How investors should play Apple stock as it looks to break 7-week losing streak

January 22, 2026

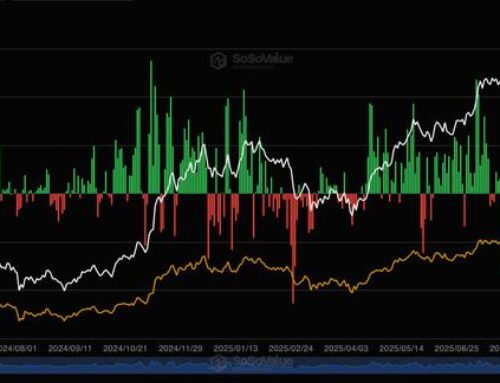

Jim Cramer has a message for investors stuck on the sidelines of Apple stock: Get back in the game. Shares of the tech giant tumbled 1.5% Tuesday, after seven consecutive weeks of losses driven by the market’s rotation out of high-growth stocks and concerns over rising component costs. The stock is down more than 11% that period, compared to the S & P 500 ‘s 1% decline. However, the silver lining of that sell-off, says Jim, is an opportunity for investors to start a position in Apple before the market wakes up to the strength of its AI strategy. “I don’t want to sell Apple here,” he said during Tuesday’s Morning Meeting. “I want to buy it.” He pointed to Apple’s new partnership with fellow Club name Alphabet , announced this month, in which the iPhone maker will use Google’s cloud technology and large language model Gemini to power its artificial intelligence features, including a revamped Siri expected later this year. “This is a great opportunity to realize that they happen to get the premier AI by dealing with Gemini,” Jim said of Apple. “They ended up being a winner here.” By tapping Google, Apple has finally shown investors some real progress in its AI strategy. New iPhone features should lead to more customer upgrades and boost sales for the tech company’s biggest money maker. This is especially crucial as Wall Street’s concerns over Apple’s lagging AI rollout weighed on sentiment last year, causing the stock to underperform other Big Tech names. Apple gained 8.5% in 2025, well short of Nvidia ‘s 39% and Microsoft ‘s nearly 15%. AAPL YTD mountain Apple (AAPL) year-to-date performance The other big worry for some Apple bears is rising memory costs. Citigroup on Monday cut Apple’s price target to $315 from $330 per share, noting that surging computing component costs will hit the company’s gross margin. This component, called dynamic random access memory, or “DRAM,” is important because it stores essential data and instructions for Apple devices while they’re in use. DRAM prices have more than doubled since last October, driven by explosive growth in AI data centers. As LLMs and AI applications become more complex, demand for DRAM is outstripping supply. But we see three reasons why the fear is overblown. First, Apple has been great at passing costs on to its customers, thanks to the pricing power that comes with selling the most important piece of consumer technology on the planet. Memory pricing jumped in 2021, for example, and didn’t have a big impact on gross margins. Second, Apple has long-term agreements with component suppliers that keep costs in check and has the scale needed to give it more negotiating power than other electronics giants when contract renewals do come up. Finally, the key catalyst for Apple stock – its AI opportunity – remains intact. Apple’s agreement with Google isn’t affected by the increased costs, since Gemini’s AI runs in the cloud and doesn’t require more of this specific computing component to run smoothly. Analysts at Evercore ISI agree, describing the memory cost headwind as “minimal” and saying iPhone demand remains “robust” in a Tuesday note to clients. As a result, they added Apple to the firm’s “Tactical Outperform list,” and reiterated their buy rating on shares. (Jim Cramer’s Charitable Trust is long AAPL, GOOGL, NVDA, MSFT. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

Search

RECENT PRESS RELEASES

Related Post