Investing Through the Turbulence of Interesting Times

May 1, 2025

Contrary to popular mythology, “May you live in interesting times” is not an ancient Chinese curse. Robert F. Kennedy, Sr., is credited with popularizing and spreading the erroneous origins of this apocryphal phrase.

Regardless of its provenance, in usage, its ironic meaning is that “interesting” is a euphemism for tumultuous, uncertain, even scary.

I think it’s fair to say we are living in interesting times.

Investors have rightly been concerned as the market has given up the very substantial gains of 2024 over the past three months.

Throughout our 55-year history, Cabot has been optimistic about the stock market over the long run, as we’ve helped a lot of people make a lot of money. We remain optimistic now. Over those many decades, we have seen a lot of ups and downs, and while history rarely repeats itself exactly, it rhymes, as we like to say.

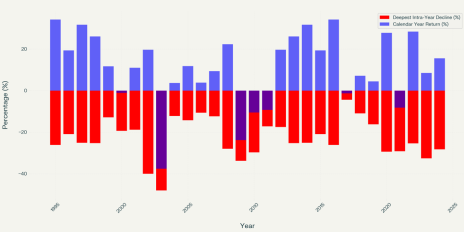

So, one response to the current situation is to look at history. This chart shows the depths of intra-year declines in the S&P 500 in the years 1995-2024, as well as the final returns for the calendar year.

S&P 500: Deepest Intra-Year Decline vs. Final Calendar Year Return 1995-2024

Data source: https://www.macrotrends.net/2324/sp-500-historical-chart-data

A few important notes on this:

- In almost every year, the S&P 500 experienced a significant intra-year decline (red bar), but frequently still finished the year with a positive return (blue bar above zero).

- Major crisis years such as 2000–2002 (dotcom bust), 2008 (financial crisis), and 2022 (inflation and rate hikes) show both deep intra-year declines and negative annual returns.

- Years like 2020 (pandemic) had a sharp intra-year drop but finished with a strong positive return, highlighting the market’s resilience and recovery potential.

- The average intra-year decline over the last 30 years is about -14%, even though the average annual return of the S&P 500 during that time is 10.4% (more if you include reinvestment of dividends), underscoring that volatility is normal even in positive years.

All of this is to say, the fact that we have negative returns three and a half months into the year is not unusual and doesn’t mean this year will be a loser.

The Cost of Exiting the Market

Faced with the kind of volatility we’ve seen in the market in recent weeks, many investors are tempted to pull their money out and wait until things settle down.

Understandable. But a mistake. A big mistake.

Investors who exit the market when there’s a substantial disruption incur three primary costs:

1) Locking in Losses: In their haste to get out of a falling market, investors often sell at a loss. As a practical matter, by the time most of us realize there’s a problem, it’s too late to get out without a loss. Less-savvy investors tend to hesitate as well and are punished with even greater losses.

2) Missing the Rebound: The best returns often closely follow steep declines. For example, 2009’s 26.46% gain followed right on the heels of 2008’s 37.00% drop, and many of the best trading days followed within a week or two of the worst trading days.

3) Compounding Impact: One year of missed participation can significantly reduce your long-term wealth.

To illustrate how this works, let’s look at a hypothetical $100 investment made in 1995. An investor who stayed fully invested through 2024 would have seen that investment grow to about $1,950 (10.4% annually).

The same investment made by someone who missed even a few of the top-performing days during that period – such as the post-March rally of 2020 – realized drastically reduced returns. Missing the 10 best days in 20 years would have reduced total returns by about 50%. Adding in the panic selling to lock in losses and forfeiting the dividends that could be reinvested can further reduce returns by as much as 40%.

Ouch!

I hope I’ve at least helped keep some investors from shooting themselves in the foot.

But, this is only part of what I want to talk about today, on the subject of the interesting times in which we find ourselves.

There’s the little matter of the gorilla. You know, the 800-pound gorilla sitting in the middle of the room.

I’m talking about what’s coming out of Washington these days.

My regular readers know I do not believe in mixing politics and investing. Good investing is about drawing upon research, experience, and insights to make the best of whatever the market conditions. Politicians make policy, and investment analysts at Cabot figure out the implications of those policies – which industries, sectors, and stocks will benefit, or not.

