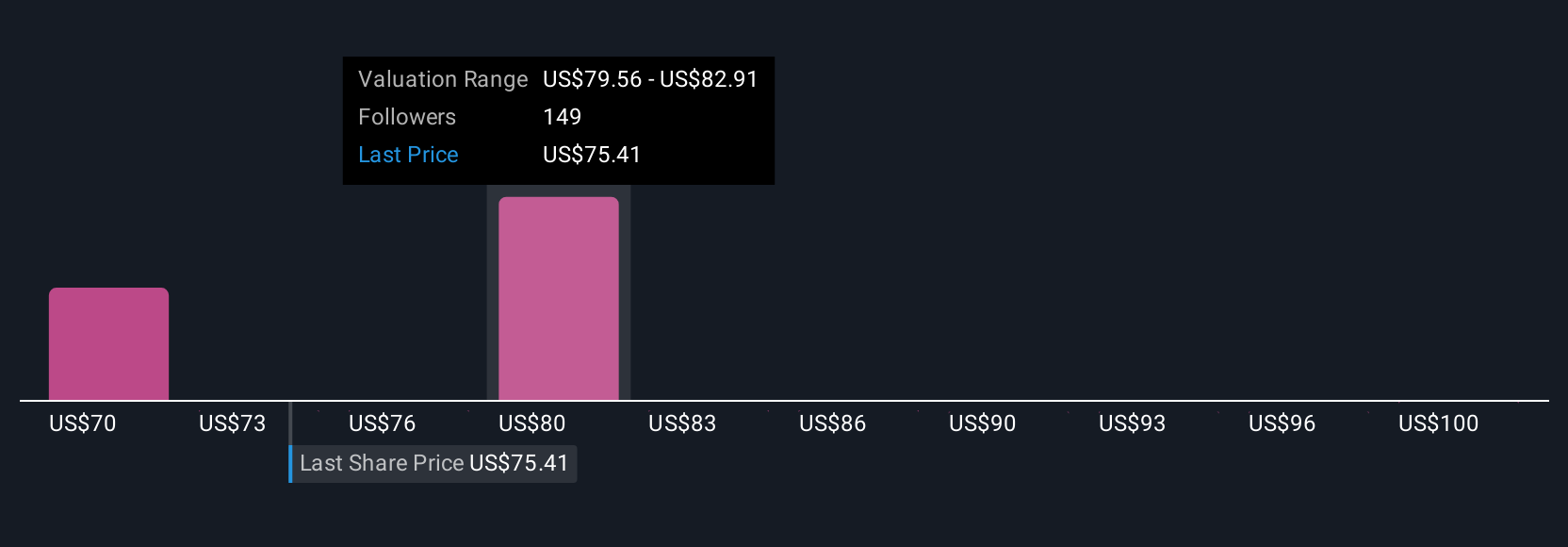

Unlike simple ratios, Narratives connect the “why” behind a stock, such as growth from AI-driven electricity demand or new regulatory changes, directly to a detailed financial forecast. This provides a transparent method for arriving at a fair value. Narratives are available right inside Simply Wall St’s Community page, making them an easy, accessible tool already relied on by millions of investors.

With Narratives, you can see at a glance whether your own view (or the consensus) says NextEra Energy is a buy or sell, based on the gap between Fair Value and today’s Price. Even better, Narratives automatically update as new earnings or news arrives, so your investment view stays dynamic and responsive.

For example, some investors set their Fair Value for NextEra Energy at $103, while others are much more conservative at $52. This shows how different perspectives and stories lead to different numbers, resulting in smarter, more personalized investing decisions.

Do you think there’s more to the story for NextEra Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if NextEra Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post