Is Bitcoin the new safe haven during trade wars?

April 15, 2025

Bitcoin joins the safe-haven debate as trade tensions rise

For decades, investors fled to gold and US Treasurys during crises, but in today’s digital, decentralized world, Bitcoin is starting to enter the safe-haven conversation. Despite its volatility, Bitcoin BTCUSD has shown signs of resilience during global turbulence, including trade wars, prompting a fresh look at its role in preserving value.

Let’s rewind a bit to understand where this question comes from.

For decades, whenever uncertainty rattled the global economy, be it war, inflation, or sudden political shifts, investors did what they always do — run to the safest hills. Historically, those hills were made of gold or filled with US Treasury bonds. But things are changing.

In a world that’s more digital, decentralized, and volatile than ever, people are asking whether Bitcoin might now be part of the conversation as a modern safe-haven asset, especially during disruptive events like trade wars.

To get into this, you need to explore what makes an asset a safe haven in the first place, how Bitcoin has behaved during recent trade-related turbulence and whether it has earned its spot alongside more traditional defensive plays.

First, the concept of a “safe haven” isn’t about making a profit. It’s about preserving value. In times of crisis, investors want assets that hold up under pressure. Gold has done this for decades. The US dollar, despite being fiat, is often seen as a safe haven due to its global reserve status and the strength of US financial institutions.

Treasury bonds are backed by the full faith and credit of the US government. All these assets are supposed to be relatively low in volatility and high in liquidity.

Now, here’s the twist: Bitcoin is not low in volatility. It’s notoriously wild. But despite that, you might have seen moments where it behaves like a safe haven. Not always, but sometimes, and that’s interesting.

Isn’t it?

The 2018-19 trade war vs Bitcoin’s role in times of turmoil

During the 2018–19 US-China trade war, Bitcoin surged as traditional markets faltered, hinting at its potential as a hedge in turbulent times. While its “digital gold” narrative gained traction, Bitcoin’s behavior often mirrors that of speculative tech stocks, keeping its safe-haven status an open question.

Take the 2018–19 US-China trade war, for example. As tariff threats escalated and tensions between the two economic giants intensified, global markets became increasingly jittery. Tech stocks took a hit. Commodities wavered. Amid all this, something strange happened. Bitcoin quietly surged. From April to July 2019, the price of Bitcoin climbed from about $5,000 to over $12,000.

It wasn’t alone. Gold also rallied during that time. However, this was one of the earliest signs that Bitcoin might not be just a risk-on asset but could also serve as a hedge in turbulent times. That period sparked a new narrative: Bitcoin as “digital gold.”

The fixed supply of 21 million coins gave it scarcity. Its decentralized nature meant it wasn’t bound to any single government’s policies. And because it lived on a global, censorship-resistant network, it was insulated from the kind of capital controls that often follow during periods of financial stress. These qualities started to resonate with investors looking for alternatives to traditional safe havens.

To be fair, Bitcoin hasn’t always stuck to the script. While there are moments where it moves inversely to risk assets, more often than not, it behaves like a speculative tech stock, especially over short time frames. Historically, Bitcoin has had a strong correlation with the Nasdaq. So, while the “digital gold” narrative is growing, it still sits side-by-side with the idea of Bitcoin being a high-beta bet for risk-seeking investors.

Did you know? A 2025 study titled Institutional Adoption and Correlation Dynamics: Bitcoin’s Evolving Role in Financial Markets analyzed daily data from 2018 to 2025. The study found that Bitcoin’s correlation with the Nasdaq 100 intensified following key institutional milestones, with peaks reaching 0.87 in 2024. This suggests that Bitcoin has transitioned from an alternative asset toward a more integrated financial instrument.

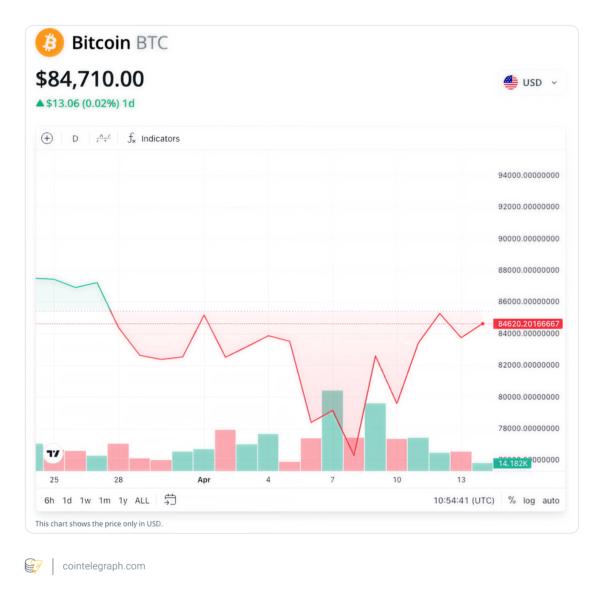

Inside the Trump tariff wars of 2025: Markets rattle, Bitcoin rises

In early 2025, Trump’s sweeping tariffs triggered panic across financial markets, with the Nasdaq and S&P suffering historic drops. Within two days, US stock indexes lost trillions, reigniting the debate over Bitcoin’s role as a modern safe haven.

