Is Apple Stock a Buy Heading Into Q4 Earnings as iPhone 17 Sales Soar?

October 29, 2025

/Apple%20Inc%20phone%20and%20data-by%20Anderson%20Reis%20via%20Shutterstock.jpg)

Apple Inc phone and data-by Anderson Reis via Shutterstock

Apple (AAPL) will release its fiscal Q4 2025 earnings after the closing bell tomorrow, Oct. 30. The iPhone maker is entering the confessional on a strong note, and it briefly joined the $4 trillion market cap club earlier this week. In this article, we’ll look at Apple’s Q4 earnings estimates and analyze if the stock can continue its momentum after the confessional.

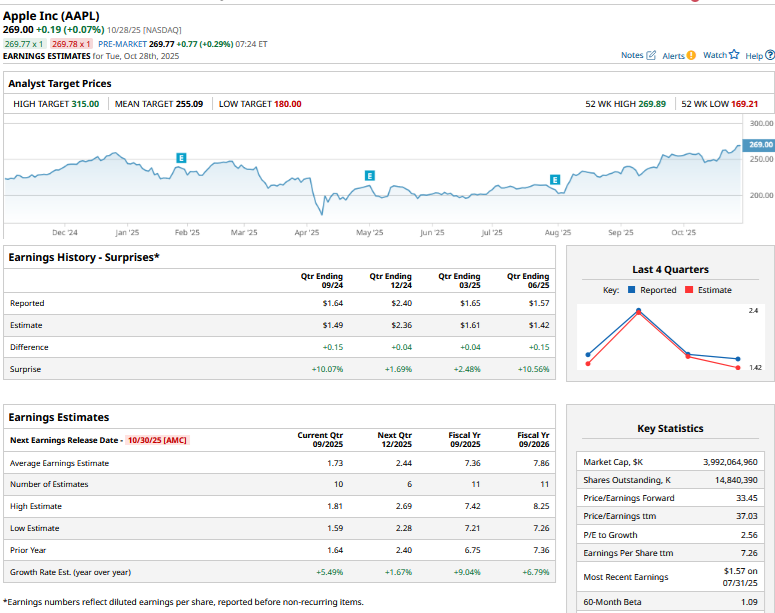

Consensus estimates call for Apple’s Q4 revenues to rise 7.6% to $102 billion. After the last few quarters of tepid top-line growth, Apple is now experiencing a revival. Following nearly double-digit revenue growth in the June quarter, management forecasts revenues to rise by “mid- to high single digits” in the September quarter. Given reports of strong iPhone 17 sales, I believe Apple might end up beating Street estimates for top-line growth.

The company’s earnings per share (EPS) is, however, expected to rise by just 5.5% to $1.73 during the quarter. Apple does not provide EPS guidance, but management guided for gross margins to range between 46% and 47% in the September quarter, after accounting for a $1.1 billion impact from tariffs. The guidance was similar to the 46.5% gross margin that the Cupertino-based company delivered in Q3.

What to Watch in Apple’s Q4 Earnings

Along with the headline numbers, I’ll be watching out for the following during the Q4 earnings call:

- iPhone 17 Adoption: Reports suggest strong sales of Apple iPhone 17 in the U.S. and China, the company’s two biggest markets (in that order). I believe iPhone 17 adoption will garner outsized attention during the earnings call, especially as its predecessor’s sales mostly underwhelmed, despite lofty expectations among a section of the market.

- Apple Intelligence: Apple Intelligence features, which the company unveiled last year, are still not available in China. During the Q4 earnings call, I will watch out for updates on that front. Notably, Apple CEO Tim Cook visited China earlier this month and met several key business and political leaders there.

- Artificial Intelligence Initiatives: Apple is still seen as a laggard when it comes to artificial intelligence (AI) – a perception the company has been trying to shed. During the previous earnings call, the company did not rule out a major acquisition to bolster its AI capabilities. During the Q4 earnings call, I will look out for commentary on Apple’s AI strategy, including any color on M&As in that space.

