How WEC Energy Group’s Dividend Affirmation and Clean Energy Investments Shape Outlook for

October 26, 2025

- WEC Energy Group’s board recently declared a quarterly dividend of US$0.8925 per share, payable December 1, 2025, to shareholders of record as of November 14, 2025, and has confirmed it will report third-quarter earnings on October 30, 2025.

- Analysts note that WEC Energy Group’s ongoing investments in clean energy and infrastructure are drawing renewed attention due to growth in demand from sectors like artificial intelligence and data centers.

- Given the board’s dividend affirmation, we’ll explore how this signals confidence in WEC’s future cash flow within its overall investment narrative.

Trump has pledged to “unleash” American oil and gas and these 22 US stocks have developments that are poised to benefit.

Advertisement

WEC Energy Group Investment Narrative Recap

To be a WEC Energy Group shareholder, you need to believe in the essential, long-term role of regulated power utilities and the company’s ability to capitalize on growing demand from sectors like data centers. The recently affirmed dividend underscores stability, but does not materially change the biggest near-term catalyst, anticipated third-quarter earnings on October 30, and the most important risk: rising financing costs that could pressure margins as the company pursues its aggressive capital plan.

The board’s confirmation of its regular dividend follows closely on the company’s strong second-quarter results, which included a solid net income of US$245.4 million and a reaffirmed full-year earnings outlook. This consistency supports investor expectations for stable cash flows, one of the main attractions for those focused on predictable income and rate-regulated returns amid sizable ongoing infrastructure investment.

On the other hand, investors should be especially aware of how higher interest rates may impact WEC’s large equity and debt financing needs, as …

Read the full narrative on WEC Energy Group (it’s free!)

WEC Energy Group’s narrative projects $10.8 billion in revenue and $2.1 billion in earnings by 2028. This requires 5.1% yearly revenue growth and a $0.4 billion earnings increase from the current $1.7 billion.

Uncover how WEC Energy Group’s forecasts yield a $118.54 fair value, in line with its current price.

Exploring Other Perspectives

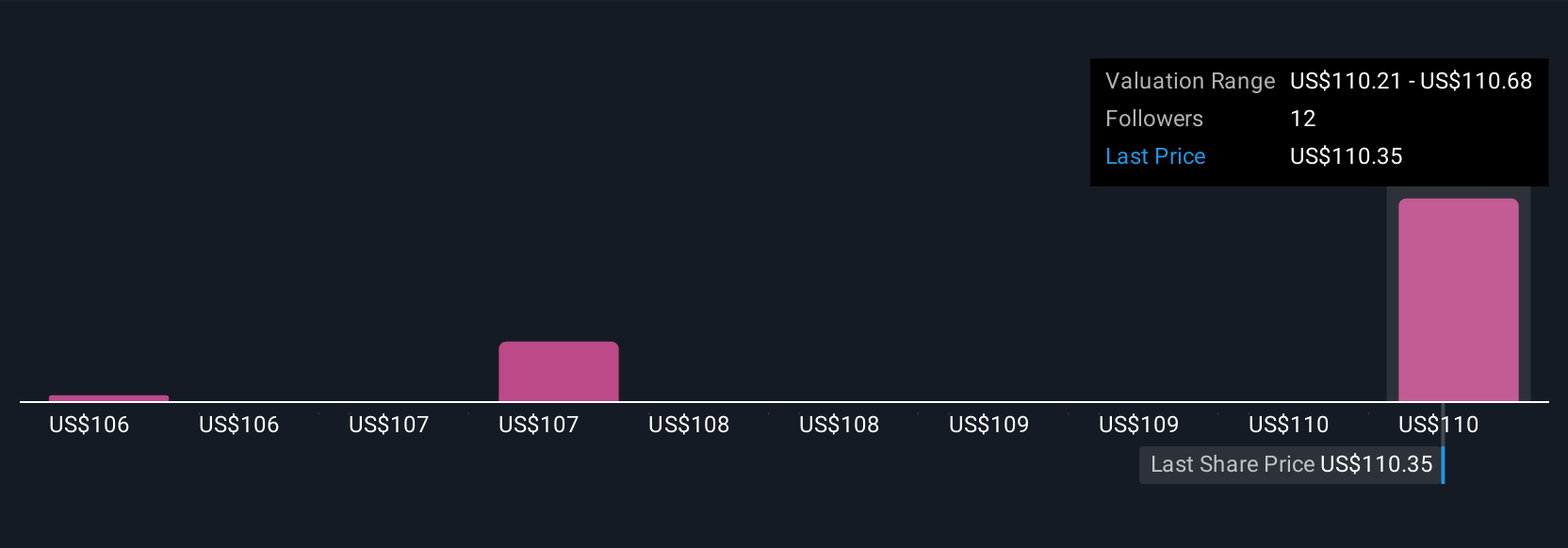

Five members of the Simply Wall St Community see WEC Energy Group’s fair value running from US$106 to US$121 per share. While opinions differ, the company’s ongoing reliance on external financing adds broader implications for future shareholder returns.

Explore 5 other fair value estimates on WEC Energy Group – why the stock might be worth as much as $121.00!

Build Your Own WEC Energy Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your WEC Energy Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free WEC Energy Group research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate WEC Energy Group’s overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if WEC Energy Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post