Fast forward to April 2025, and the question of whether Bitcoin can serve as a safe haven got tested again. This time, it was in a much more pronounced way. In February 2025, Trump, now in his second term as president, announced a fresh wave of aggressive tariffs aimed at revitalizing American manufacturing.

This was the kind of headline that immediately spooks financial markets, especially when major trading partners began whispering about retaliation. By April 2, Trump had declared what he called “Liberation Day,” a sweeping set of tariffs covering nearly all imported goods. It was framed as economic patriotism, but to markets, it spelled chaos.

Chaos came quickly. On April 3, the Nasdaq Composite plunged by nearly 6%, losing over 1,000 points in one session. This was a record-setting drop in terms of raw numbers. The S&P 500 didn’t fare much better, falling close to 5%. Investors began to panic about supply chain disruptions, inflationary pressures and a possible global slowdown.

Then came April 4, and the panic only deepened. The Nasdaq slid into official bear market territory, and the Dow lost over 2,200 points in a single day. Within 48 hours, America’s major stock indexes had lost trillions in value.

Did you know? Barry Bannister, chief equity strategist at Stifel, noted that Bitcoin and the Nasdaq 100 have been driven by speculative fervor fueled by lenient Fed policies. He highlighted that Bitcoin tends to trade in tandem with highly leveraged tech-focused ETFs, indicating a strong correlation between Bitcoin and tech stocks.

Bitcoin didn’t soar amid market crash, but It didn’t sink either

During the April 2025 market crash, Bitcoin held steady while stocks plunged, surprising many with its resilience. It didn’t surge, but its stability amid chaos hinted at its growing role as a value-preserving asset in turbulent times.

So, what did Bitcoin do? Surprisingly, nothing catastrophic, and that was the story. While nearly everything else was tanking during the tariff-fueled sell-off, Bitcoin didn’t crash. That alone turned heads.

In a market where even the most established benchmarks were falling apart, Bitcoin’s relative stability stood out to portfolio managers and institutional watchers.

Long criticized as too volatile for serious portfolios, Bitcoin quietly weathered the storm better than many traditional assets. This wasn’t a moonshot moment. It was a resilience moment. Value preservation over value multiplication. And that’s what investors look for in a safe haven. Its ability to hold ground while the Nasdaq and S&P plunged gave more weight to the idea that Bitcoin might be evolving into something sturdier.

To be clear, Bitcoin hasn’t fully decoupled from risk assets. It still responds to liquidity flows, monetary policy and investor sentiment. But at times like April 2025, it showed something different. It didn’t break. It held! And for a growing number of investors, that’s starting to matter.

Bitcoin isn’t the new gold, but it’s not the old BTC either

Bitcoin’s growing resilience stems from a maturing market, rising institutional adoption and its appeal as a non-sovereign, portable hedge in times of financial or geopolitical stress. While not yet the ultimate safe haven, it’s clearly moved beyond its speculative roots and is earning a seat at the table.

Part of this growing strength is structural. Over the past few years, the Bitcoin market has matured. Institutional adoption has risen. Spot Bitcoin ETFs now live in major markets. Custody solutions are better. And perhaps most importantly, there’s a broader understanding of what Bitcoin represents.

Bitcoin is not just a speculative coin anymore. It’s a tool for financial sovereignty, for hedging against fiat depreciation and for stepping outside the boundaries of politicized financial infrastructure.

There’s also the fact that Bitcoin is entirely non-sovereign. In a trade war scenario, where fiat currencies can be weaponized, and capital controls are deployed, Bitcoin becomes very attractive to people who want to move money across borders without interference. It’s portable, permissionless and increasingly liquid. These are three attributes of an asset you want in a crisis.

Of course, none of this means Bitcoin is now the undisputed king of safe havens. Gold still plays that role for most of the world’s conservative investors. The US dollar is still the default when people want liquidity in a crunch. And Bitcoin’s price swings can still make people nervous. But you are seeing it graduate amid the market chaos. It’s no longer the outsider it once was.

Bitcoin in times of crisis, safe haven 2.0?

In both 2019 and 2025, Bitcoin showed flashes of safe-haven behavior, proving it can act as a hedge in times of geopolitical stress. While it’s not gold just yet, its unique properties make it an increasingly serious contender in the global financial playbook.

During both the 2019 trade tensions and the 2025 tariff escalation, Bitcoin acted more like a hedge than it did in earlier cycles. And that’s noteworthy. Even if Bitcoin doesn’t yet consistently play the safe-haven role, it’s starting to show it can, at least in specific contexts.

There’s a bigger question brewing here, too. What does it mean for financial markets if Bitcoin does become a mainstream safe-haven asset? How does that change portfolio construction, risk models or even geopolitical strategy? After all, Bitcoin isn’t gold. It plays by entirely different rules.

Bitcoin is programmable. It can be moved across the world instantly. It can be sliced into satoshis and embedded into smart contracts. If it becomes part of the global toolkit for navigating crises, that changes the game.

So, is Bitcoin the new safe haven during trade wars? Not quite, at least not in the traditional sense. But it has undoubtedly earned a seat at the table.

Bitcoin may not be the asset your grandparents bought to protect themselves in uncertain times, but for a growing number of investors, especially in the digital age, it’s becoming their version of safety. As geopolitical tensions rise and confidence in traditional financial systems erodes, Bitcoin is positioning itself as a potential hedge for the future.

Related Post