Is AGNC Investment Stock a Buy Now?

December 30, 2025

AGNC Investment has a massive 13% dividend yield, but tread carefully if you are looking for a reliable dividend stock.

AGNC Investment (AGNC +0.14%) is a fairly well-run mortgage real estate investment trust (mREIT). If you are looking to add an mREIT to your portfolio, it could be a good option.

However, before you buy AGNC and its huge 13% dividend yield, you need to step back and consider what you are really looking for. If your goals align with management’s goals, it could be worth buying. If not, AGNC Investment will likely disappoint you.

What does AGNC Investment do?

A property-owning real estate investment trust (REIT) is fairly easy to understand. These companies do what you would do if you owned a rental property, just on a much larger scale. Essentially, a REIT allows you access to institutional-level properties with the added bonus of the dividends avoiding corporate-level taxation (you have to pay taxes on REIT dividends as if they were earned income).

Image source: Getty Images.

Mortgage REITs use the same business structure, but they have a vastly different business approach. Instead of buying physical assets, mREITs, such as AGNC, purchase mortgages that have been pooled together into bond-like securities. While a property-owning REIT is an operating business, mREITs are often more like mutual funds.

This is because the value of an mREIT’s business is, essentially, the value of the portfolio of mortgage securities it owns. Those securities are bought and sold on a regular basis, so their value changes based on market conditions. The same can be said of physical property, of course, but the dynamics are drastically different given that buildings generally change hands infrequently.

Advertisement

This has a very big impact on who should buy an mREIT like AGNC Investment. Property-owning REITs are, generally speaking, a great option for income investors seeking stocks offering reliable income streams. But mREITs have a less impressive history regarding dividend reliability.

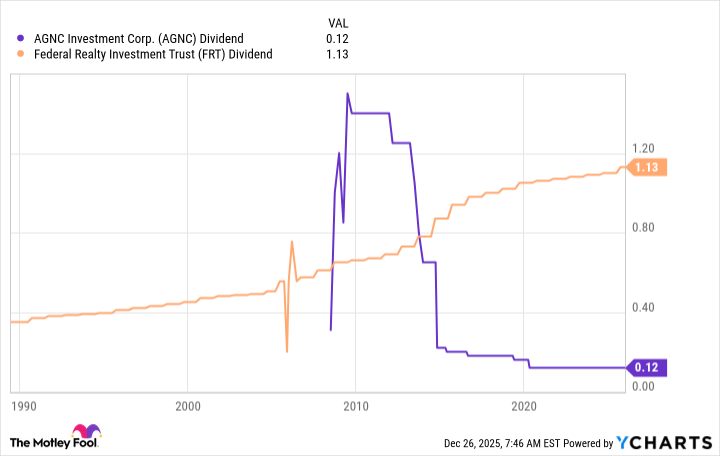

AGNC Dividend data by YCharts.

What are you looking to achieve?

The chart above highlights the problem for dividend investors. Federal Realty (FRT 0.07%) is a Dividend King. It is the only Dividend King REIT, boasting over 50 consecutive annual dividend increases. AGNC, by contrast, has seen its dividend fluctuate dramatically since its initial public offering. Property-owning Federal Realty is the epitome of dividend reliability in the REIT sector; AGNC Investment, with its portfolio of mortgage securities, is the opposite.

If you are trying to build a reliable income stream, one that grows over time, you should consider avoiding AGNC Investment. It simply isn’t built to provide that kind of income consistency, and its history confirms this. What does AGNC Investment aim to provide? Total return.

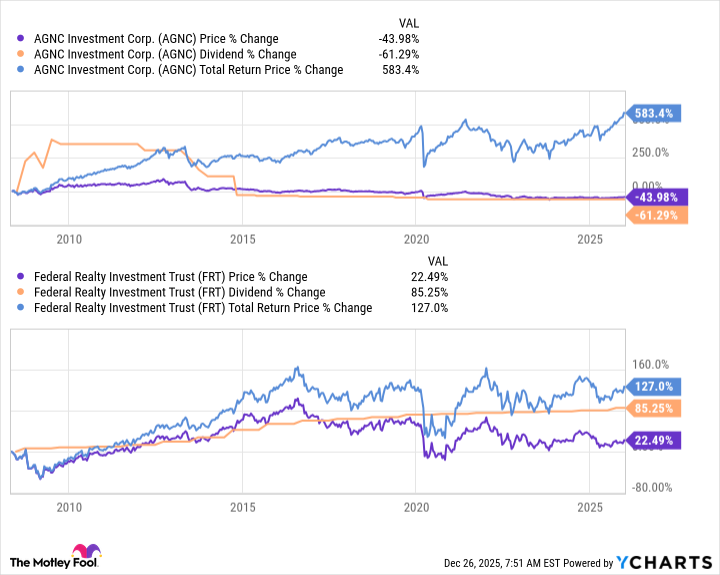

In order to fully benefit from an investment in AGNC, you’ll need to reinvest all of the dividends you collect. If you spend them, you are likely to be disappointed with the outcome you receive. The chart below highlights the issue.

Despite a falling dividend and stock price, AGNC Investment’s total return since its inception has trounced the total return of Federal Realty over that same span. If you spent the dividends you collected from each stock, Federal Realty would have been a much better choice. However, if you reinvested the dividends, AGNC’s total return would prevail. AGNC could be a solid buy today, but only if you are looking for total return.

AGNC Investment Corp.

Today’s Change

(0.14%) $0.01

Current Price

$10.84

You need to buy AGNC for the right reason

Whether AGNC is a good investment choice for you will ultimately depend on your goals. You have to identify both what you want to achieve and take the time to understand what AGNC actually provides.

If you only buy because of the huge dividend yield, you could end up disappointed by a dividend cut. However, that won’t be AGNC Investment’s fault. It is fairly clear about its big-picture goal, and it does a good job of achieving that goal, despite dividend cuts.

Search

RECENT PRESS RELEASES

Related Post