Investment With a Gender Perspective: The Approach and Proposal of Asset Managers

March 23, 2025

Investment With a Gender Perspective: The Approach and Proposal of Asset Managers – Funds Society

Women’s Day

Investments in women represent, in their opinion, the most scalable and diversified investment opportunity

Closing the gender gap in labor force participation and management positions could alone contribute up to 7 trillion dollars to global GDP

According to UBS, investments made by women offer the opportunity to incorporate capital with a more defined purpose into portfolios

The last 25 years have been marked by a growing focus on diversity and gender inclusion worldwide, with specific strategies aimed at eliminating biases across all areas of society. This trend has also reached the investment sector and its investment criteria.

According to UBS in its Gender-Lens Investment report, the origins of gender-focused investing are deeply rooted in the collective effort to empower women. “However, it would be a mistake not to recognize the significant economic benefits that can result from it. Closing the gender gap in labor force participation and management positions could alone contribute up to 7 trillion dollars to global GDP. This number rises to between 22 and 28 trillion dollars if gender equality is achieved,” the report states.

These potential economic benefits are capturing the attention of governments and economists, who are implementing new strategies to strengthen the role of women in society. However, UBS also believes that investors can benefit from this momentum by identifying opportunities within the three gender-focused investment perspectives.

Investment Ideas With a Gender Perspective

The first perspective proposed by UBS is based on the idea that investments for women encompass a wide range of products and services that meet their needs. “We believe the most viable investment opportunity lies in emerging digital technologies,” the report states. In their view, many gender-focused efforts, such as those related to education or financial inclusion, have concentrated on serving women in emerging and frontier markets, often through philanthropic mechanisms such as blended finance and grant funding.

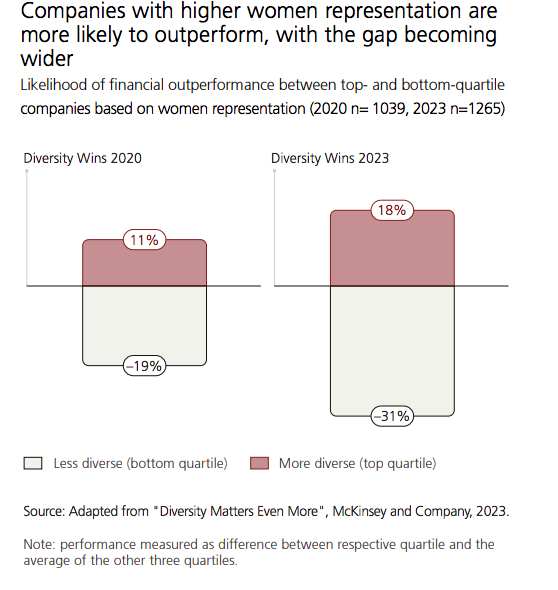

The second idea UBS advocates in its report is that investments in women represent, in their opinion, the most scalable and diversified investment opportunity, as they provide access to various industries, regions, and types of companies. In this regard, they explain that this includes more established approaches, such as “investing in companies with significant female representation in management positions, based on the investment thesis that diverse companies tend to achieve better financial performance.”

Related Posts

Search

RECENT PRESS RELEASES

Related Post