Is Meta Stock a Buy for 2026?

January 9, 2026

Meta Platforms had a rough end to 2025.

Meta Platforms (META +1.32%) didn’t have a bad 2025, as its stock rose around 13%. Still, that trails the S&P 500 (^GSPC +0.51%), as it delivered 16% gains in 2025. However, Meta could have handily outperformed the market if its third quarter earnings report hadn’t been so poorly received by the market. That caused the stock to drop in October, and shares haven’t recovered since.

Meta’s stock is down around 16% from its all-time high, which could present a buying opportunity for investors if the reason it fell was shortsighted in nature.

So, is Meta a strong buy for 2026? Or is there something investors should be worried about?

Image source: Getty Images.

Meta’s advertising business is crushing it

Meta Platforms is the parent company of social media sites like Facebook, Instagram, and Threads. None of these platforms costs any money to use, and when something is free to use, you are the product. All of these platforms generate revenue through advertising income — a business model that’s becoming even more sophisticated with the integration of artificial intelligence (AI).

During Meta’s Q3 earnings call, founder and CEO Mark Zuckerberg discussed the huge gains the company is seeing by implementing generative AI. Its numbers indicate users are spending 5% more time on Facebook and 10% on Threads. He highlighted videos on Instagram being watched 30% more this year than last. The more time users spend on these platforms, the more ads they are exposed to, increasing Meta’s revenue.

Advertisement

Meta Platforms

Today’s Change

(1.32%) $8.52

Current Price

$654.58

They’re also using AI to ensure the ads viewers are seeing are relevant, which increases conversion rate. A better-performing ad can charge a premium, and all that adds up to Meta’s advertising business doing incredibly well.

In Q3, Meta’s overall revenue rose 26%. Of Meta’s $51.2 billion total revenue in Q3, $50 billion came from advertising, so this is the primary focus of the company’s finances.

However, investors often forget about how Meta is making money and zoom in on where it’s spending, which is where the problems arise.

The market is worried about Meta’s spending

Meta has been no stranger to spending large sums of money where it thinks the direction of social media is heading. A few years ago, it changed its name to Meta Platforms to reflect its massive investment in the metaverse, a vision that never came about. Now, it’s spending huge sums of money on AI data centers, an area where some are questioning if Meta is spending too much.

In 2024, Meta spent $39.4 billion on capital expenditures. For 2025, it expects that total to come in around $70 billion to $72 billion. That’s about a $30 billion increase from 2024 to 2025, but the jump in 2025 to 2026 could be even greater.

In Meta’s guidance, the company noted that it expects “the capital expenditure growth will be notably larger in 2026 than in 2025.” This means that capital expenditures will total at least $100 billion in 2026, and likely much higher.

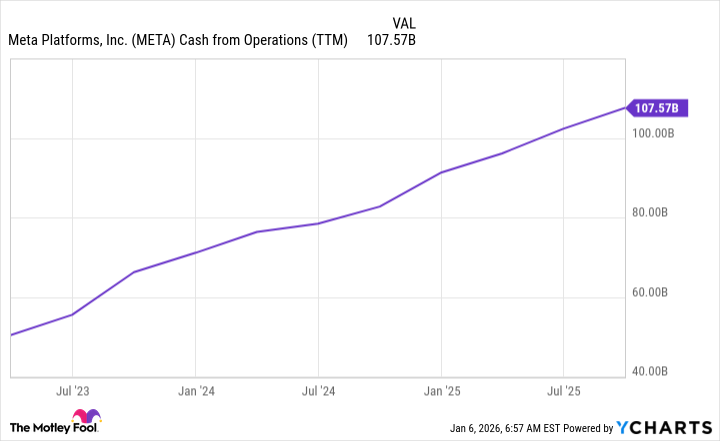

Over the past 12 months, Meta has generated nearly $110 billion in cash from operations, so essentially all of its cash flows will be devoted toward building out its AI infrastructure footprint.

META Cash from Operations (TTM) data by YCharts

This concerns the market, so the stock got slammed following the Q3 release. The question is, is the risk worth the reward?

In my opinion, yes. Meta has a dominant base business, and while cash flows could be used elsewhere, the benefit that AI could have could make these data centers worth every penny. There’s also the possibility that they end up being a colossal waste, at which point Meta reverts to its base business and becomes a cash flow machine again.

Either way, I think Meta will be a successful long-term investment. You have to keep your eye on the future rather than some of the short-term spending plans it has. The market is focused on the short term, thus the negative reaction. This is a great long-term opportunity, and 2026 should be a great year to bounce back.

Search

RECENT PRESS RELEASES

Related Post