Is American Superconductor’s Valuation Justified After Recent Renewable Energy Contract Wi

November 1, 2025

- Wondering if American Superconductor is a hidden gem or just riding a wave? You are not alone. Plenty of investors are eager to understand what this company is really worth.

- The stock has rocketed higher, up a huge 131.8% year-to-date and an even more stunning 1492.2% over the last 3 years. However, it has cooled slightly with a -0.6% loss in the past week.

- The latest headlines have highlighted American Superconductor’s recent contract wins and expanding partnerships in the renewable energy sector. This has caught the eye of momentum-focused traders. The growing attention from both the market and the media has helped drive the stock’s rapid price moves, leaving many to wonder if its valuation can keep up with expectations.

- Officially, American Superconductor scores a 0 out of 6 on our valuation checks. This suggests classic value investors might want to dig deeper. Up next, we will break down the standard methods for assessing if the shares are overpriced. Stick around because there is an even smarter way to judge value that most people overlook.

American Superconductor scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Advertisement

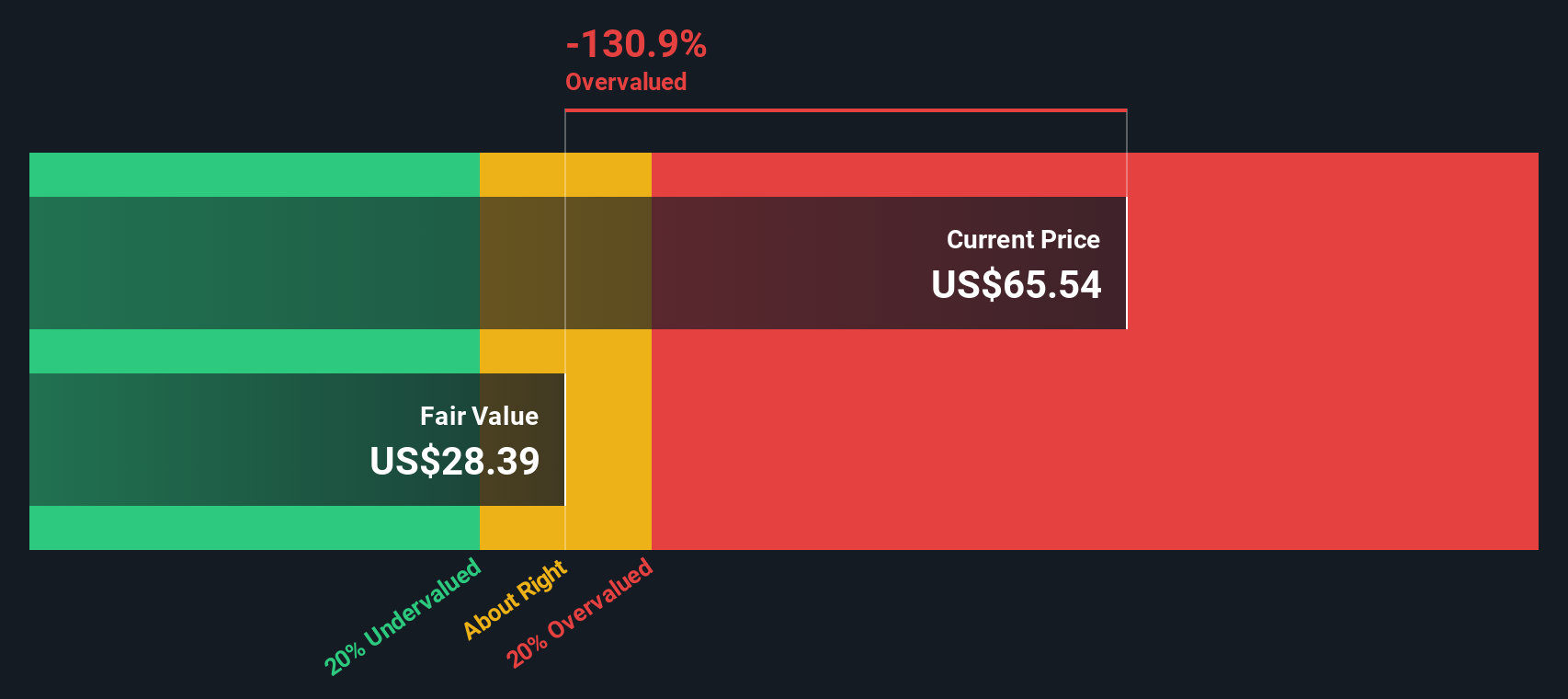

Approach 1: American Superconductor Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s dollars. This method helps investors figure out what the business is worth by looking at all the money it is expected to generate in the years ahead.

