Is Ethereum’s comeback real?

May 16, 2025

- Ethereum price hovers above $2,500 on Friday after soaring nearly 100% since early April’s bottom.

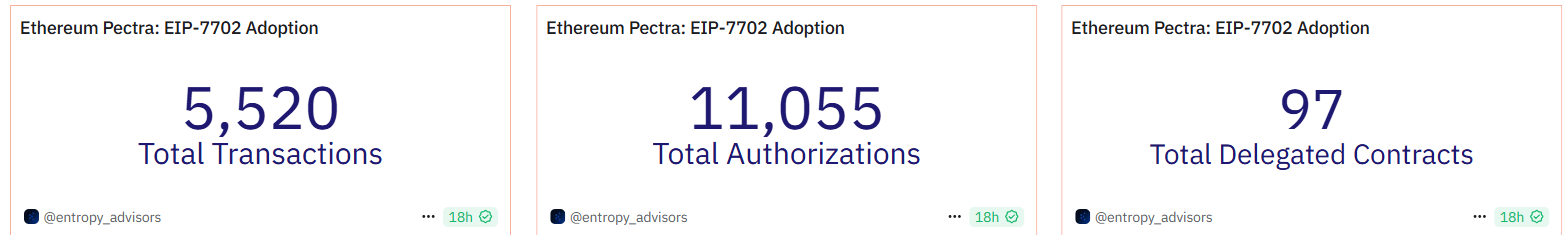

- The ETH Pectra upgrade has boosted over 11,000 EIP-7702 authorizations in a week, indicating healthy uptake by wallets and dApps.

- The growing stablecoin usage and tokenization, Layer 2 institutionalization and ETH short unwind support the price rally.

Ethereum (ETH) is making a comeback after months of underperformance. At the time of writing on Friday, it hovers above$2,500 after soaring nearly 100% since early April’s bottom.

The Pectra upgrade has seen swift adoption, with more than 11,000 EIP-7702 authorizations already processed in a week, indicating healthy uptake by wallets and Decentralized Applications (dApps).

Additionally, the surge in stablecoin activity, rising institutional adoption of Ethereum Layer 2 networks, and an unwind of ETH short positions fuel renewed market optimism. To understand whether this rally has staying power, FXStreet spoke with several crypto experts for their insights.

Ethereum’s latest major network upgrade, Pectra, went live on May 7, marking a significant step forward for the ecosystem. Within just a week of its activation, over 5,520 transactions and 11,055 authorizations have been processed under the new framework, according to Dune data — signaling strong adoption by wallets and dApps.

Building on the momentum of last year’s Dencun upgrade, Ethereum’s Pectra update delivers critical enhancements across usability, scalability, and staking infrastructure.

In an exclusive interview, Alvin Kan, COO of Bitget Wallet, told FXStreet that, “Ethereum’s Pectra upgrade, which brought features like gasless transactions and session-based permissions, unlocks powerful capabilities and could bring the next wave of users! If wallets are able to tackle the challenge of turning Ethereum’s complexity into something intuitive — clear approvals, familiar login flows, and built-in safety checks, we move closer to Web3 that feels less like developer tooling and more like consumer software. Pectra cuts Layer 2 fees, and this could trigger a new wave of on-chain activity. Wallets can scale infrastructure and offer users faster transaction confirmation, better bridging between L1 and L2, and seamless dApp interactions. Performance, not just features, becomes a key differentiator here.”

Ethereum price soared nearly 100% from April’s low of $1,385 to May 13’s high of $2,738, despite lagging behind BTC and other Layer 1 earlier in the cycle.

