If The United States Buys 1 Million BTC, Bitcoin Could Skyrocket To 1 Million Dollars, Pre

April 16, 2025

8h05 ▪

6

min read ▪ by

Mikaia A.

The bitcoin market is at a strategic crossroads, with a proposal that could redefine its future. What if the United States bought 1 million BTC? This simple decision could trigger a bitcoin price explosion, potentially propelling it to 1 million dollars. An announcement from Trump or the US government could have a major global impact, shaking the entire cryptocurrency market. Let’s dive into the implications of such a strategy.

A global shock for the bitcoin price: towards 1 million $?

The proposal to buy 1 million BTC by the United States, to create the country’s Bitcoin reserve, is like a bombshell. According to Zach Shapiro of the Bitcoin Policy Institute, this announcement would trigger a global shock:

If the United States announces that they are buying one million Bitcoin, it would cause a global earthquake. The bitcoin price would probably soar to something like one million dollars.

This idea of buying such a volume of bitcoins is part of a strategic approach that would transform bitcoin into a full-fledged store of value, rivaling gold.

The calculation is simple: a massive purchase of this scale would cause a rise in demand, which would automatically drive prices up. Especially since, according to Bitwise CIO, bitcoin could well reach 1 million dollars if an institution buys trillions of dollars worth of BTC.

Currently, with a bitcoin price around 83,000 dollars, this seems like an ambitious goal, but not totally unrealistic if such a strategy were to materialize.

Bitcoin is on the verge of reaching unexpected heights if a major institution enters the market – Bitwise CEO

A “budget-neutral” acquisition thanks to customs duties revenues

Matthew Pines, Executive Director of the Bitcoin Policy Institute, proposes using customs duties revenues to finance the bitcoin acquisition. He believes this would allow the United States to buy more BTC without raising citizens’ taxes. In other words, the government could use funds from import taxes to grow its bitcoin reserves while maintaining a balanced budget.

We are making a fortune from customs duties. 2 billion dollars per day.

This strategy could give a new economic boost to the world’s largest economy while consolidating its position as a bitcoin superpower. The US government would thus seek to strengthen its reserves in digital assets and reduce its dependence on fiat currencies.

This scenario is even more plausible with the new economic policies implemented by the Trump administration, which aims to make bitcoin a strategic currency for the United States. Such an investment could also diversify national reserves by aligning bitcoin with assets like gold.

It is not hard to imagine BTC at 1 million dollars or more.

This acquisition via customs duties (and not classic public funds) could offer a compromise between the need to replenish public finances and that of supporting the cryptocurrency market.

“Tariff revenues can allow the United States to afford more Bitcoin without touching taxes,” says Matthew Pines.

Bitcoin as a global reserve asset: the future in question

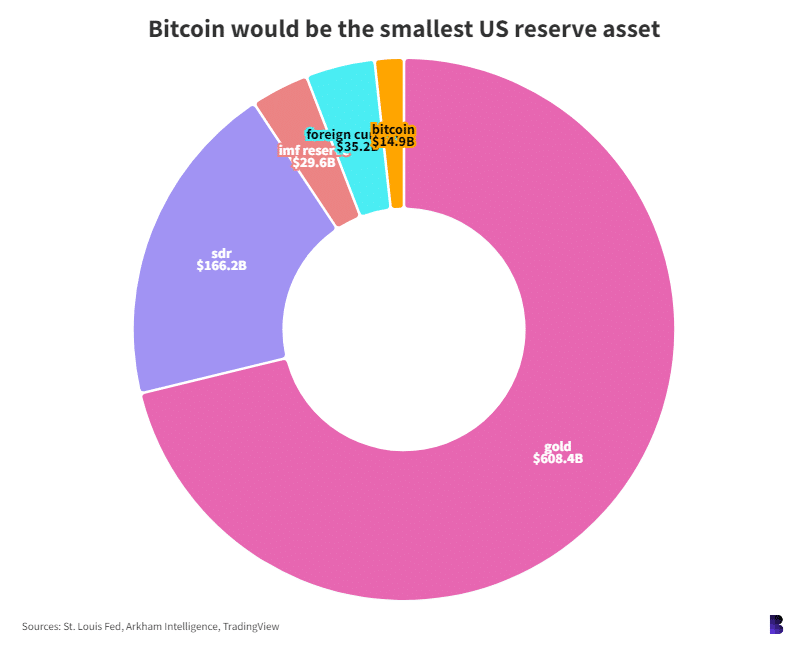

If this strategy materializes, it would mark a turning point in bitcoin’s history. It would transition from a volatile digital currency to a store of value comparable to gold. Currently, the global market remains largely dominated by traditional assets, such as gold or international currencies.

The shift from gold to bitcoin could even happen faster than expected, especially if countries like the United States initiate the move. The Bitcoin strategic reserve, mentioned in Trump’s executive order, could thus be the starting point of a fundamental change in how nations manage their asset reserves.

The adoption of bitcoin as a globally accepted asset would break down a new barrier, thus facilitating its integration into the asset reserves of other countries.

The geopolitical repercussions of such a decision would be enormous. Not only would it affect the value of bitcoin, but it would also change the perception of fiat currencies worldwide.

Bitcoin could well take on the role of gold as the global reserve in the long term, estimates Vivek on Twitter

Key points:

- 1 million BTC bought by the United States could propel the bitcoin price to 1 million dollars;

- The “budget-neutral” strategy using customs duties to finance the BTC purchase would allow strengthening without additional tax cost;

- Bitcoin could replace gold as a global store of value, with major geopolitical repercussions;

- The plan could change the game for the global financial system by pushing back fiat currencies.

Start your crypto adventure safely with Coinhouse

This link uses an affiliate program.

The possibility that the United States buys 1 million BTC could be a revolution for bitcoin, propelling its price to 1 million dollars and changing the global geopolitical balance. However, this strategy remains a bold proposal, a time bomb, and its success will depend on the support of many economic and political actors. Bitcoin’s future now seems more uncertain and fascinating than ever.

Maximize your Cointribune experience with our “Read to Earn” program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.

Search

RECENT PRESS RELEASES

Related Post