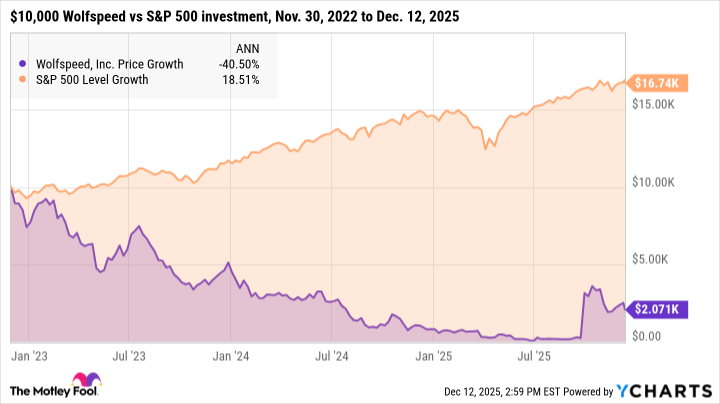

If You’d Invested $10,000 in Wolfspeed 3 Years Ago, Here’s How Much You’d Have Today

December 15, 2025

Is Wolfspeed a comeback story, or a cautionary tale? See what a $10,000 investment from late 2022 would be worth today.

I used to own some Wolfspeed (WOLF 6.55%) stock, starting in March 2020, right after the COVID-19 crash. The company was known as Cree at the time, an experienced maker of LED light elements. Cree was expanding its gallium nitride (GaN) and silicon carbide (SiC) chip-making capacity, and the company seemed poised for great returns as a leading parts supplier to the electric vehicle industry.

The company sold its LED business, doubled down on its specialized semiconductors, and drew closer to breakeven bottom-line results (starting from deep losses) over the next couple of years.

But it also burned a ton of cash and the success I expected in electric vehicle chips never seemed to materialize. So I lost patience with the investment thesis and closed my Wolfspeed position at the end of November 2022 with a 129% gain. Not too shabby!

Wolfspeed

Today’s Change

(-6.55%) $-1.30

Current Price

$18.56

A $10,000 Wolfspeed stake, 3 years later

Selling those Wolfspeed shares turned out to be a great move. I missed the perfect all-time high by about a year, but the stock continued to drop and hasn’t come close to its November 2022 levels since then. I’m glad the cash burn spooked me into selling.

How have Wolfspeed investors fared in that roughly three-year period? Let’s say you bought $10,000 of Wolfspeed stock on Nov. 30, where I exited my position.

Advertisement

The $10,000 bet is down to just $2,071. Ouch. If you insist on strict full-year returns, Wolfspeed has lost 77.3% in three years while the S&P 500 (^GSPC 1.07%) gained 73.4%.

The plunge included a Chapter 11 bankruptcy protection process, entered in June 2025 with the financial restructuring completed three months later.

Image source: Getty Images.

Fellow Fool Leo Sun likes Wolfspeed’s business prospects given its lighter debt load. I’m not so sure. My portfolio got lucky with this volatile chipmaker in 2022, but there are more GaN and SiC manufacturers available today, and the electric vehicle boom slowed down in 2025. Wherever Wolfspeed goes from here, I’ll gladly watch the drama from Wall Street’s sidelines.

Search

RECENT PRESS RELEASES

Related Post