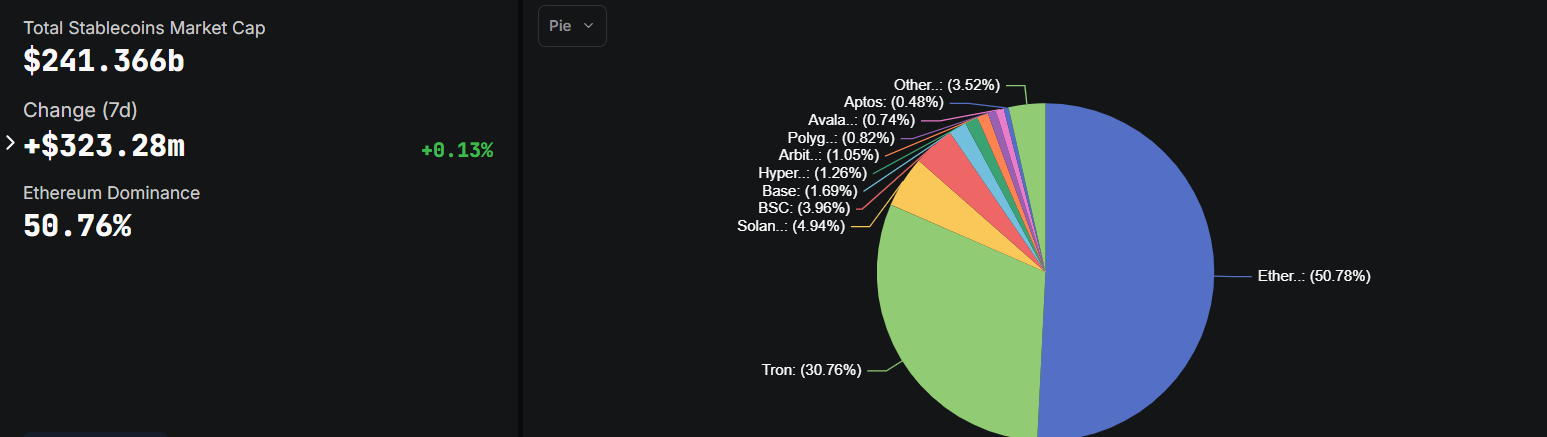

Bernstein analysts, led by Gautam Chhugani, identified three key drivers behind Ethereum’s recent price rally. First, a surge in stablecoin adoption and asset tokenization has reignited interest in Ethereum’s role as foundational infrastructure, highlighted by Stripe’s $1.1 billion acquisition of Bridge and Meta’s renewed push into stablecoins.

The graph below by DefiLama shows that Ethereum currently hosts nearly 51% of the total stablecoin supply, making it the prime platform benefiting from this trend.

Total Stablecoin by chain chart. Source: DefiLlama

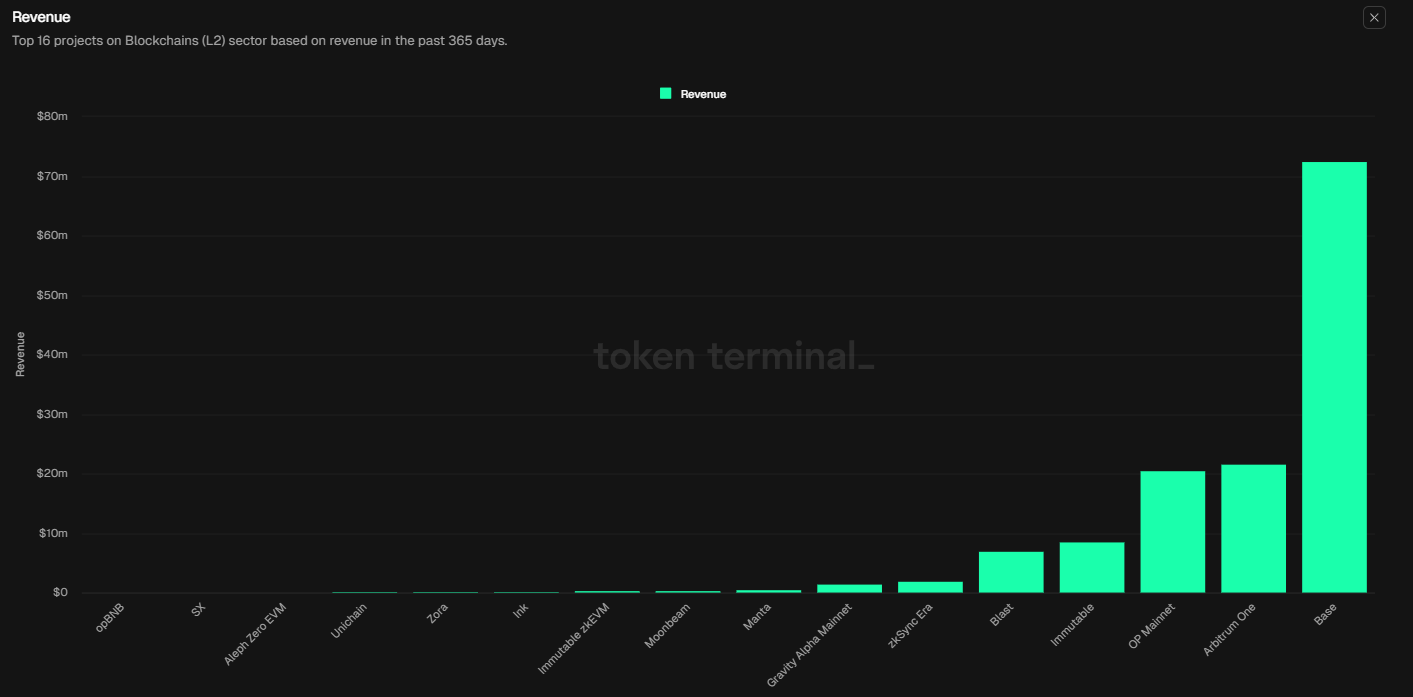

Second, Ethereum’s Layer 2 networks are becoming integral to institutional crypto infrastructure. Platforms like Base are generating substantial revenue, as shown in the graph below, and Robinhood’s acquisition of WonderFi signals a potential expansion into tokenized equities using Ethereum-based systems.

