Investing a Lump Sum at All-Time Highs – A Wealth of Common Sense

July 5, 2025

A reader asks:

I recently sold my condo for $400k and want to invest the money in the stock market. However, it appears the market is at an all time high. Should I invest elsewhere or wait for a market correction?

Excellent question.

Let’s start with the math first and then work our way to the psychological ramifications.

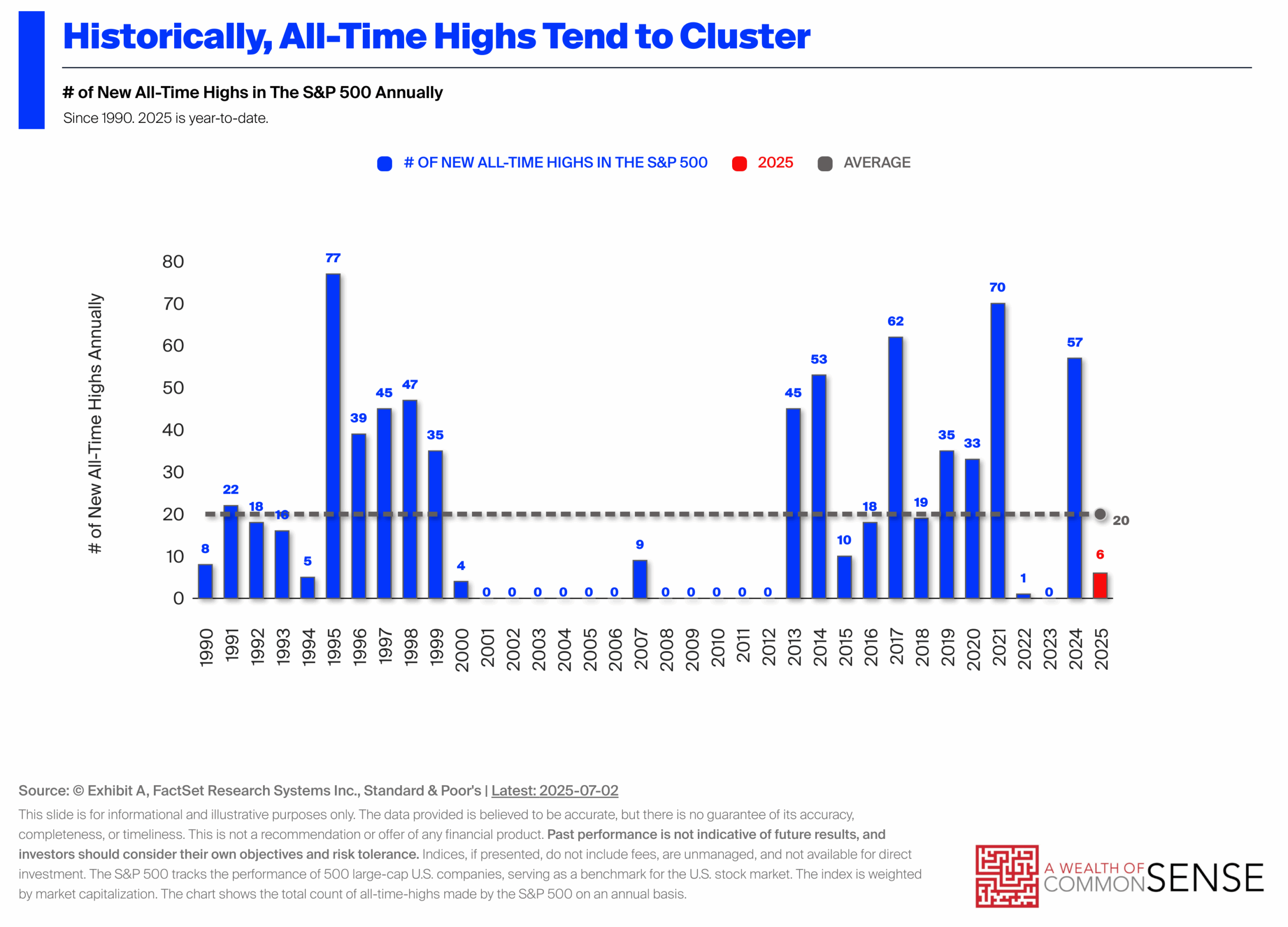

Here are some charts from Exhibit A on the history of all-time highs:

The good news is that new all-time highs are perfectly normal. On average they happen 20 times a year since 1990.

