Is Apple’s Current Stock Price Justified After Q1 2025 Profits Exceed Expectations?

November 6, 2025

- Thinking about whether Apple’s stock is really worth the price? You’re not alone. Many investors are buzzing about whether its current level offers true value or just excitement fueled by headlines.

- Apple’s shares have risen 5.2% in the past month and are up an impressive 21.9% over the last year, with momentum hinting at both growth potential and shifting expectations from the market.

- Recently, news has focused on Apple’s ongoing innovations, such as announcements about new devices and developments in artificial intelligence, sparking renewed optimism among investors. Headlines regarding regulatory challenges and shifting global supply chains have also played into recent price moves, adding layers of both opportunity and uncertainty.

- But what does the math say? On our valuation checks, Apple scores only 1 out of 6 for being undervalued. Next, we’ll break down how different models assess its price and why there could be an even better way to look at Apple’s true value by the end of this article.

Apple scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Advertisement

Approach 1: Apple Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s dollars. This approach aims to find the present value of Apple’s predicted cash generation, reflecting both near-term analyst estimates and longer-term trends extrapolated by Simply Wall St.

Apple’s current Free Cash Flow stands at $99.9 Billion. Analyst forecasts provide explicit estimates out to 2028, with Apple’s Free Cash Flow projected to rise each year and reaching as high as $154.7 Billion by 2028. Beyond that, projections for 2030 and later are extrapolated, with Apple’s Free Cash Flow expected to reach $186.8 Billion in 2030. This suggests strong, sustained growth in the company’s cash-generating ability.

