How Investors Are Reacting To Bitmine Immersion Technologies (BMNR) Pursuing Top Ethereum

October 28, 2025

- In recent days, commentary from Bitmine Immersion Technologies’ Chairman Tom Lee and other crypto leaders reignited attention on cryptocurrency valuations and institutional positioning, as the company highlighted its ambitions to become the top Ethereum treasury operator for institutional and private investors.

- This focus on large-scale Ethereum accumulation has positioned Bitmine Immersion Technologies at the forefront of investor interest amid shifting macroeconomic conditions and renewed optimism in crypto markets.

- We’ll explore how Bitmine Immersion Technologies’ Ethereum treasury strategy strengthens its investment narrative as institutional interest in digital assets returns.

We’ve found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Advertisement

What Is Bitmine Immersion Technologies’ Investment Narrative?

For Bitmine Immersion Technologies, the core belief investors need to embrace is that institutional adoption of digital assets, particularly Ethereum, will accelerate and sustain a premium for companies with significant crypto reserves and treasury operations. The latest industry discussion, prompted by remarks from Chairman Tom Lee and others, comes at a moment when public companies’ cryptocurrency holdings are being stress-tested by falling token and stock prices. While Bitmine’s stated goal to hold 5% of the global Ethereum supply positions it as a unique proxy for institutional sentiment, the drop in digital assets and the heavy recent capital raising highlight real risks. The aggregate impact of the recent crypto downturn may actually sharpen focus on near-term catalysts like treasury performance or future partnerships, but it also intensifies pressure on profitability and amplifies concerns about valuation and dilution, especially after substantial new share and warrant issuances. Given the extended volatility and pricing excesses already flagged by analysts, the near-term impact on Bitmine’s outlook appears material and could shape both risk appetite and timing for prospective shareholders.

But underlying all this opportunity is a risk tied to unpredictable crypto market swings, something all investors should keep in mind.

Bitmine Immersion Technologies’ share price has been on the slide but might be dropping deeper into value territory.Find out whether it’s a bargain at this price.

Exploring Other Perspectives

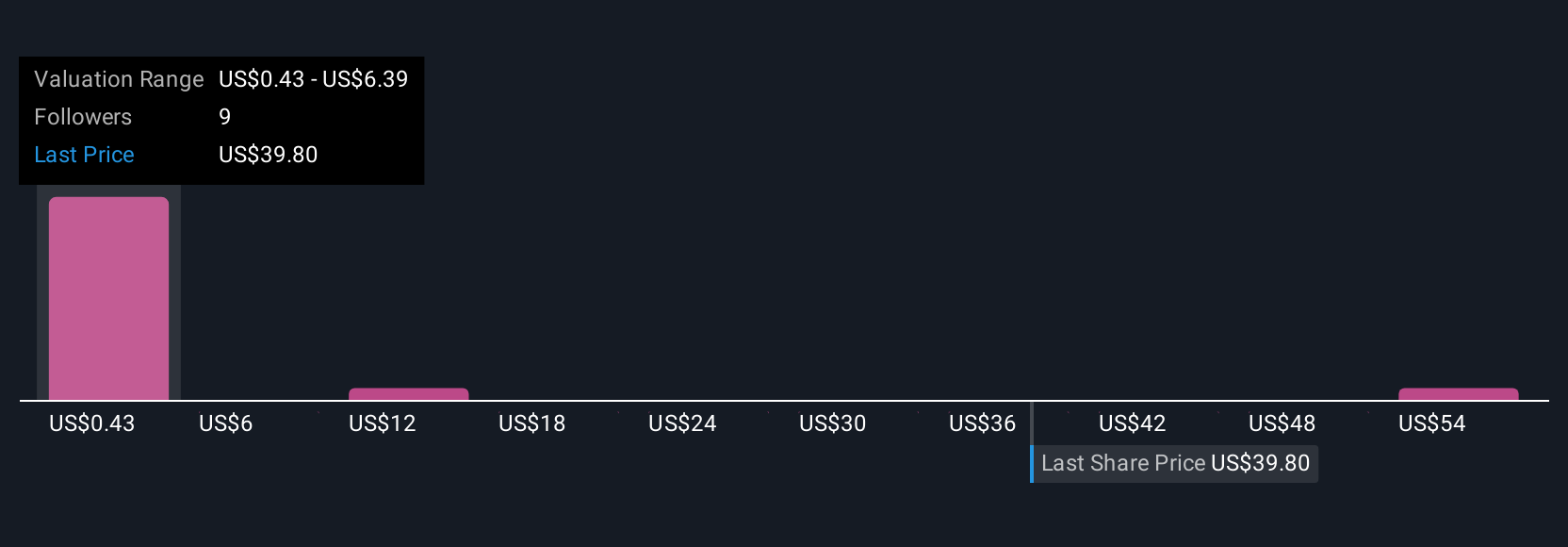

The Simply Wall St Community provides 27 retail investor fair value estimates for Bitmine Immersion Technologies ranging from under US$1 to US$130 per share. These views span extreme ends, reflecting sharply mixed expectations. With future Ethereum risk and recent equity dilution so prominent, you may want to consider how widely investor opinions diverge before forming your own view.

Explore 27 other fair value estimates on Bitmine Immersion Technologies – why the stock might be worth over 2x more than the current price!

Build Your Own Bitmine Immersion Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bitmine Immersion Technologies research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Bitmine Immersion Technologies research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Bitmine Immersion Technologies’ overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don’t delay:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Bitmine Immersion Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post