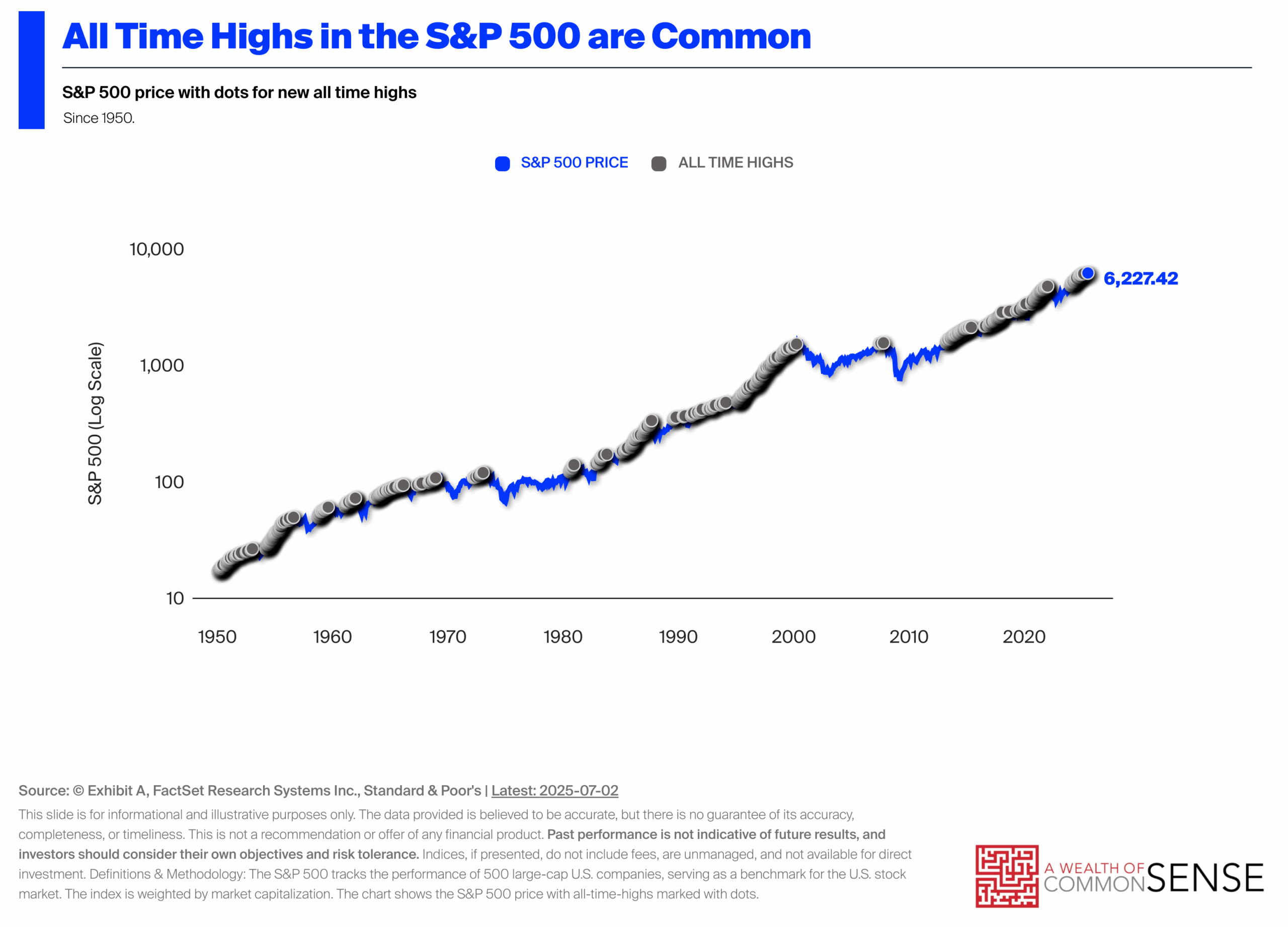

The bad news is that there can be dry spells as those new highs tend to cluster. Here’s another way of looking at this:

Obviously, the all-time highs cluster around bull markets while the droughts are caused by bear markets and lost decades.

