Is Ethereum’s correction almost done?

April 16, 2025

It may feel like ages, and we don’t blame you for feeling like it, but Ethereum (ETH) has not moved since its all-time high (ATH) of $4865 set in November 2021. It dropped to $883 by June 2022 and rallied slowly to $4109 in December 2024. Four months later, it reached as low as $1384. Currently, it is trading at $1600.

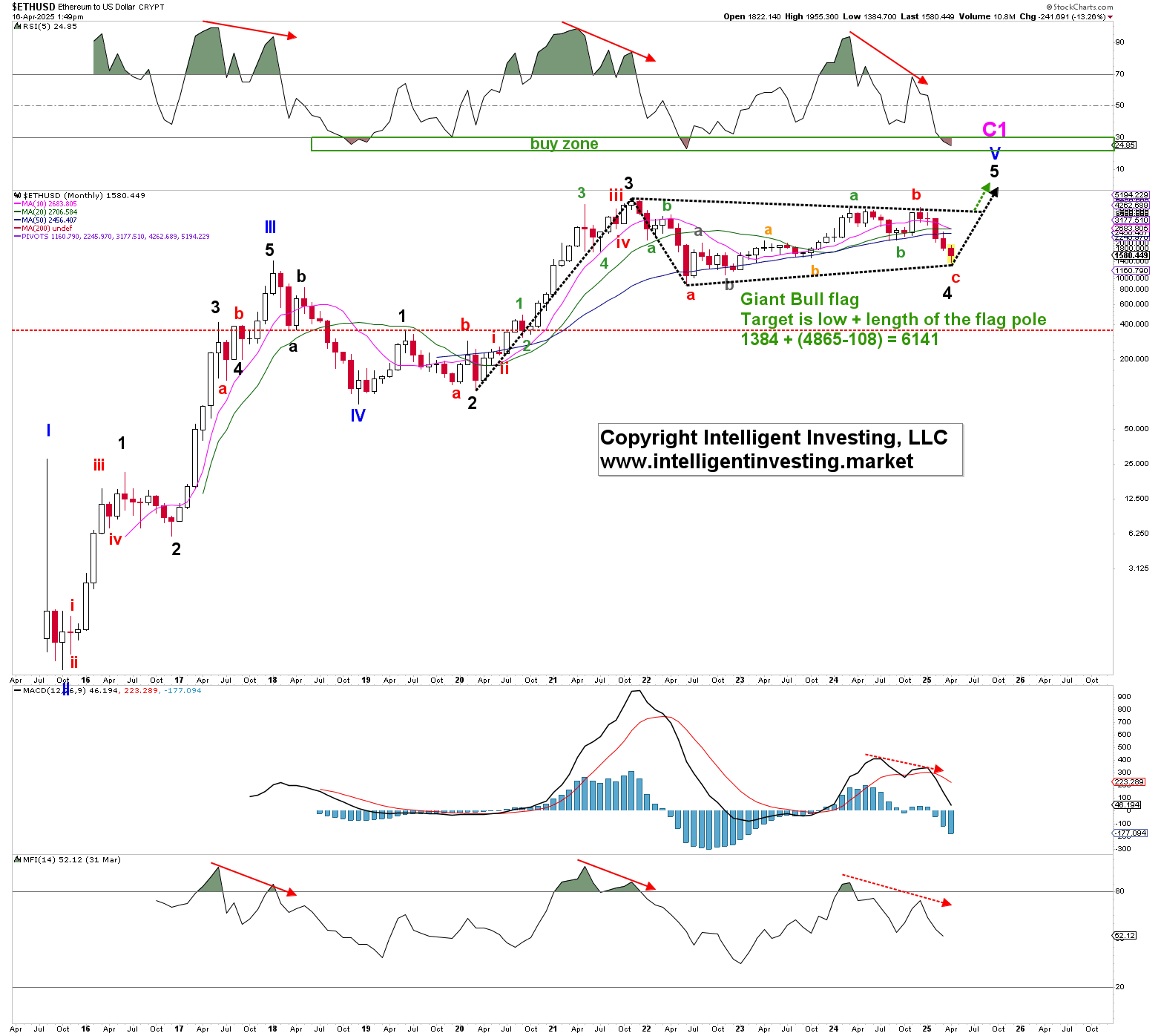

Using the Elliott Wave (EW) Principle, the drop from the ATH to the $883 low counts best as three (green) waves lower (W-a, -b, and -c) to complete a larger (red) W-a. See Figure 1 below. The rally from then to last December’s high overlaps, i.e., lots of ups and downs, and therefore counts best as three subdividing (green) waves as well: red W-b. Now, ETH is completing five waves lower for the red W-c of the black W-4.

In EW terms, a 3-3-5 pattern is called a “flat” correction and occurs primarily as a 4th wave. From a technical pattern perspective, Ethereum is most likely forming a Bull flag pattern (black dotted lines). The flagpole was the rally from the 2020 low to the 2021 ATH. The flag is the aforementioned sideways pattern, and a breakout can then target $6000+, assuming this month’s low holds.

