I Think Apple Stock Has Become a Hold for These 3 Reasons

October 29, 2025

Most of Apple’s buy catalysts have disappeared in recent years.

Among tech stocks, one of the bigger surprises is Apple’s (AAPL +0.14%) relatively underwhelming performance. The tech giant’s stock has barely earned any gains in 2025, and it has lost its world’s largest company by market cap title to Nvidia and Microsoft.

What’s more, Apple has been the primary victim of the move into cash by Warren Buffett’s Berkshire Hathaway. Since the end of 2023, Berkshire’s holdings of Apple has fallen from almost 906 million to 280 million, as of the second quarter of 2025.

Knowing this, it appears Apple’s historic run has come to an end, and these three reasons explain why.

Image source: Getty Images.

1. Apple is no longer the lead innovator

When Steve Jobs began his second stint as Apple’s CEO, he rebuilt the company on innovation. Creations such as the iPod changed the way we listen to music, and the invention of the iPhone in 2007 redefined the cellphone industry and how users interact with the internet. The invention of the iPhone so profoundly affected Apple that, to this day, it accounts for the majority of the company’s revenue.

Unfortunately, for Apple, the pace of innovation slowed considerably after Jobs passed away in 2011. In terms of artificial intelligence (AI), Apple has invested in the technology, but other Magnificent Seven stocks, especially Nvidia, have taken the lead.

According to Counterpoint Research, the latest iPhone release, the iPhone 17, outsold the iPhone 16 by 14% in its first 10 days of availability in the U.S. and China. However, investors should also remember that the iPhone 16 was the first iPhone to utilize the AI system, Apple Intelligence. That indicates the higher sales are likely driven by the need for an upgrade rather than the AI technology.

Today’s Change

(0.14%) $0.37

Current Price

$269.18

2. Slowing revenue growth

Also, given the importance of the iPhone to Apple, the company has had to contend with decelerating revenue growth.

In the first nine months of fiscal 2025, revenue of $314 billion grew by only 6% compared to the same period in fiscal 2024. Even though the iPhone accounted for 51% of its revenue during that period, that segment grew by only 4% over the same period.

Moreover, of its product segments, only the Mac and Apple Services experienced double-digit revenue growth in the first three quarters of fiscal 2025. The Mac’s growth is likely due to the popularity of its M-Series chips, and the services segment has grown as Apple has expanded its ecosystem.

Unfortunately for Apple, these are comparatively small revenue drivers compared to the iPhone and unlikely to boost its overall total.

3. Valuation

Furthermore, at least on some levels, the market did not seem to appreciate Apple stock until after the beginning of the pandemic.

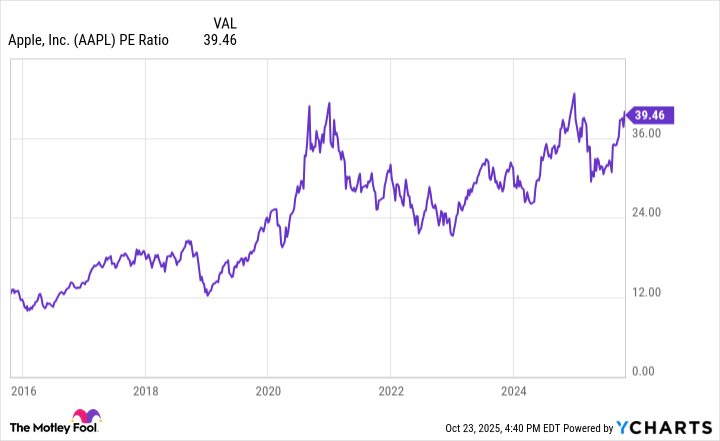

During the middle of the 2010s, when Apple’s revenue growth was often in the double digits, the company’s P/E ratio rarely exceeded 20. Not surprisingly, that was the time that Buffett and his team began to buy Apple shares aggressively.

AAPL PE Ratio data by YCharts

Still, the pandemic fueled a buying binge during the pandemic, sending its P/E ratio higher, and the stock has traded above 30 times earnings for most of that time since.

Today, despite slowing revenue growth, Apple stock trades at an astounding 39 times earnings. Indeed, the comparative success of the iPhone 17 could help it maintain its valuation for the foreseeable future. Nonetheless, it remains to be seen whether the company’s growth can justify its current multiple over a longer time horizon.

Apple stock is a hold

Considering the state of Apple as a company and its valuation, investors should treat the stock as a hold.

Admittedly, Apple has long played a prominent role in the tech industry, and that shows no signs of changing despite not being on the cutting edge with AI.

However, the company has become significantly less innovative in recent years. Additionally, it seems the market was only willing to bid Apple stock to a higher valuation as its revenue had slowed.

Such behavior seems to validate Berkshire’s move to reduce its stake in the company. Although Apple stock will probably rise gradually over time, investors might earn higher returns by investing existing cash elsewhere.

Search

RECENT PRESS RELEASES

Related Post