Huge News For Lyft Stock Investors

September 26, 2025

The second player in ride-hailing is mounting a comeback. But is the stock a buy today?

The market counted out Lyft (LYFT -2.20%) for years, with investors favoring ridesharing leader Uber Technologies instead. Now, Lyft is beginning to mount a comeback, with its stock actually beating the returns of Uber year to date. Why? Lyft has begun to claw back some market share in the United States while at the same time it has flipped to generating positive free cash flow.

On Sept. 17th, Lyft announced a new partnership with premier self-driving car company Waymo in Nashville. This is a large development for Lyft’s business as it tries to navigate the potential opportunities and disruptions of autonomous vehicles. Here’s the skinny on Lyft’s new partnership and whether the stock is a buy for your portfolio today.

Partnership with Waymo

As a self-driving platform, Waymo has steadily expanded to new cities around the country. In some — such as Austin and Atlanta — Waymo has partnered with Uber to manage its ridesharing operations. In Nashville, it will be partnering with Lyft to manage its fleet of vehicles. Self-driving cars do not have people operating them, and therefore need to be stored at a company-owned location for maintenance, cleaning, and recharging.

Through Lyft’s Flexdrive service, Waymo’s vehicles will be managed by Lyft in Nashville. As Lyft is a fast-growing player in the ridesharing market, investors saw this partnership with Waymo as a positive development, and they sent Lyft’s shares up over 10% last week.

Waymo is a partner to Lyft today. In the future, it could end up being a bruising competitor. Customers in Nashville will be able to hail a Waymo self-driving vehicle on Lyft or on the Waymo mobile application. In other markets, Waymo has been able to gain share of rides by solely reaching customers directly through its smartphone application.

This could end up being the main starting point for customers in Nashville as well, even if Lyft is managing the physical fleet of vehicles. However, Waymo is not Lyft’s only self-driving teammate; the company announced a deal with Mobileye back in 2024.

Image source: Getty Images.

Stable market share in United States

Autonomous vehicles pose both a threat and an opportunity for Lyft over the long run. In the short run, it needs to worry about competing with the dominant player in the ridesharing space: Uber.

CEO Dave Risher has made significant progress since joining the company in 2023. In the United States, Lyft’s market share has grown from 26%-27% when Risher joined to 30%-31% today, driven by lower costs on rides and innovative features such as the ability for female riders to choose female drivers. Lyft decided to enter Canada as its first country outside the U.S., while it also has other growing features, such as the previously mentioned Flexdrive program.

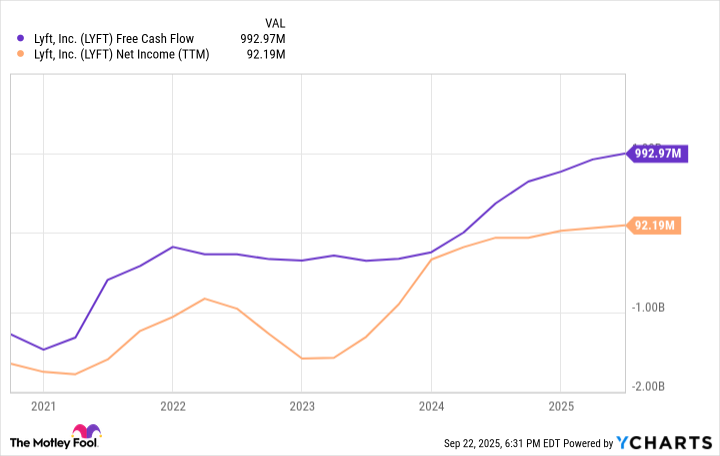

Overall, this turnaround has helped Lyft accelerate revenue growth. Revenue totaled $1.59 billion last quarter, up 11% year over year. Importantly, the company is now cash-flow-positive, proving that it can profitably operate as the underdog in the United States. Over the past year, Lyft had $92 million in net income and $993 million in free cash flow.

LYFT Free Cash Flow data by YCharts

Should you buy Lyft stock?

Now up 75% just in 2025, Lyft has a market cap of $9.2 billion. This looks cheap compared to the trailing-free-cash-flow generation and Uber’s monstrous $200 billion market value.

When you look at net income, which includes non-cash charges for insurance reserves and stock-based compensation, Lyft’s stock is not as cheap, with a price-to-earnings ratio (P/E) of around 100. However, Lyft may still have a lot of room to expand its profit margins, as its net income was just 0.9% of total booking volume spent on the Lyft platform last quarter.

Risher and the team have turned the corner for Lyft. Bankruptcy is not a concern anymore, revenue is steadily growing, and new irons are getting thrown in the fire, like the Waymo partnership. The stock is not screamingly cheap, but Lyft could still present good value for investors who buy today and hold for the next five years (or longer).

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Uber Technologies. The Motley Fool recommends Lyft. The Motley Fool has a disclosure policy.

Search

RECENT PRESS RELEASES

Related Post