Is It Safe to Invest in Defense Stocks Again?

November 1, 2025

Pure-play defense companies have faced challenging margin conditions in recent years, but are there signs of improvement in recent results?

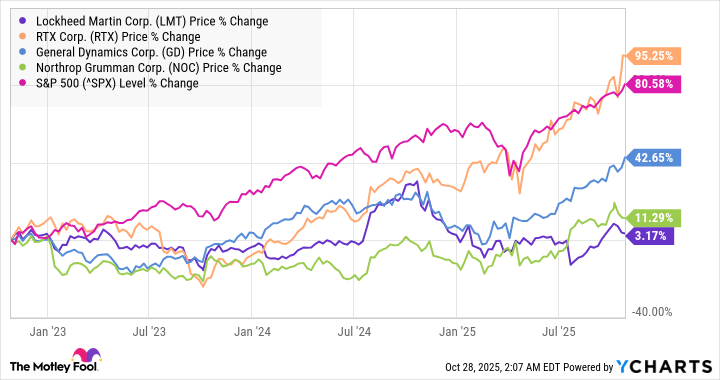

It’s been a confusing period for defense companies. While the end-market environment appears conducive to revenue growth, many of the leading defense contractors have notably underperformed the market.

That said, three leading defense companies, Lockheed Martin (LMT +0.44%) and the defense businesses of GE Aerospace (GE 0.53%) and RTX (RTX +0.61%), raised their full-year guidance recently. Is this a sign that the defense industry has turned the corner?

Defense companies on the defensive

The chart below shows the underperformance of some of the leading defense contractors in recent years, with RTX arguably being the only outperformer due to its commercial aerospace exposure. It’s somewhat surprising given NATO’s expansion and the commitment by NATO countries to invest 5% of their individual annual gross domestic product (GDP) in defense by 2035, with a minimum of 3.5% a year before reaching this goal.

Image source: Getty Images.

The percentage numbers may seem small, but they are game changers in a mature, relatively low-growth industry like defense. Moreover, there’s a need to replenish equipment sent to Ukraine. There’s no shortage of geopolitical flashpoints to spur more spending, as well as U.S. defense spending priorities, including the Golden Dome. Yet the chart reads as follows.

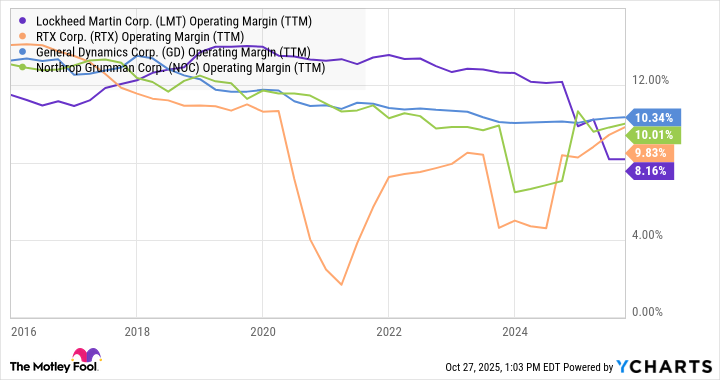

The problem appears to come down to two issues, both of which play out as stagnating, declining margins for defense companies — never a good sign.

LMT Operating Margin (TTM) data by YCharts

The first of the two issues relates to the supply chain crisis stemming from the COVID-19 lockdowns (which continue to negatively impact missile production today due to a shortage of rocket motors) and to ballooning inflation for certain defense products. The second issue is more concerning and relates to ongoing margin pressure from fixed-price development programs and a more challenging negotiating position being taken by the industry’s most important client, the U.S. government.

Moreover, the increasing complexity of some of these defense programs — Lockheed Martin’s technology refresh of the F-35 fighter and Boeing’s (BA +0.47%) problematic fixed-price development programs, including Air Force One — has taken its toll on both companies.

Three companies that raised guidance recently

That said, there are signs of recovery. Boeing’s CEO, Kelly Ortberg, is doing an excellent job of getting its defense business back to profitability. RTX terminated a fixed-price development contract last year as management prioritized better growth opportunities, and as noted, GE Aerospace, RTX, and Lockheed Martin recently raised guidance in their defense businesses.

|

Company |

Business |

Full-Year Guidance Change |

|---|---|---|

|

Lockheed Martin |

Total company |

Increased midpoint of sales guidance by $250 million to $74.5 billion, and segment operating profit by $50 million to $6.7 billion |

|

GE Aerospace |

Defense and propulsion technologies |

Increased revenue growth expectations to high single-digit growth from mid single digits to high single digits, and midpoint of segment operating profit by $500 million to $1.25 billion |

|

RTX |

Raytheon |

Increased midpoint of adjusted operating profit guidance by $163 million to $3.15 billion |

Data source: Company presentations.

What management said

Digging into the details, GE Aerospace management said its increased guidance was due to “year-to-date performance from improved deliveries,” likely driven by improved material availability. Lockheed Martin’s guidance increase was underwhelming, and although CEO Jim Taiclet said the company has tried to take the “lion’s share” of the risk out of fixed-price development programs, he, understandably, couldn’t predict with 100% certainty that every risk was covered.

Meanwhile, RTX management cited guidance increases for international deliveries, notably higher-margin Patriot deliveries, in the third quarter. It said that orders came through for core, mature Raytheon products that it can deliver at higher margins.

What it means for investors

The improvement in parts availability from GE Aerospace is a good sign, but note that it primarily makes engines. Lockheed’s guidance increase is minimal, and RTX’s Raytheon profit guidance was driven by a mix of orders (revenue guidance stayed the same), which may not repeat.

All told, while progress has been made on the supply chain issue, it’s far from clear that the pressures on defense stocks have fully abated. Consequently, if you want exposure to the industry, it makes sense to stick to stocks like GE Aerospace, RTX, and Boeing rather than the pure-play defense companies.

We may well be moving to an era where a combination of tougher bargaining by the defense industry’s largest client and the increasing complexity of defense technology is creating a long-term pincer movement on margins.

Search

RECENT PRESS RELEASES

Related Post