If You Put $1,000 into Qualcomm Stock 20 Years Ago, Here’s What You Would Have Today

November 28, 2025

(Image credit: Ramon Costa/SOPA Images/LightRocket via Getty Images)

Few companies have been as critical to mobile communications as Qualcomm (QCOM). The tech giant’s chips and technology power devices made by everyone from Apple (AAPL) to ZTE (ZTCOY). At the same time, Qualcomm rakes in billions of dollars of revenue in royalties from licensing its patents.

Based on its ubiquity and illustrious history of technological innovation, you might think QCOM has been a great buy-and-hold bet.

It has not.

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail.

Profit and prosper with the best of expert advice – straight to your e-mail.

Mostly, QCOM has been dead money. And as for the past two decades, it has been a sinkhole of opportunity cost.

Qualcomm was founded in the 1980s, but it emerged as a tech disruptor when the cellphone market blew up in the latter part of the following decade. The company’s CDMA digital cellular technology became a global standard, and nearly every handset manufacturer licensed it.

Qualcomm followed that win by pivoting to designing semiconductors for mobile devices. Snapdragon, which integrated CPUs, GPUs, modems and other components onto a single chip, became the go-to processor for Android smartphones.

Today, Qualcomm is evolving its Snapdragon platforms to power AI, PCs and high-end Android smartphones, among other endeavors. It even hopes to compete with Apple’s (AAPL) M-series chips.

However, while analysts tend to be bullish about Qualcomm’s prospects, its past performance has been desultory.

A valuation hangover from the go-go dot-com days did investors no favors for years – but legal headwinds and dashed dreams hurt more. The company spent a good chunk of the 2010s fighting antitrust lawsuits in the U.S. and overseas. Qualcomm also had a bruising standoff with a little customer known as Apple.

Adding insult to injury, Qualcomm’s attempt to acquire NXP Semiconductors (NXPI) was blocked by regulators. A hostile takeover bid for Qualcomm by Broadcom (AVGO) was similarly halted.

Take a look at Qualcomm’s top line and you’ll see that revenue would grow as much as 30% one year – and then decline 7% the next. The unstable and uncertain situation naturally took a toll on returns.

Over its entire life as a publicly traded company, QCOM stock almost doubles the performance of the broader market, with an annualized total return (price change plus dividends) of 19.9% vs. 10.8% for the S&P 500.

Unfortunately, that’s about the only time frame in which QCOM looks good. Indeed, the tech stock lags the broader market on pretty much every standardized time frame you pull up. (Over the past 10 years, QCOM does outperform the S&P 500 by about 1.6 percentage points.)

