If You’d Invested $1,000 in the Utilities Select Sector SPDR Fund (XLU) 10 Years Ago, Here

January 4, 2026

An alternative investment would have performed better.

It can be fun to play what-if games, especially at the end or beginning of the year. If you’re an investor interested in the utilities sector, for example, you might wonder how you’d have done, had you plunked $1,000 in the State Street Utilities Select Sector SPDR ETF (XLU +1.15%). It’s an exchange-traded fund (ETF) — a fund that trades like a stock — and it’s focused on utilities businesses.

Select Sector SPDR Trust – State Street Utilities Select Sector SPDR ETF

Today’s Change

(1.15%) $0.49

Current Price

$43.18

Here’s the answer to that question: Your investment would now be worth about $2,443. That’s pretty good — more than doubling your money — and represents an average annual gain of 9.3%. But it’s worth noting that had you parked that money in a low-fee S&P 500 index fund instead, your stake would be worth around $3,658. The S&P 500 has simply had an excellent decade, averaging annual gains of more than 13%, well above the historic long-term average of close to 10%.

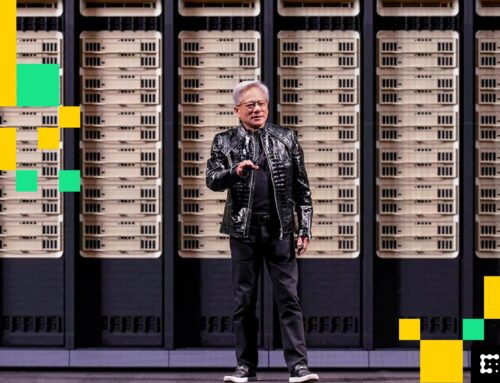

Image source: Getty Images.

Note, too, that dividends matter. Had you reinvested your dividends along the way, you’d have ended up with $2,728, and an average annual gain of 10.6%. (The S&P 500 with dividends reinvested would have grown to $3,979, at an average annual growth rate of 14.8%.)

To give you an idea of what the State Street Utilities Select Sector SPDR ETF invests in, check out its recent top 10 holdings (out of 31):

|

Stock |

Percent of ETF |

|---|---|

|

NextEra Energy |

12.63% |

|

Constellation Energy |

8.45% |

|

Southern Co. |

7.28% |

|

Duke Energy |

6.90% |

|

American Electric Power |

4.68% |

|

Sempra |

4.38% |

|

Vistra |

3.89% |

|

Dominion Energy |

3.82% |

|

Exelon |

3.33% |

|

Xcel Energy |

3.31% |

Source: Morningstar.com. As of Dec. 29, 2025.

If you’re bullish on the utility sector — perhaps because the rapid spread of artificial intelligence (AI) and data centers is increasing demand for energy — give this ETF some consideration. Know that it offers a dividend, too, with a recent dividend yield of 2.55%.

Search

RECENT PRESS RELEASES

Related Post