Is Investing in “The DORKs” a Good Idea Right Now? @themotleyfool #stocks $DNUT $KSS $RKT

July 27, 2025

Hoping to profit from a short squeeze is a risky strategy.

There’s a new investing trend out there. Well, perhaps “newish” is the best way to put it, because to my eyes this is just a recycling of the meme stock fad that swept through the markets four years ago. That didn’t end well for a lot of people, and I have similar expectations for this one.

The stocks feeding into this trend are known as DORK stocks — an acronym for the stock tickers of Krispy Kreme (DNUT 3.02%), Opendoor Technologies (OPEN 4.34%), Rocket Companies (RKT 0.71%), and Kohl’s (KSS -6.16%). Just as in the meme stock boom of old, some of these companies are seeing wild changes in price and valuation for no good reason. But the trading volume is up as investors’ interest is piqued.

If the DORK stock name isn’t enough to scare you off, then perhaps a closer look at the companies would do it. However — and I can’t stress this enough — investing in DORK stocks seems to be a really bad idea. If you’re itching to try it, here’s what you should know.

Image source: Getty Images.

Hype isn’t a realistic strategy

First, let’s take a look at the companies. Krispy Kreme makes great doughnuts, but I’m not willing to say it’s a good investment today. Opendoor, which operates a digital platform that allows people to sell their houses, is linked closely to Rocket Companies, which allows people to apply for mortgages and manage their money. Kohl’s is a struggling big-box clothing retailer.

Krispy Kreme saw first-quarter revenue drop by 15% from a year ago, and posted a loss of $33.4 million and an earnings per share loss of $0.20. Opendoor’s Q1 revenue dropped by 2%, to $1.2 billion, and the company posted a net loss of $85 million. Rocket saw its Q1 revenue drop 25% from a year ago to $1.03 billion, and posted a loss of $212 million. And Kohl’s saw net sales for the first quarter drop 4.1% to $3 billion. Like other DORK names, Kohl’s was in the red for the quarter, posting a loss of $15 million.

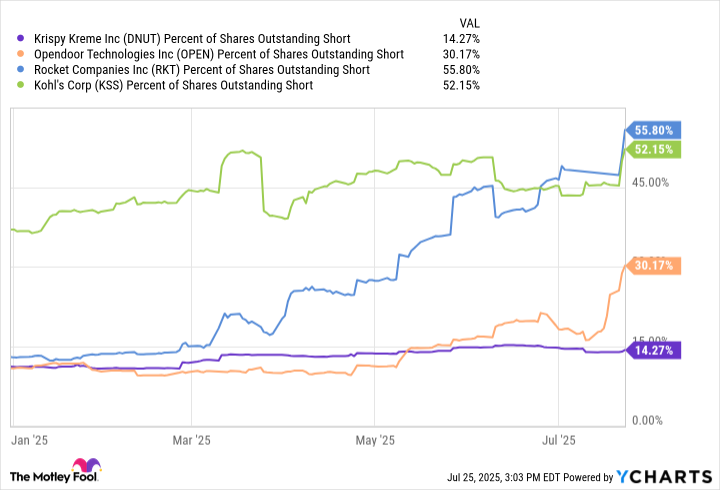

So, the DORK stocks, at least today, are officially losers. But there are a few meme-type catalysts that are pushing them into the public eye, such as short interest. Rocket and Kohl’s both have more than half of their outstanding shares shorted, while Opendoor has more than 30%. All of those numbers are incredibly high.

DNUT Percent of Shares Outstanding Short data by YCharts.

When investors short a stock, they’re betting that the price will go down, so there’s a lot of money out there betting that these names will drop. Retail investors can lap up additional shares in hope that hedge funds that are betting against a stock will find themselves squeezed and have to sell at a higher price — similar to the infamous short squeeze of GameStop in 2021.

We’re back to 2021

I know there are lots of retail investors who enjoyed the 2021 meme stock fad that included names like GameStop, AMC Entertainment, and BlackBerry. I wasn’t one of them. In fact, I wrote pretty stridently against investing in meme stocks, because I see it as a sure way of losing money over the long term. When you’re trading on pure momentum without a solid underlying business, you’re just asking to lose your money.

Some of the DORK stocks are already showing major volatility. Kohl’s, which normally has a trading volume of 13 million shares, saw 209 million shares traded on July 22. The stock price jumped 120% over a two-day period, but has since lost nearly all those gains.

Opendoor became hot when a hedge fund manager put a price target of $82 on the stock, which had been struggling to remain at more than $1 and avoid potentially being delisted from the Nasdaq. Now Opendoor is up 380% in the last month (although at this writing, it still trades for less than $2.50 per share). The stock saw massive trading volume of 1.8 billion shares on July 21 and 1.07 billion shares on July 23. (Its average volume is only 164.8 million shares.)

Krispy Kreme’s shares haven’t been as volatile (probably because the short interest is comparatively low). But it still had more than 152 million shares trade hands on July 23, compared to its average trading day of 8.2 million. Rocket Companies also saw action July 22 and July 23 as more than 51 million shares changed hands each day, versus the company’s average trading volume of 15.4 million shares.

But the reality is that you can’t time the market, and many more people lose money than win trades with meme stocks. Because short-term stock prices are a product of supply and demand, you can’t predict how a stock price will move — and if you guess wrong, you could sustain some big losses.

How to invest

My advice is to hold back. There are hundreds of better choices than a meme stock, and you should instead be looking for names with good fundamentals, decent profit, and a sustainable business model.

But if you are determined to invest in DORK stocks, hedge your bets. Invest responsibly, with only a small part of your portfolio that you are willing to lose. You never want to overplay your hand, particularly with volatile investments — and those include DORK stocks.

Search

RECENT PRESS RELEASES

Related Post