As one reader recently reminded me, however, the primary drivers of market conditions are coming out of Washington right now.

In the currently hyper-sensitive, highly partisan country we inhabit, I am going to absolutely avoid the distraction of talking politics. This is NOT a political diatribe.

I’m talking about economics.

I don’t recall whether all of this was covered in my undergrad econ courses or in my micro and macro classes from business school, but there are a few basic ideas that have driven the worldview of many economists for most of the last 100 years. Let’s review some that are relevant today:

1) Removing trade barriers permits production to shift to areas with a relative advantage (cheaper labor, better climate, access to raw materials, educated workforce, etc.), raising standards of living.

2) Independent central banks setting interest rates and other monetary policies reduce the temptation for leaders to goose the economy for short-term advantage with long-term costs.

3) Tariffs can help new businesses get a foothold in industries already dominated by other countries.

4) Tariffs can protect strategically important industries in a country (rice in China, steel, etc.).

5) Tariffs are a tax that increases costs that fall disproportionately on small businesses and consumers. (Tariffs used to be the primary revenue source for the Federal government. They were replaced by a progressive income tax because the tax burden fell disproportionately on the little guys.)

6) Widespread tariffs are inflationary because they increase prices and, over time, reduce the incentive for efficiency.

7) Businesses like a stable, predictable environment in which to make investments, hiring plans, and supply chain decisions. Clear rules and laws, even if considered suboptimal, are preferable to uncertainty and unpredictability.

8) Uncertainty in labor markets tends to reduce consumer spending as workers have concerns about job security and pay cuts (especially with the prospect of increased inflation).

9) Companies delay capital expenditures in an unpredictable environment, as it is difficult to project costs and returns.

I will note that politicians and economists have often failed to account for those left behind when production shifts to areas of relative advantage. People, education and physical plants are not as fungible as capital and have a much harder time responding, let alone responding quickly, to free trade-driven changes. That has been a serious oversight with real economic, political and social consequences.

Unless you’ve been vacationing off the grid for the past month, you probably know that all of these ideas have been challenged recently.

As we know, the announcement of widespread, and substantial, tariffs – particularly on our biggest trading partners, China, Canada, and Mexico – sent the stock market into a significant decline as many of the concerns noted in the numbered items above were triggered. The prospect of actions being taken to compromise the independence of the Federal Reserve Bank has only heightened concerns of economists, CEOs, and investors.

Some of the actions taken in the first three months of the administration can be undone, but some of the impacts will continue to reverberate even so. There is no going back. Now is the time to understand the new conditions and find the best path forward.

We Are in Uncharted Waters

To a significant extent, the Trump administration has taken the U.S. – and global – economy into uncharted waters. Particularly since World War II, the focus of global trade has been on removing barriers. We have not had a period in modern economic times where significant barriers to trade have been added, and certainly not by such a dominant global economic power.

We also have not experienced the current level of volatility, and unpredictability, in the economic and trade policies of the United States government.

There are people who think this new approach is brilliant and will produce a new, better foundation for the future. Others think it is crazy. Someone is likely to be right. We just don’t know who. And, many new approaches and ideas seem unworkable, even crazy, until they work.

Will this experiment work to produce a better economy, measured by profits and standard of living for stakeholders? It’s too early for anyone to say with certainty.

What we can say with certainty is that investors are likely to face turbulence for the foreseeable future.

What Do We Do Now?

Cabot doesn’t have a crystal ball any more than anyone else does.

What we do have is a solid understanding of finance, economics and the history of how markets have behaved in the past. And we follow all relevant market developments and Fed actions, participate in earnings calls, and watch what the institutional investors are doing.

As I tried to make clear in the first part of this post, history tells us that staying invested in the market, even in volatile or down markets, generally makes a difference in your investing performance. Often a substantial difference.

It is in these conditions that the insights and guidance of expert, professional investment analysts can make the biggest impact on your ultimate success.

If we are, in fact, living in interesting times, I am here to say I find investing profits pretty interesting.

I hope you will let Cabot be your guide to greater profits.

Sincerely,

Ed Coburn

President, Cabot Wealth Network

Search

RECENT PRESS RELEASES

Related Post