For American Superconductor, the latest report shows Free Cash Flow (FCF) of $26.59 million. Analysts predict this number will keep climbing, with projections reaching $52.1 million by 2028. Analysts provide direct forecasts for the next five years. Cash flows further out to 2035 are estimated based on historical trends and industry growth assumptions. These projections show FCF rising as high as $113.73 million within the decade.

Based on this growth, the DCF model calculates an estimated intrinsic value of $28.15 per share. However, with the current share price well above this figure, the model suggests the stock is overvalued by 110.4% using these cash flow projections.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests American Superconductor may be overvalued by 110.4%. Discover 832 undervalued stocks or create your own screener to find better value opportunities.

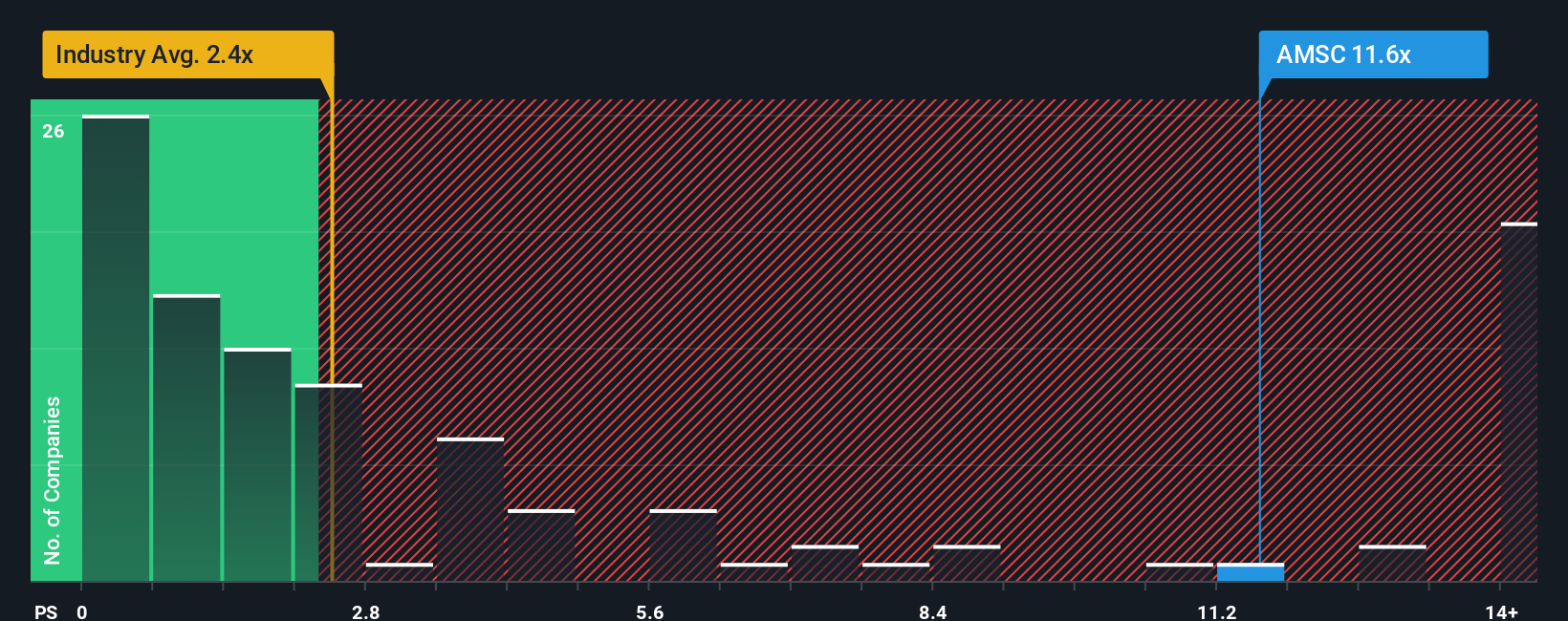

Approach 2: American Superconductor Price vs Sales

The Price-to-Sales (P/S) ratio is a commonly used valuation method for companies experiencing rapid growth or not consistently profitable. For American Superconductor, which has shown surging revenue, the P/S ratio provides a useful way to compare the stock’s valuation to others in the sector.

In industries with strong growth prospects and moderate risk, investors are generally willing to pay slightly more for each dollar of revenue. As a result, a “normal” or “fair” P/S ratio can vary widely. High growth, profitability, and robust market opportunities can justify a premium. In contrast, higher risks or thinner margins can weigh the number down.