- Glasses vs. VR Headsets: There were reports that Apple has shelved plans to revamp its Vision Pro mixed-reality headset — a product that never really took off in the first place — to focus on smart glasses. During the Q4 earnings call, I will watch out for updates on the company’s hardware strategy as the race for the next computing platform heats up.

Apple Stock Forecast

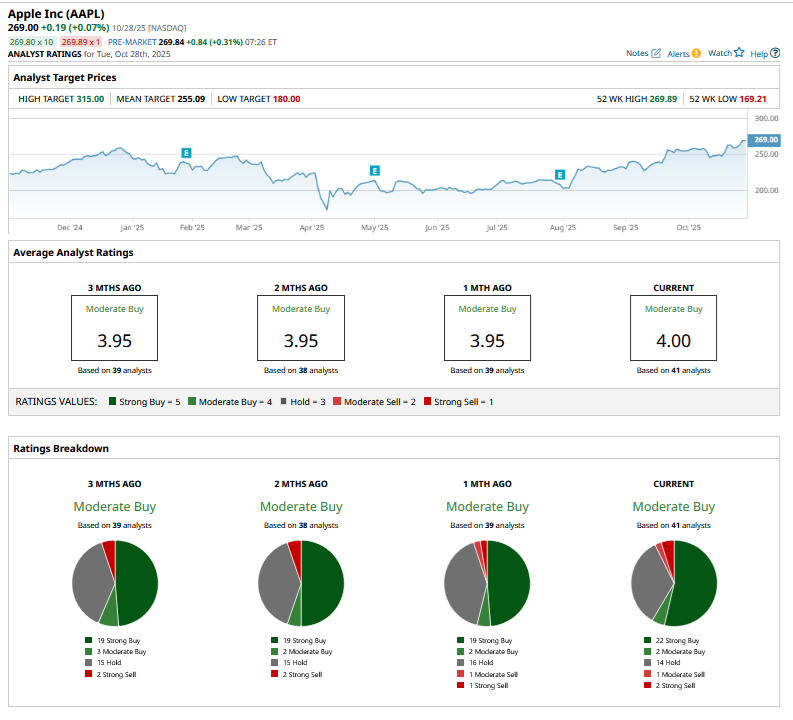

Apple has had a love-hate relationship with sell-side analysts over the last two years. It was hit with a series of downgrades at the beginning of 2024, and again early this year, over concerns ranging from a slowdown in iPhone sales to competitive pressure in China. However, AAPL garnered some upgrades during the course of the year as the company managed to allay the worst of the fears.

Something similar is playing out this month amid reports of strong initial sales of iPhone 17, and several brokerages, including Baird, JPMorgan, Wells Fargo, and Goldman Sachs, have raised AAPL’s target price. Loop Capital went a step further and upgraded Apple from a “Hold” to “Buy” while raising its target price from $226 to $315.

Apple is currently rated as a “Moderate Buy” on average among the 41 analysts tracked by Barchart, and while the stock has run ahead of its mean target price, its Street-high target price of $315 is 17.1% higher than the Oct. 28 close.

Should You Buy AAPL Stock Before Q4 Earnings?

I was bearish on Apple for much of 2025 but have turned incrementally bullish as the company seems to have addressed many of the issues, especially related to its supply chain. Its valuations might look a bit stretched, though, as the forward price-to-earnings (P/E) multiple has expanded to 33.5x amid the recent rally. Notably, Apple’s earnings growth has been quite tepid in recent quarters, which has made its valuation multiples appear even higher.

Overall, I maintain a balanced view on Apple ahead of the report and don’t expect much of a post-earnings bump, especially given the recent rally and rich valuations. For Apple shares to rise significantly higher, management needs to position the company as a key player in physical AI, and while the company has made small steps in that direction, it still needs to do a lot more.

On the date of publication,

Mohit Oberoi

had a position in: AAPL

. All information and data in this article is solely for informational purposes.

For more information please view the Barchart Disclosure Policy

here.

Search

RECENT PRESS RELEASES

Related Post