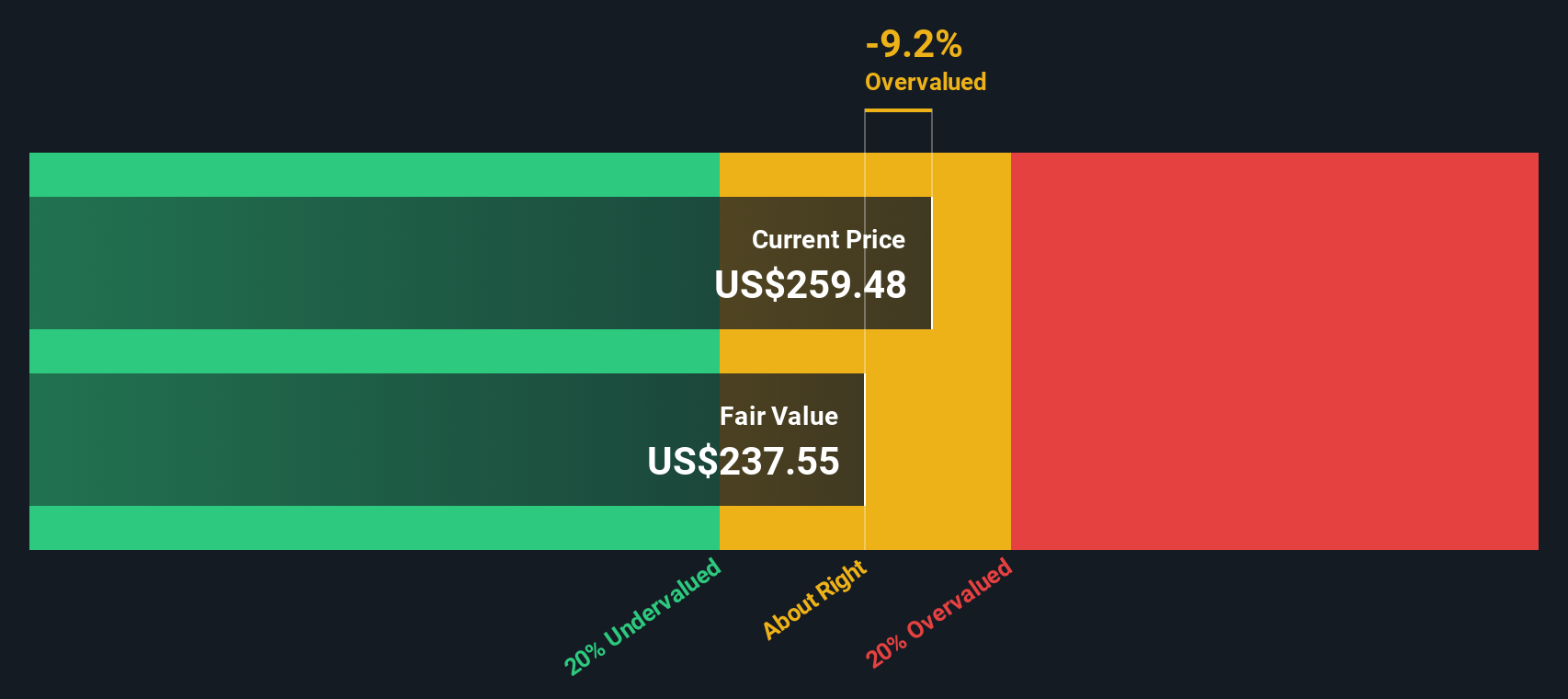

According to this DCF model, the intrinsic value per share for Apple is $225.66, while the current stock price is 19.7% higher than that value. Using this method, Apple shares appear overvalued by the DCF approach.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Apple may be overvalued by 19.7%. Discover 843 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Apple Price vs Earnings

The Price-to-Earnings (PE) ratio is a go-to valuation tool for profitable companies like Apple, as it tells investors how much they are paying for every dollar of current earnings. This makes it especially relevant for mature, established businesses with consistent profits, since it sets expectations about the future based on what the company earns today.

What counts as a “normal” PE ratio depends a lot on how fast the company is expected to grow, as well as how certain those future earnings are. Higher growth and lower risk typically mean a higher PE is justifiable. By contrast, industries with lower growth or companies facing more uncertainty often trade at lower PE multiples.

Apple’s current PE ratio stands at 35.64x. For context, the average PE among its peers is 33.88x, while the wider technology industry averages a notably lower 22.98x. This means Apple trades at a premium compared to both its direct competitors and the sector as a whole.

This is where Simply Wall St’s “Fair Ratio” metric comes in. The Fair Ratio estimates what Apple’s PE should be by factoring in its earnings growth, profit margins, industry trends, risk profile, and even market cap. This approach makes it much more tailored than simply comparing with benchmarks or peer averages.

Apple’s Fair Ratio is 43.87x, which is noticeably higher than its current PE of 35.64x. Since Apple’s PE is below the Fair Ratio by more than 0.10, this suggests the stock is currently undervalued on this measure, even though it trades above peers and industry levels.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Apple Narrative

Earlier we mentioned there’s an even better way to look at valuation, so let’s introduce you to Narratives, a simple approach where you go beyond just the numbers and add your own story about where you think Apple is headed.

A Narrative connects your personal perspective on Apple’s future, what you believe about its innovation, margins, growth, and risks, with a set of financial forecasts, culminating in your own estimate of fair value.

On Simply Wall St’s Community page, millions of investors already use Narratives to easily map their views onto Apple’s revenue, earnings, and market assumptions, seeing how their thesis stacks up against others in real time.

What makes Narratives so practical is they update dynamically when new earnings, news, or major events hit, helping you reassess your view and compare Fair Value with Apple’s current share price to guide your next buy, hold, or sell decision.

For example, recent Apple Narratives span from a bullish outlook with a fair value near $275, focusing on AI-driven growth and resilient margins, to a more bearish take with fair value as low as $177, highlighting slowing innovation and rising competitive risks. This demonstrates just how much your story impacts your valuation.

For Apple, however, we’ll make it really easy for you with previews of two leading Apple Narratives:

Fair Value: $275.00

Current discount to this value: -1.8%

Revenue growth rate: 12.78%

- Despite a steep 35% drop from its peak due to U.S.-China tariffs, Apple demonstrates resilience by shifting production to India and Vietnam while seeking tariff exemptions.

- Strong Q1 2025 financials, with profits exceeding expectations and services revenue hitting records, support analysts’ Moderate Buy consensus and a price target above current levels.

- Long-term optimism centers on Apple’s AI investments, brand loyalty, and innovation, suggesting the company is well positioned to recover and benefit from emerging technology trends.

Fair Value: $207.71

Current premium to this value: 30.1%

Revenue growth rate: 6.39%

- New EU regulations and supply chain changes, plus a shaky strategy in emerging markets like India, threaten Apple’s margins and ability to grow sales.

- Significant reliance on service revenues from deals like the Google agreement and proprietary tech exposes Apple to regulatory and competitive risks that could erode growth.

- Costly bets on new products, such as the Apple Vision Pro, may not bring meaningful returns, while increased R&D costs could compress profits even further.

Do you think there’s more to the story for Apple? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post