Investing in Boku (LON:BOKU) five years ago would have delivered you a 83% gain

November 18, 2025

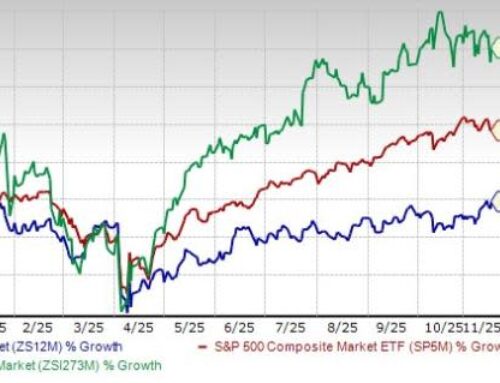

Boku, Inc. (LON:BOKU) shareholders might be concerned after seeing the share price drop 12% in the last month. But that doesn’t change the fact that the returns over the last five years have been pleasing. After all, the share price is up a market-beating 83% in that time.

With that in mind, it’s worth seeing if the company’s underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it’s a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Boku achieved compound earnings per share (EPS) growth of 36% per year. This EPS growth is higher than the 13% average annual increase in the share price. So one could conclude that the broader market has become more cautious towards the stock. Having said that, the market is still optimistic, given the P/E ratio of 62.20.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It’s probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Boku’s earnings, revenue and cash flow.

Boku shareholders gained a total return of 15% during the year. Unfortunately this falls short of the market return. On the bright side, that’s still a gain, and it’s actually better than the average return of 13% over half a decade This could indicate that the company is winning over new investors, as it pursues its strategy. It’s always interesting to track share price performance over the longer term. But to understand Boku better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we’ve spotted with Boku .

But note: Boku may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Search

RECENT PRESS RELEASES

Related Post