Is BitMine Immersion Technologies’ (BMNR) Ethereum Treasury Pivot Redefining Its Instituti

November 18, 2025

- BitMine Immersion Technologies recently announced the appointment of Chi Tsang as CEO and major changes to its board while revealing that it now holds over 3.55 million Ethereum tokens, about 2.9% of total supply, and aims to reach 5%.

- This move positions BitMine as the world’s largest Ethereum treasury, solidifying its unique approach as a publicly listed equity proxy for institutional investors seeking Ethereum exposure.

- We’ll examine how BitMine’s rapid shift to an Ethereum-centric treasury shapes its investment narrative and long-term market positioning.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Advertisement

What Is Bitmine Immersion Technologies’ Investment Narrative?

For investors eyeing BitMine Immersion Technologies, the story hinges on its bold transformation into a massive, Ethereum-centric treasury and on-chain finance platform. This unique position as the largest listed Ethereum holder, aiming for 5% of the network, stands out from conventional crypto miners. The board’s rapid refresh, including Chi Tsang’s appointment as CEO with deep institutional backing, signals intent to further bridge traditional markets with digital assets. However, the company remains unprofitable, with its losses widening even as revenue grows at an impressive clip. Shareholder dilution and a volatile share price are clear risks, especially given BitMine’s reliance on continually raising equity rather than generating profits. While the new leadership could boost institutional confidence, these changes are unlikely to materially alter the biggest near-term catalysts or risks, with the share price still highly sensitive to sentiment and Ethereum’s price swings.

On the other hand, volatility linked to funding and market sentiment remains front of mind for investors.

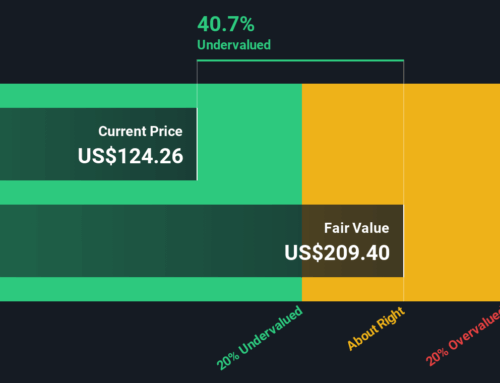

Bitmine Immersion Technologies’ share price has been on the slide but might be dropping deeper into value territory.Find out whether it’s a bargain at this price.

Exploring Other Perspectives

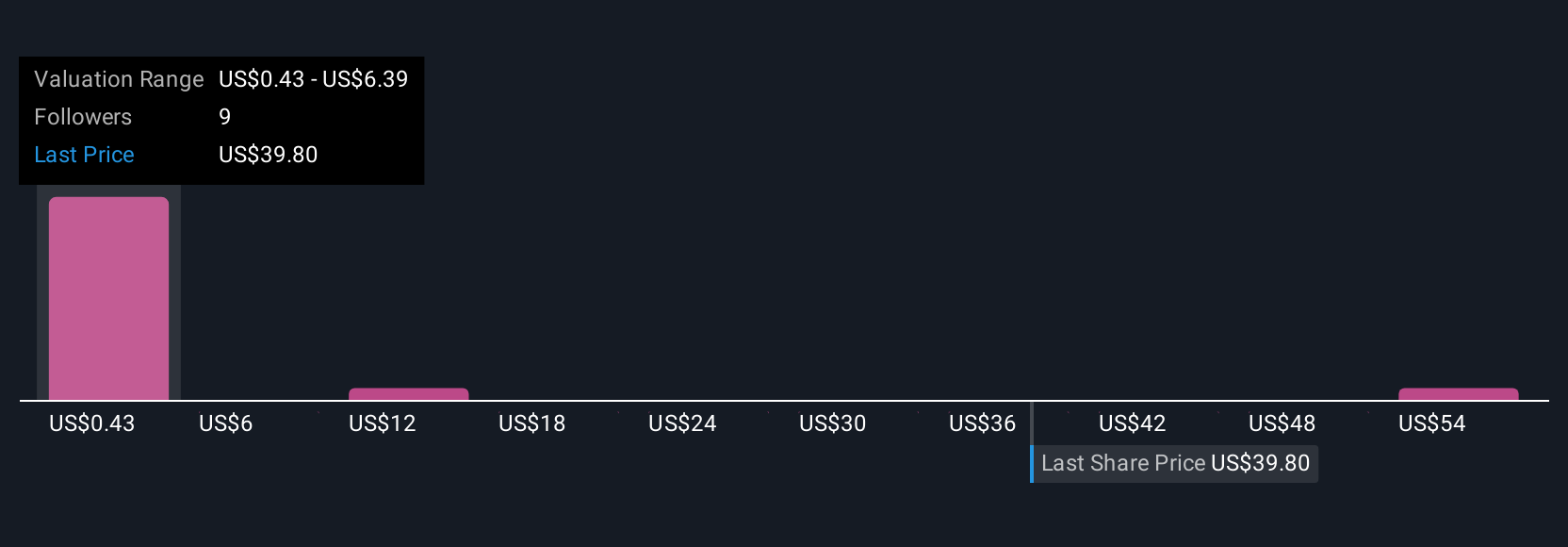

Within the Simply Wall St Community, 27 retail investors estimate BitMine’s fair value across a vast spectrum, from under US$1 to US$130 per share. Opinions reflect considerable disagreement about future prospects, especially given the firm’s continued losses and ongoing need for equity financing. Explore multiple viewpoints to understand what drives such wide-ranging valuations.

Explore 27 other fair value estimates on Bitmine Immersion Technologies – why the stock might be worth over 4x more than the current price!

Build Your Own Bitmine Immersion Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bitmine Immersion Technologies research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Bitmine Immersion Technologies research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Bitmine Immersion Technologies’ overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Bitmine Immersion Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post