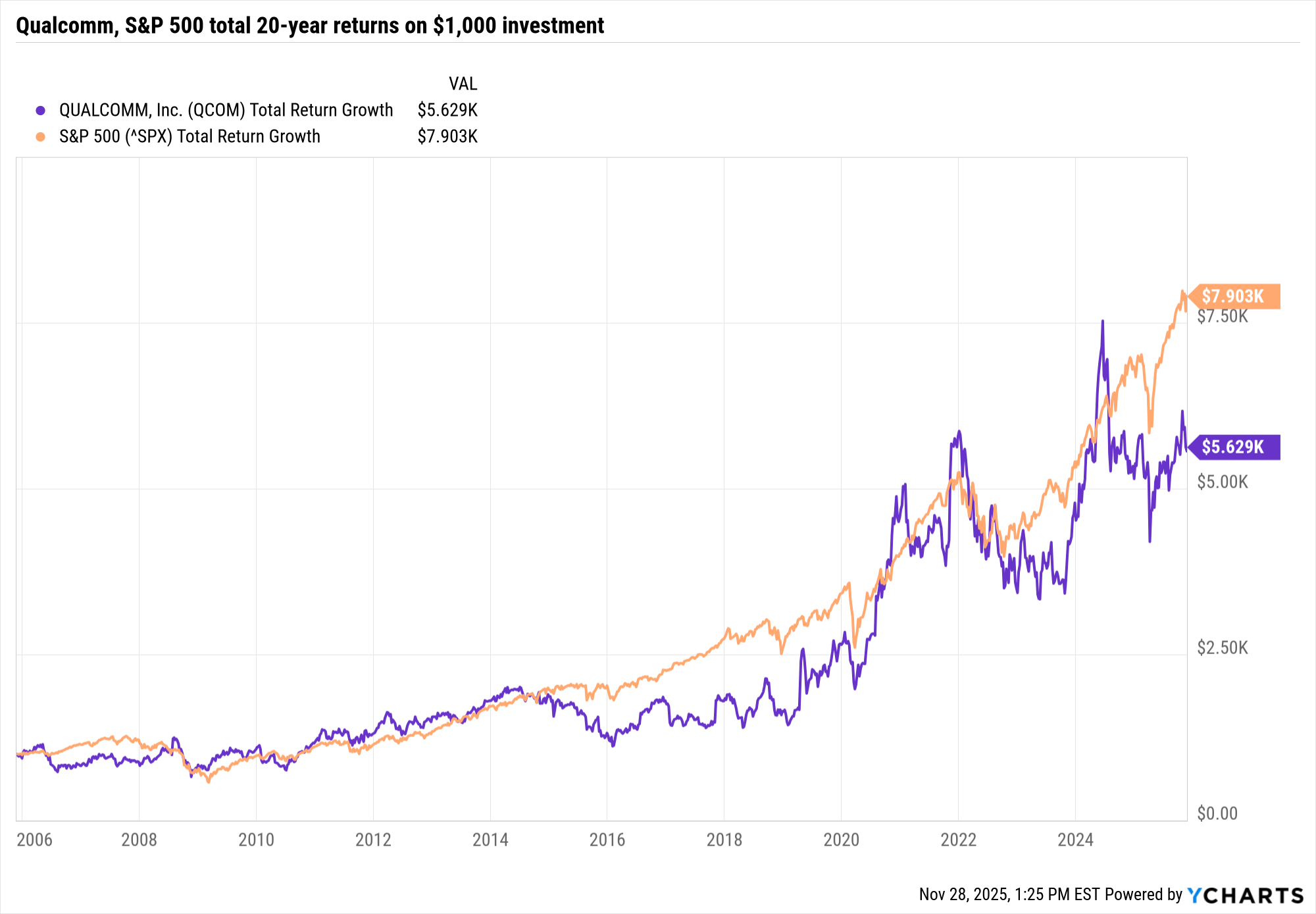

(Image credit: YCharts)

What does this sort of chronic underperformance look like on a brokerage statement? Take a look at the above chart and you’ll see that if you put $1,000 into Qualcomm stock 20 years ago, it would today be worth about $5,600 – or an annualized total return of 9%.

The same sum invested in the S&P 500 would theoretically be worth $7,900 today, or 10.9% annualized.

Can QCOM stock finally start delivering for patient investors?

Of the 36 analysts covering the semiconductor stock surveyed by S&P Global Market Intelligence, 11 rate it at Strong Buy, five say Buy, 19 have it at Hold and one calls it a Strong Sell. That works out to a consensus recommendation of Buy, albeit with modest conviction.

Speaking for the bulls, Argus Research analyst Jim Kelleher likes the way Qualcomm is navigating the rolling loss of its Apple business by focusing on a host of other opportunities.

“Snapdragon processors are well suited for the age of on-device Gen AI,” the analyst writes. “Qualcomm is experiencing rapid growth in markets such as automotive, networking and IoT and has an unmatched royalty stream. On that basis, QCOM appears undervalued on significant long-term growth prospects.”

More Stocks of the Past 20 Years

- If You’d Put $1,000 Into Netflix Stock 20 Years Ago, Here’s What You’d Have Today

- If You’d Put $1,000 Into Microsoft Stock 20 Years Ago, Here’s What You’d Have Today

- If You’d Put $1,000 Into Apple Stock 20 Years Ago, Here’s What You’d Have Today

TOPICS

Get Kiplinger Today newsletter — free

Profit and prosper with the best of Kiplinger’s advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Search

RECENT PRESS RELEASES

Coinbase vs. Riot Platforms: Which Bitcoin-Exposed Crypto Play Wins?

SWI Editorial Staff2025-11-28T13:01:15-08:00November 28, 2025|

Coinbase Bitcoin Premium Turns Positive as Silver Hits Record High

SWI Editorial Staff2025-11-28T13:00:53-08:00November 28, 2025|

Negative consequences do not deter young adults from using alcohol and cannabis together,

SWI Editorial Staff2025-11-28T13:00:21-08:00November 28, 2025|

Is recreational marijuana legal in Nevada? Here’s what the law says

SWI Editorial Staff2025-11-28T12:59:56-08:00November 28, 2025|

Legal Cannabis, Illegal Drive: The ‘Open Package’ Trap

SWI Editorial Staff2025-11-28T12:59:36-08:00November 28, 2025|

Illegal Saugerties cannabis shop shuttered

SWI Editorial Staff2025-11-28T12:59:19-08:00November 28, 2025|

Related Post