If You’d Invested $10,000 in Apple Stock 30 Years Ago, Here’s How Much You’d Have Today

August 21, 2025

You’d be more than a millionaire.

Every investor dreams of finding that one stock that can skyrocket and turn them into a millionaire. Those are pretty hard to find, and that’s why it’s so important to diversify. You don’t know which stocks will deliver the greatest returns in 30 years. But if you carefully choose an assortment of stocks and sit on them for a few decades, you could end up with returns like Apple‘s (AAPL -0.54%).

Image source: Getty Images.

Apple makes products people love. It has created an ecosystem of users who buy all of its products, like laptops, iPhones, and iPads, and upgrade to newer models as they become available.

Apple’s products come with a differentiated experience that makes it stand out from the many other device companies on the market, and Apple has catapulted to one of the largest companies in the world. It was the most highly valued company in the world for years before recently falling into third place, and it’s the fourth-largest company in the U.S. by sales.

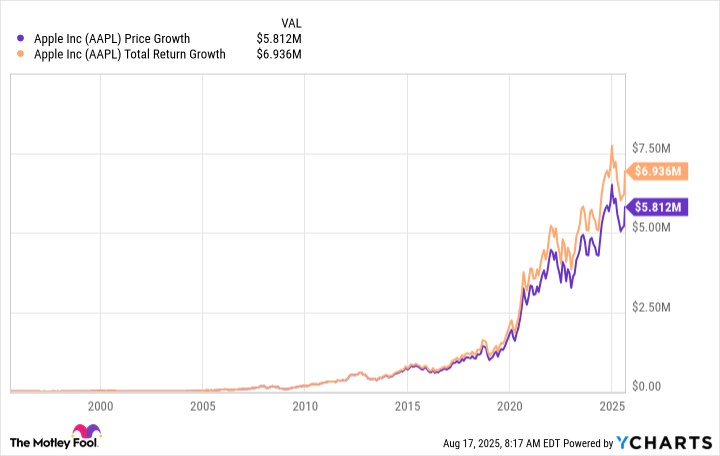

If you had recognized Apple’s potential 30 years ago and invested $10,000 in its stock, you’d be a multimillionaire today with about $6.9 million if you’d reinvested dividends.

It’s unlikely that Apple can achieve the same growth over the next 30 years, although it can still offer value to investors as an industry giant with a strong moat.

But I want to underscore a few lessons investors can apply to other stocks. One is that in 1995, Apple had already been a public company for several years. You don’t have to invest in public companies in their first days of trading to make your money work for you. Another is to notice how much money dividends add to the total — the dividend adds more than $1 million to the total here, though Apple’s current dividend yield is under 1%.

Investors should look to diversify, and know that one huge winner can wipe out losses from their losers.

Jennifer Saibil has positions in Apple. The Motley Fool has positions in and recommends Apple. The Motley Fool has a disclosure policy.

Search

RECENT PRESS RELEASES

Related Post