American Superconductor currently trades at 10.49x P/S, which is well above both the electrical industry average of 2.27x and the peer average of 3.63x. At first glance, this suggests the stock is richly valued by traditional standards.

Simply Wall St’s proprietary Fair Ratio for American Superconductor is 2.29x. Unlike raw industry or peer comparisons that only look at averages, the Fair Ratio blends in the company’s specific growth outlook, profit margins, market size, and risk profile to deliver a more tailored view of value.

Comparing the Fair Ratio of 2.29x with the current P/S of 10.49x, the valuation appears stretched. The stock is trading far above what would be considered fair given its fundamentals, signaling that it may be overvalued at current levels.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your American Superconductor Narrative

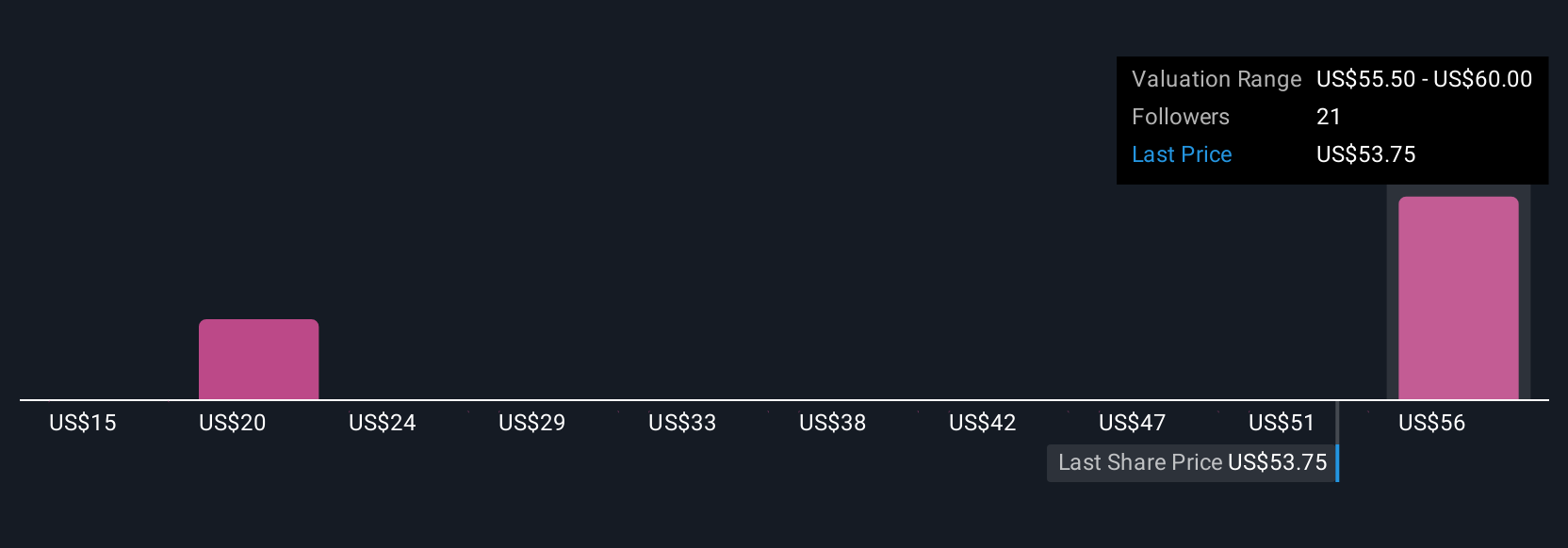

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your unique story or perspective about a company: the reasoning and assumptions behind your fair value estimates, including how you see its future revenues, margins, and risks unfolding.

Narratives connect the dots between a business’s real-world story and its projected financials, empowering you to link qualitative ideas to quantitative forecasts, which then flow through to a custom fair value for the stock. This tool is both intuitive and accessible; on Simply Wall St’s Community page, millions of investors use Narratives to outline, tweak, and share their investment theses.

Narratives let you cut through the noise by clearly showing how your outlook stacks up against the current market price, helping you decide if now is the right time to buy, hold, or sell. Plus, your Narrative’s fair value updates dynamically when new information such as company earnings, news, or guidance arrives.

For example, one Narrative on American Superconductor expects demand from tech, renewable energy, and policy trends to push revenues up 12.4% annually and projects a fair value of $66.67 a share, while a more cautious view anticipating cyclical risks and margin pressure yields a much lower fair value. This highlights how Narratives flex to match any outlook.

Do you think there’s more to the story for American Superconductor? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post