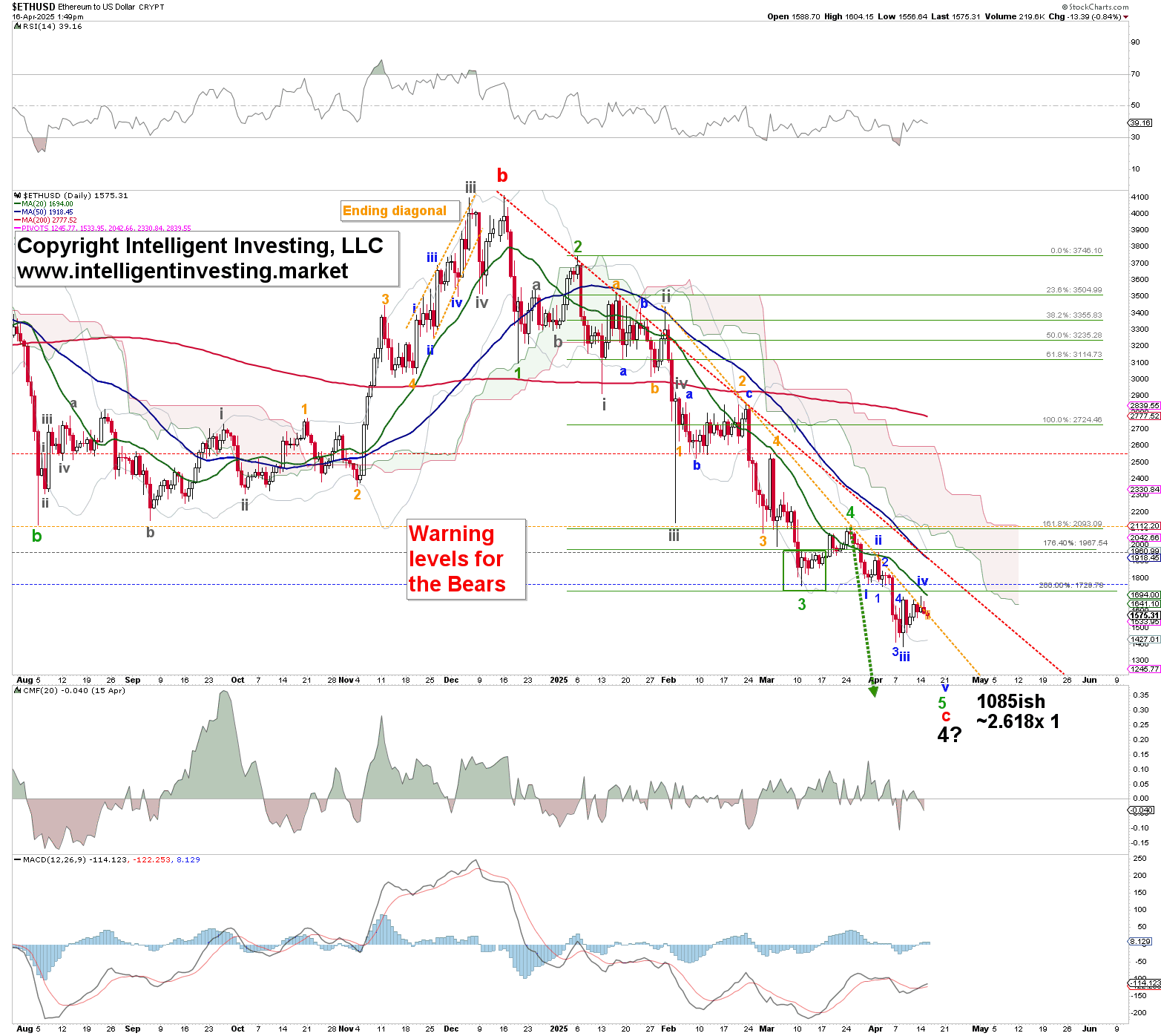

Zooming in on the path since the December 2023 high, we’re tracking the completion of those five waves lower. See Figure 2 below. The ideal target is around $1085, where the green W-5 equals the length of the green W-1, measured from the green W-4 high: green dotted arrow. Moreover, that level is the 2.618x extension of W-1 measured from W-2.

ETH is in a strong downtrend, suggesting more downside. It is firmly below its declining 20-day simple moving average (20-d SMA), which is also below the (blue) 50-d SMA and the (red) 200-d SMA. It is also below the declining Ichimoku Cloud and the (red dotted) downtrend (DT) line, which has held all upside in check since the December high.

Thus, Ethereum can still wrap up at least one more set of 4th and 5th waves to the ideal $1085ish target zone to complete the more significant (black) 4th wave. However, if ETH moves above at least the 50-d SMAs, the DT line, and $2093 without making a lower low first, we must consider the four-month-long downtrend complete and look towards the low $6000s over the next several months. As such, there’s an increasingly favorable risk/reward setup in the making for those who would like to have exposure to Ethereum, contingent on holding above its 2019 high at $356.

Share:

Cryptos feed

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Search

RECENT PRESS RELEASES

Related Post