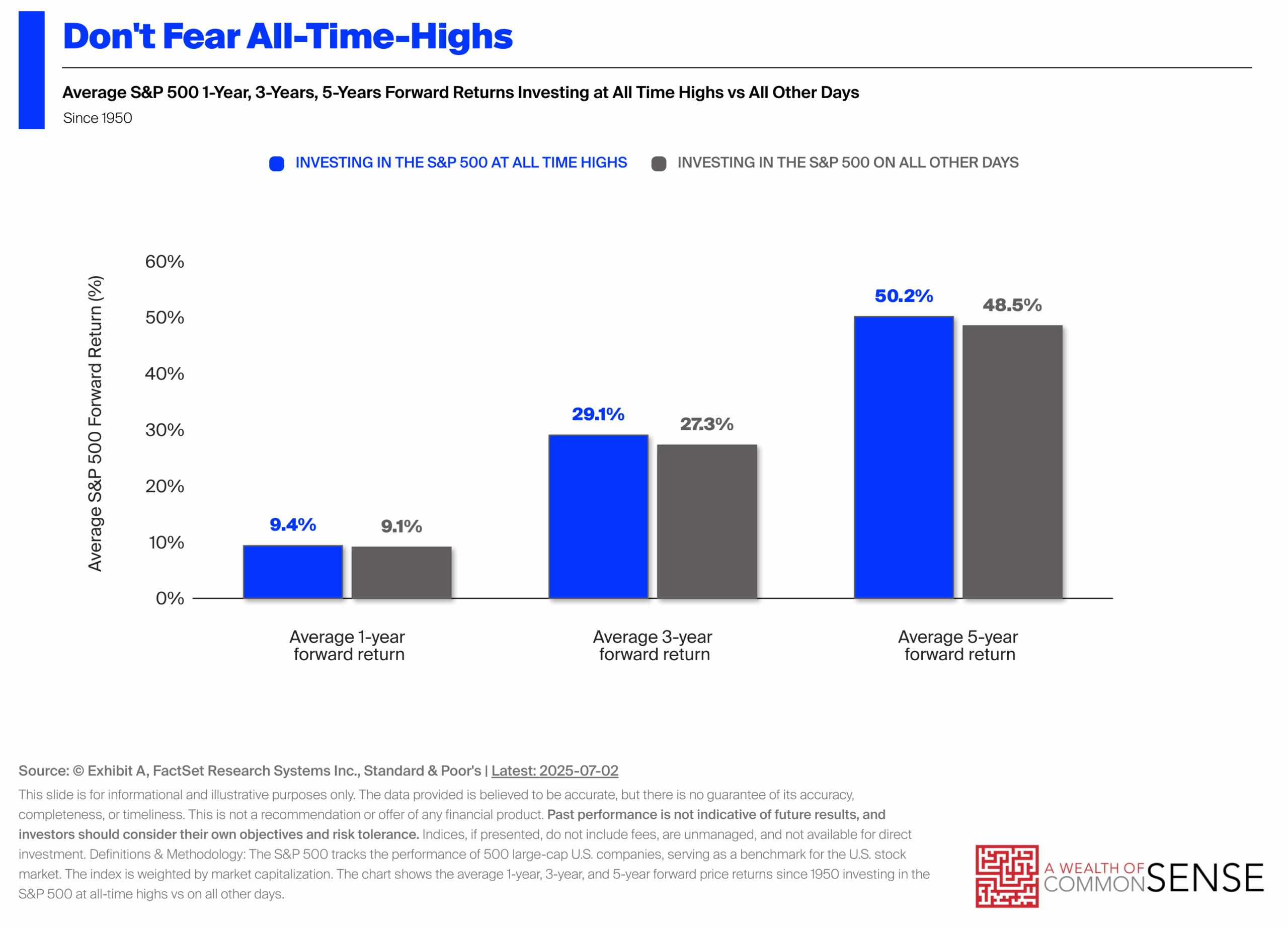

Let’s do some more good news since I like to be positive:

Not only are new all-time highs perfectly normal, your returns are actually better when you invest at those levels than putting your money to work on all other days over 1, 3 and 5 year windows.

If you’re looking at this strictly from a cost-benefit perspective, you don’t need to be scared off by new highs in the stock market. They happen more often than you think.

Long-term investors need to become accustomed to buying and holding at new heights.

People have been trying to call THE top of this bull market since the bottom in 2009.

The thing is one of these all-time highs will be THE peak that occurs before a nasty market crash. There will be a painful bear market and we won’t see new highs for a few years.1

This is the hard part when thinking through a lump sum investment like this.

The math tells you the stock market is up three out of every four years, on average, and investing at all-time highs offers slightly above average results. Those are pretty good odds.

But the psychology tells you losses bring far more pain than the pleasure you receive from gains.

This is why many people are more comfortable dollar cost averaging into the market, even if it’s a sub-optimal approach from a spreadsheet perspective.

Regret minimization is key when working through these decisions.

Some people would regret missing out on further gains if they dollar cost averaged into stocks and the market keeps moving higher. Most people would feel more regret if they put that lump sum to work and the market immediately rolled over.

You shouldn’t always allow behavioral psychology to guide your actions but you have to weigh the pros and cons of both the math and human nature when making big investment decisions like this.

You also don’t have to put all of this money into stocks. You could create a more balanced portfolio of stocks, bonds, cash and other investments if that makes it easier to be fully invested sooner.

An all-or-nothing approach tends to invite more opportunities for regret.

Michael and I talked about investing at all-time highs and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

The Lump Sum vs. Dollar Cost Averaging Decision

Now here’s what I’ve been reading lately:

- 34 lessons from writing every day (Ryan Holiday)

- Non-perfect planning (Contessa Capital)

- We are automatic (Basis Pointing)

- Financial independence is overrated (Of Dollars & Data)

- Between the extremes (A Teachable Moment)

- The case for owning bonds (Best Interest)

Books:

1It’s worth noting we went two years or so with no new highs from the 2022 bear market.

Search

RECENT PRESS RELEASES

Related Post