Layer 2 projects revenue in the past 365-day chart. Source: Token Terminal

Lastly, hedge funds that previously shorted ETH to hedge long positions in Bitcoin (BTC) and Solana (SOL) are now reversing those trades. As Ethereum’s fundamentals strengthen and the market narrative shifts in its favor, the unwinding of these shorts has added further upward pressure to ETH’s price.

Moreover, Derive.xyz analyst told FXStreet that ETH has a 20% chance of exceeding $4,000 by Christmas (up from 9% last week) and a 12% chance of hitting $5,000. The chance of ETH falling below $1,500 by Christmas has dropped to 15% (down from 40%).

The weekly chart shows that Ethereum broke above the descending trendline (drawn by connecting multiple weekly highs since mid-December) in the first week of May, rallying 39% and closing above its 200-week Exponential Moving Average (EMA) at $2,243. Ethereum continues its gains by 3.26% so far this week, and when writing on Friday, it trades above $2,500.

Looking at technical indicators, bullish momentum is gaining traction. The Relative Strength Index (RSI) reads 53 and points upward on the weekly chart, indicating slight bullish momentum. The Moving Average Convergence Divergence (MACD) is showing a bullish crossover this week, further supporting the bullish thesis, giving a buy signal and indicating an upward trend.

If ETH continues its upward move, it could extend the rally to retest the 50% Fibonacci retracement (drawn from the December high of $4,107 to the April low of $1,385) at $2,746. A successful weekly close above this level could extend additional gains to test the 61.8% Fibonacci retracement level at $3,067.

ETH/USDT weekly chart

However, if ETH breaks and closes below its 200-week EMA at $2,243 on a weekly basis, it could extend the decline to retest its psychological importance level at $2,000.

To gain more insight, FXStreet interviewed some experts in the crypto markets. Their answers are stated below:

Q: How critical is Ethereum’s dominance in stablecoins to its long-term valuation?

It’s a major pillar of Ethereum’s moat, especially as stablecoins underpin much of onchain activity. If Solana or other chains start to gain significant stablecoin share, it could undermine Ethereum’s perceived dominance, but the L2 vs L1 value split complicates the picture — most burn still comes from L1 activity, even though the roadmap has long planned for L2s to scale throughput.

Q: Can Ethereum compete with Bitcoin as a store of value, or should it focus solely on utility?

Ethereum doesn’t need to choose. Its edge lies in being a hybrid — a utility asset powering onchain economies and a technological store of value backed by ongoing innovation. That combination is hard to replicate and remains compelling for long-term believers.

Q: Is Ethereum the clear winner in real-world asset tokenization infrastructure?

Right now, yes. Over 80% of tokenized assets live on Ethereum or its L2s, driven by institutional trust and tooling maturity. But as usage moves toward DeFi, cost and UX will matter more, opening the door for competition and L2s if Ethereum doesn’t keep executing on the scaling.

Q: What drives Ethereum’s recent 100% rally since April — fundamentals or positioning?

Ethereum’s recent rally appears more positioning-driven than fundamentally led. While the Pectra upgrade introduced meaningful improvements in scalability, staking economics, and UX (via EIPs 7251, 7702, and 7623), these changes are still in the early phase of being priced in. The real catalyst seems to be a mix of technical exhaustion, with ETH/BTC at decade lows, combined with a sentiment shift sparked by leadership messaging and a visible crypto-native rotation. ETF flows remain minimal, underscoring that this move is largely driven by intra-crypto positioning rather than institutional inflows.

Q: How critical is Ethereum’s dominance in stablecoins to its long-term valuation?

Ethereum’s role as the dominant settlement layer for stablecoins is foundational to its long-term relevance. However, that lead is being tested by more performant chains like Solana. Ultimately, Ethereum’s ability to maintain composability, serve as a final settlement layer, and host institutional-grade stablecoins — including potential sovereign-backed ones like a KRW stablecoin — will be key to long-term value accrual. Dominance in stablecoin issuance matters, but it’s Ethereum’s settlement layer stickiness that will determine its staying power.

Q: How much upside does Ethereum gain from Layer 2 adoption and revenue growth?

L2 adoption is a critical unlock for Ethereum, enabling scalability without compromising decentralization. EIP-4844 and the Pectra upgrade further reduce L2 costs via blobspace expansion, but the key issue now is value capture. ETH must prove it can retain meaningful revenue and validator incentives in a world where L2s settle cheaply. While L2s act as distribution channels, recent L1 revenue drops post-Dencun show that Ethereum’s financial sustainability needs recalibration to match this scaling success

Q: What are the main risks to Ethereum’s current price momentum?

Ethereum faces several headwinds: regulatory uncertainty around ETF staking and broader compliance issues, weakening validator economics from declining L1 revenues, and the persistent concern that L2s may not contribute enough to ETH burn or value accrual. If the base layer’s security budget erodes, validator participation and decentralization could suffer. Meanwhile, unless Ethereum finds a way to sustainably monetize the L2 boom, momentum may stall despite strong adoption metrics.

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum’s roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.

Share:

Cryptos feed

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Search

RECENT PRESS RELEASES

Related Post