How Long-term Compounding Multiplies the Awesome Power of the Stock Market

June 27, 2025

Time is the secret ingredient of investing, a market veteran says. Over many decades, diversified stock index funds have produced extraordinary results.

Forget about the upheaval in the Middle East. Don’t dwell on Russia’s war with Ukraine, U.S. tariffs and the budget deficit — or just about anything else that has been dominating news coverage and threatening to undermine the markets.

These issues are critical right now, undeniably. But history suggests that they will be irrelevant in your investing life, if your horizon is long enough.

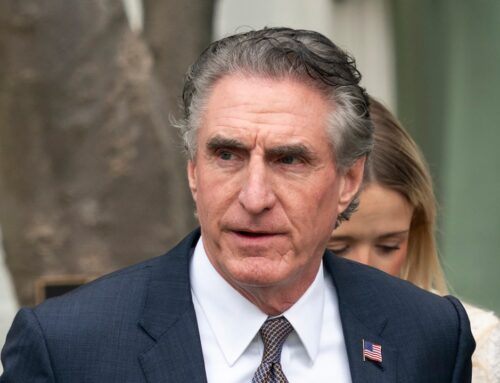

Instead, focus on just one thing: the remarkable record of compounded, reinvested stock returns over many decades. That’s the message of Charles D. Ellis, a pioneer of diversified index fund investing, who has distilled decades of experience and study into a deliberately simple new book, published in February by Wiley: “Rethinking Investing: A Very Short Guide to Very Long-Term Investing.”

“The secret to investing, in my view, is time,” Mr. Ellis, 87, told me in a telephone conversation. “How much time is there between now, when you invest the money, and when you’re going to spend the money. By ‘long term,’ most people think six months, maybe a year, maybe even a few years.”

I’ve said in many columns that, based on history, a long-term investor needed to stay in the stock market for at least a decade, and preferably longer, to have a high probability of an excellent return. Mr. Ellis said that’s stilltoo short to enjoy all the benefits of long-term investing. Instead, Mr. Ellis advised, think 60 years — or longer.

Really, I asked? Who has that kind of investing horizon?

“Actually, many of us have do,” he said. “Say you start in your mid-20s and you continue through your mid-80s. And then, if you’re lucky, you can go longer than that.”

Search

RECENT PRESS RELEASES

Related Post