Is Bitcoin a Buy, Sell, or Hold in 2026?

December 25, 2025

Bitcoin’s four-year cycle appears to be broken. Here’s what’s actually driving prices now — and how to play it in 2026.

If technical analysis were an exact science, Bitcoin (BTC +0.41%) would be soaring right now. However, the charts forgot to check the news. More importantly, they forgot that the structure of the whole crypto market fundamentally changed in 2024 and 2025.

The four-year cycle isn’t broken. It’s either retired or on vacation.

VanEck and 21Shares analysts recently published fresh overviews of the broader crypto market and the specific Bitcoin situation.

Both firms are basically saying the same thing: The four-year Bitcoin halving cycle still matters symbolically, but it’s no longer the engine that drives crypto prices higher over time.

A few themes stood out in their reports:

- Bitcoin’s annual issuance is now below 1% — less than gold’s inflation rate. That’s a nice, symbolic milestone, but also a sign that the upcoming halvings will carry less power. Each halving cuts the mining rewards by less, because there’s less left to cut. That’s just mathematics.

- The buyers have changed. Exchange-traded funds (ETFs), corporate treasuries, and sovereign governments absorbed more than the total number of mined Bitcoins in 2025. This is patient, sticky capital setting up shop — not retail FOMO-chasers looking at charting indicators.

- Bitcoin’s volatility is compressing. The recent drawdowns stopped at 30%, compared to 60% wipeouts (and more) in the first three cycles. Bitcoin is launching fewer moonshots, but fewer face-melting crashes too. In other words, it’s starting to behave like a mature financial asset, earning its “digital gold” moniker.

Bitcoin

Today’s Change

(0.41%) $357.53

Current Price

$87912.00

Bitcoin’s bull case

Crypto isn’t just for enthusiasts anymore. Deep-pocketed investors are building large Bitcoin positions, led by Strategy (formerly known as MicroStrategy) and its 671,268 coins. At today’s prices, that’s a $58.9 billion Bitcoin portfolio.

Advertisement

Eleven other companies have converted at least $1 billion of cash into Bitcoin on their balance sheets, according to BitcoinTreasuries.net. The list includes Bitcoin miners like MARA Holdings and Riot Platforms, but also Elon Musk’s Tesla and the Trump Media & Technology Group.

Traditional banks and financial services are still nowhere to be found among the 100 largest Bitcoin holders, but 2026 could change that. With easy access to spot Bitcoin ETFs, cash managers can add Bitcoin exposure to their balance sheets through ordinary stock-trading channels.

According to 21Shares, about 7% of the Bitcoins in circulation already sit in ETF portfolios. That ratio should increase in the coming years, as massive investment services like Morgan Stanley are allowed to recommend Bitcoin funds.

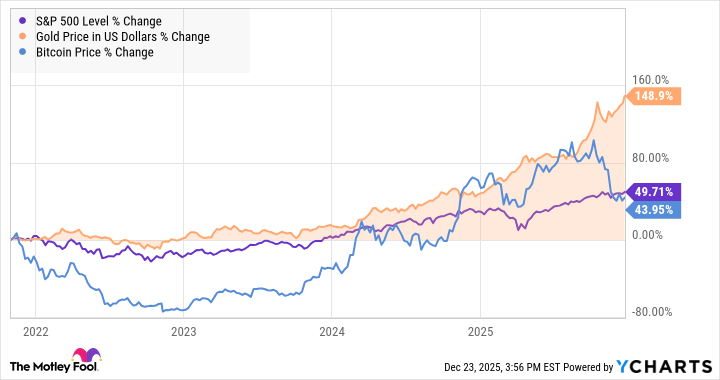

And let’s not forget about Bitcoin’s potential as a hedge against macroeconomic jitters. As of Dec. 23, gold prices are up by 71% year to date, far outpacing a 16% gain for the S&P 500 (^GSPC +0.32%) stock market index. Investors are starving for safe havens. If Bitcoin can connect to just a small slice of that gigantic market, it would chip away at the glittery metal’s $31 trillion of total market value.

The charts from earlier halving periods couldn’t predict any of this, because the market dynamics have changed with ETFs and institutional investors at the table. Things really are different this time.

Image source: Getty Images.

Bitcoin’s bear case

It’s not all moonshots and rainbows, of course.

The institutional investor activity also brings some drawbacks. Bitcoin isn’t seeing a groundswell of organic network growth in 2025, and the number of people who own the currency isn’t rising. The main idea in the Bitcoin white paper was to supply a radically different digital currency to the masses, but the ownership is getting centralized these days.

Bitcoin miners essentially convert electric power into digital coins, but artificial intelligence (AI) systems also use a lot of power. Leading Bitcoin miners are picking up AI computing as a lucrative side gig, diverting electricity and other resources from the crypto business.

And that safe-haven plan is still an academic idea with no real proof. Take the global inflation crisis of 2022, for example. The S&P 500 fell as much as 25% as the drama played out. Gold played its expected stabilizer role and stopped at a 20% loss, but Bitcoin dropped 77% lower.

Among these three options, gold has been the best asset to hold since November 2021:

^SPX data by https://ycharts.com“>YCharts

How to play Bitcoin in 2026

The bulls and the bears brought their A-games to this fight. Both skeptics and Bitcoin maximalists are leaning on some solid arguments right now.

I see Bitcoin as a great long-term investment. It’s OK if the next crypto winter arrives earlier than expected. In the long run, organic demand for this alternative currency should grow while the supply remains almost unchanged. This thesis is taking a break right now, but it should be temporary. As such, I don’t mind doubling down on my Bitcoin holdings when prices are down.

At the same time, Bitcoin remains a volatile and unpredictable asset. Unlike Strategy chairman Mike Saylor, I’m not betting the farm, the tractor, and all my chickens on this single idea.

About 5% of my diversified investment portfolio is allocated to Bitcoin, other cryptocurrencies, and crypto-based ETFs. I might increase that ratio to 8% or even 10% next year, but that’s about it. You have to account for the risks, threats, and downsides, too.

Search

RECENT PRESS RELEASES

Related Post