How Investors May Respond To Vistra (VST) Supplying Meta’s AI Data Centers With Long-Term

January 12, 2026

- In early January 2026, Vistra announced it had entered into 20-year power purchase agreements with Meta to supply more than 2,600 megawatts of zero-carbon nuclear energy from three PJM-region plants, including significant capacity uprates and plans to seek 20-year license extensions for each reactor.

- This long-duration, nuclear-backed deal effectively makes Vistra a core energy partner for Meta’s AI data center build-out while underpinning local jobs, tax revenue, and grid reliability in Ohio and Pennsylvania.

- Next, we’ll examine how anchoring 2,600 megawatts under long-term nuclear contracts with Meta could reshape Vistra’s investment narrative.

We’ve found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Advertisement

Vistra Investment Narrative Recap

To own Vistra, you need to believe in its shift toward contracted, low carbon baseload power tied to long-lived AI and data center demand, while accepting elevated leverage and execution risk on large projects. The Meta nuclear PPAs strengthen the near term earnings visibility catalyst but do not remove key risks around debt loads and the capital intensity of uprates, life extensions, and broader fleet investments.

The most relevant recent announcement alongside the Meta deal is Vistra’s planned US$4.7 billion acquisition of Cogentrix Energy, which adds 10 modern gas plants aimed at supporting rising data center and industrial demand. Together, long term nuclear PPAs and expanded gas capacity frame Vistra as a scaled supplier to AI power needs, but they also concentrate the story around successful integration, disciplined capital allocation, and stable commodity markets.

Yet for investors, the real concern may be how Vistra’s higher leverage interacts with…

Read the full narrative on Vistra (it’s free!)

Vistra’s narrative projects $24.5 billion revenue and $3.4 billion earnings by 2028.

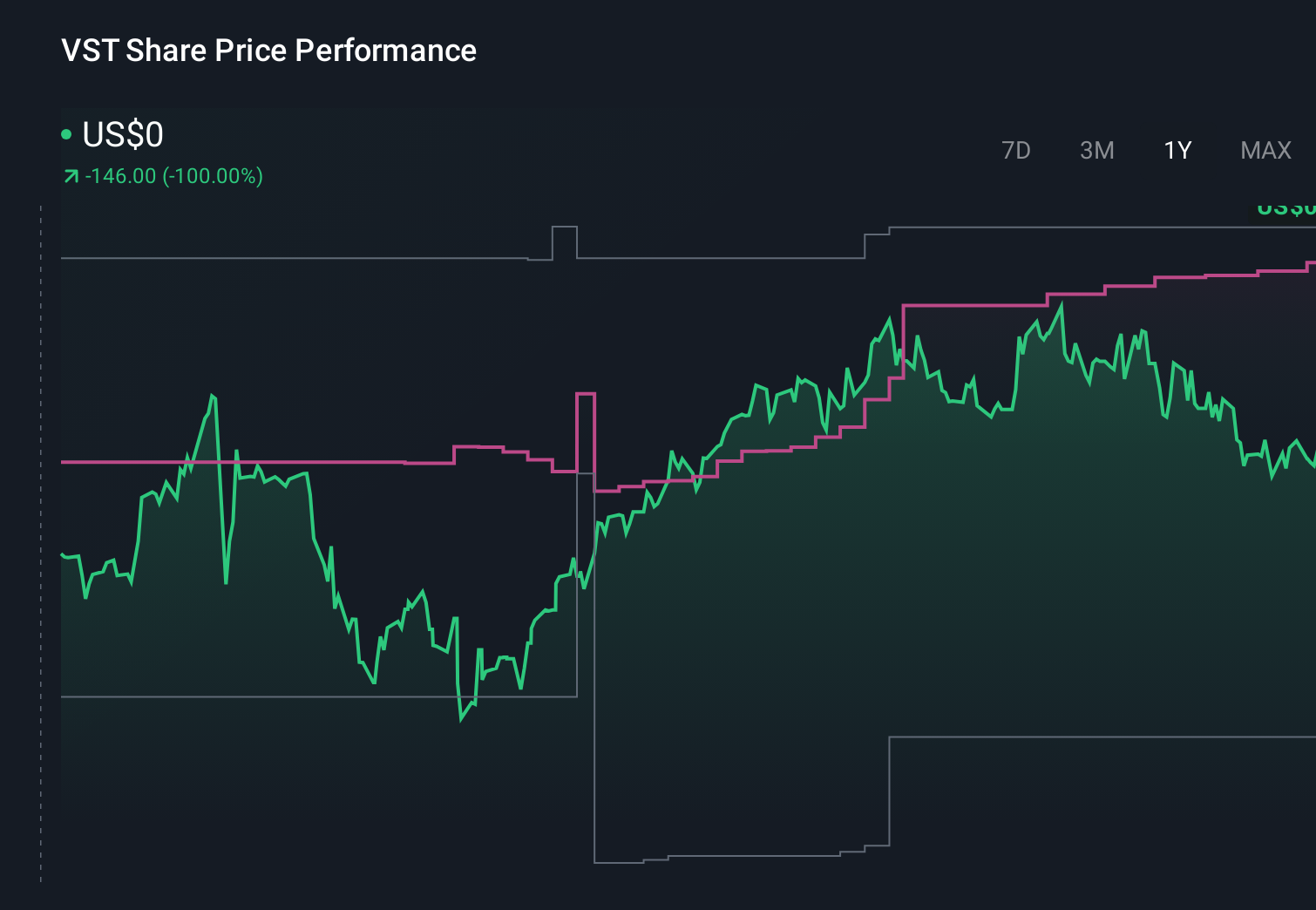

Uncover how Vistra’s forecasts yield a $233.29 fair value, a 40% upside to its current price.

Exploring Other Perspectives

Thirteen fair value estimates from the Simply Wall St Community span roughly US$142 to US$358 per share, showing how far apart individual views can be. When you set that against Vistra’s rising leverage and capital hungry buildout, it underlines why you might want to compare several of these perspectives before deciding how this story could affect future performance.

Explore 13 other fair value estimates on Vistra – why the stock might be worth over 2x more than the current price!

Build Your Own Vistra Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vistra research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Vistra research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Vistra’s overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post