Investing $5,000 Into Each of These 3 Stocks During the 2020 Crash Would Have Created a Po

April 16, 2025

Buying stocks when overall markets are falling can seem dangerous and counterintuitive. However, if you’re investing in stocks for the long term, the benefits are extremely rewarding.

A great example would have been buying shares of quality companies amid the market chaos of 2020. Five years ago, around April 14, 2020, the S&P 500 was already down nearly 13.5% for that year despite being in the midst of a rebound after a steep decline in March due to the emergence of the coronavirus pandemic. While it wasn’t an easy time to buy stocks given the uncertainty ahead, doing so could have resulted in some significant gains for investors.

Strategy (MSTR 0.35%), Celsius Holdings (CELH -0.98%), and Nvidia (NVDA -7.03%) have all generated monstrous gains for investors in just the past five years.

If you had invested $5,000 into each one of these stocks in April 2020, you’d have well up over $300,000 today. Here’s a look at how much those investments would be worth as of April 16, and whether these stocks are still good buys right now.

Strategy: $126,750

The best-performing stock on this list is Strategy, formerly known as MicroStrategy. It would have turned a $5,000 investment into roughly $126,750 over just a five-year stretch. It’s an astounding performance, especially when you consider that the main reason investors are bullish on it is for its position in Bitcoin — it prides itself on being the largest corporate holder of the cryptocurrency.

Yet, investing $5,000 into the digital currency itself would have grown to a more modest sum of $63,000. Strategy has been the better investment. Despite posting volatile earnings numbers that sometimes feature massive seven-figure losses, its favorable position on Bitcoin has been a big reason for its rapid rise in value.

While it technically provides companies with business intelligence solutions, Strategy has risen primarily due to the hype and excitement relating to crypto. Its fundamentals don’t support its sizable $80 billion-plus market cap. This is a highly speculative and volatile investment, and investors shouldn’t assume that because the tech stock has done so well in the past five years, it will be able to replicate these types of returns in the future.

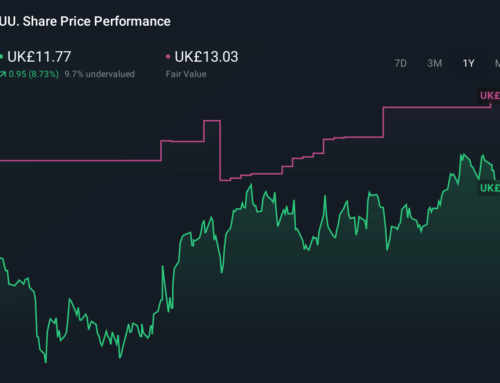

Celsius Holdings: $129,400

Energy drink company Celsius Holdings has made for a tremendous growth stock over the years, establishing itself as one of the top companies in the industry over that time frame. A $5,000 investment in the business five years ago would now be worth a staggering $129,400 — and this is even with shares of Celsius falling more than 50% over the past 12 months.

Moving forward, the company can still be an appealing investment given its focus on the sugar-free market, where it can be a big player. It recently announced plans to acquire Alani Nutrition, which will expand its presence in that area. Last year, Celsius’ sales grew by just 3% to $1.4 billion, but with much more growth still on the horizon for the business, it may not be too late to invest in the stock.

Nvidia: $72,900

Chipmaker Nvidia has been a top stock to own due to its growth in artificial intelligence (AI). It plays a vital role in helping businesses expand their AI capabilities. It may seem surprising that the stock isn’t higher on this list, but that’s largely because of tariffs and the economic uncertainty ahead for the tech industry as a whole, and the risk that spending on chips may slow down in the near future.

Nvidia’s five-year returns are still impressive, however, and the stock would have turned a $5,000 investment into close to $73,000 today. The company’s dominance in AI chips makes it a strong buy moving forward as Nvidia’s robust earnings and growth make it likely the business will become even more valuable in the future, and any dip in price could be an attractive buying opportunity for investors.

In its most recent fiscal year, which ended in January, the company reported over $130.5 billion in sales (more than double what it generated a year earlier), and profits of $72.9 billion soared from $29.8 billion in the previous year. Nvidia has been a growth machine, and even if business slows down in the near term, this can still make for an excellent long-term buy.

In total, a $15,000 investment across all these stocks five years ago would now be worth a staggering $329,000. These massive returns should remind investors that buying when sentiment is poor may not be as bad a time to invest in the stock market as it may appear to be.

Search

RECENT PRESS RELEASES

Related Post