Hybrid Mining Equipment Venture Might Change the Case for Investing in Cummins (CMI)

September 21, 2025

- In September 2025, Cummins Inc. and Komatsu Ltd. signed a memorandum of understanding to jointly develop hybrid powertrains for heavy mining equipment, with Wabtec included as a drive system supplier for advanced, decarbonized solutions.

- This collaboration signals an important shift towards low-emissions mining technologies and highlights Cummins’ growing role in industrial decarbonization initiatives beyond its core diesel engine business.

- We’ll explore how this agreement to accelerate hybrid mining equipment development may impact Cummins’ clean energy and power systems investment narrative.

Trump has pledged to “unleash” American oil and gas and these 22 US stocks have developments that are poised to benefit.

Advertisement

Cummins Investment Narrative Recap

To be a Cummins shareholder today, you need faith in the company’s ability to convert industrial decarbonization trends into durable earnings, even as its legacy truck business faces cyclical and regulatory headwinds. The hybrid mining equipment partnership marks progress in Cummins’ energy transition efforts, but the immediate catalyst, robust demand for power generation and backup solutions, remains primarily driven by data centers, while the principal risk continues to be weak North American truck orders and ongoing margin pressure; overall, near-term impacts from the news are not material.

Of the recent announcements, Cummins’ agreement for Pioneer Clean Fleet Solutions stands out for its direct push into low-carbon heavy-duty transportation. While the hybrid mining joint venture expands Cummins’ reach in electrified powertrains, the Pioneer collaboration is most relevant to short-term catalysts by targeting growing volumes in natural gas trucks, providing another potential offset to core market weakness.

By contrast, investors should keep in mind the risk that extended softness in truck demand, despite Cummins’ decarbonization efforts, could still lead to…

Read the full narrative on Cummins (it’s free!)

Cummins’ narrative projects $40.6 billion in revenue and $4.3 billion in earnings by 2028. This requires a 6.4% yearly revenue growth and a $1.4 billion increase in earnings from the current $2.9 billion level.

Uncover how Cummins’ forecasts yield a $418.53 fair value, in line with its current price.

Exploring Other Perspectives

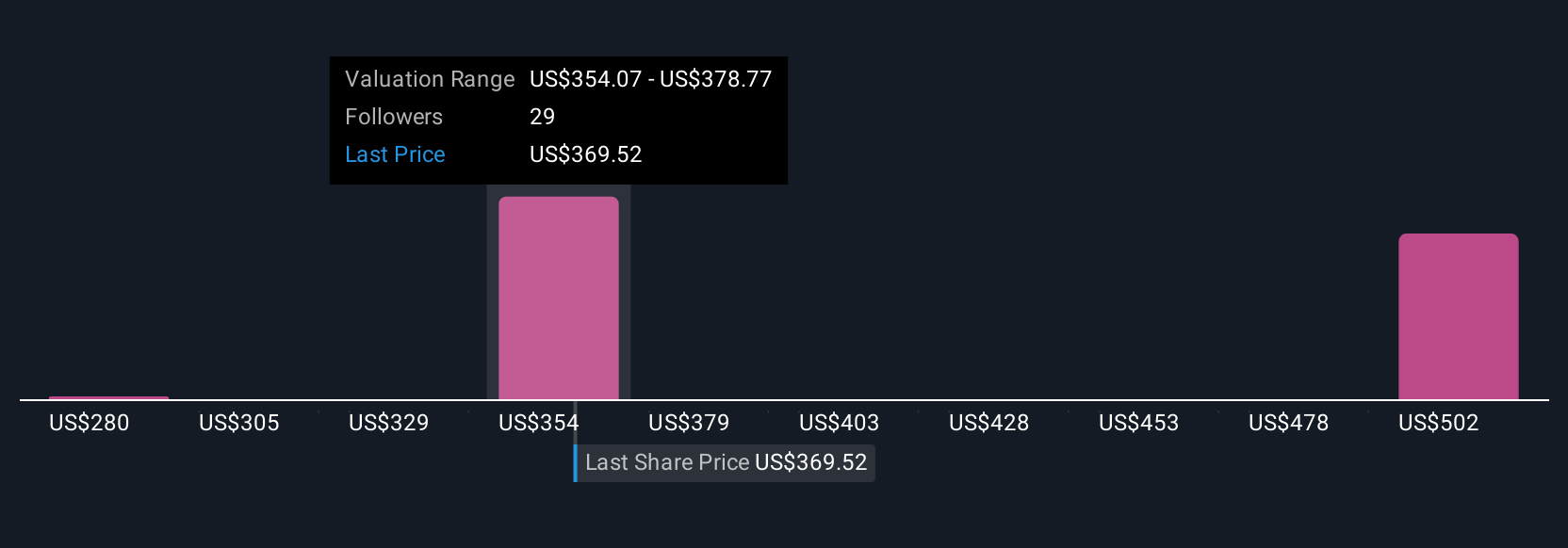

Simply Wall St Community members provided fair value estimates for Cummins ranging from US$280 to US$620 based on four unique analyses. In light of the company’s recent pivot toward hybrid solutions, these opinions show how views differ on whether clean energy investments can balance potential declines in core segments.

Explore 4 other fair value estimates on Cummins – why the stock might be worth as much as 46% more than the current price!

Build Your Own Cummins Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cummins research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cummins research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Cummins’ overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don’t delay:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post