Is SharpLink Gaming’s (SBET) Ethereum Strategy Recasting Its Digital Asset Narrative?

October 10, 2025

- SharpLink Gaming recently presented at the Digital Asset Treasury Showcase after reporting near US$1 billion in unrealized profits from its Ethereum holdings, reflecting significant growth in its digital asset portfolio since June.

- The company’s Ether holdings, which total around 839,000 coins, have positioned SharpLink among the most prominent corporate participants in digital asset treasuries and staking initiatives.

- We’ll examine how SharpLink’s expanding Ether portfolio and yield-generating plans inform its evolving investment narrative in digital assets.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Advertisement

What Is SharpLink Gaming’s Investment Narrative?

For anyone considering SharpLink Gaming, the underlying belief to hold the stock is that the company’s transformation into a digital asset-focused business will translate its large Ethereum holdings and blockchain integration into future value, despite current unprofitability and thin revenues. The recent surge in SharpLink’s Ethereum portfolio, and the move to stake ETH on emerging networks like Linea, has quickly become one of the most important short-term catalysts. This newfound liquidity and nearly US$1 billion in unrealized gains could temporarily ease some liquidity and going concern worries, shifting attention back to digital asset initiatives and potential equity innovations like stock tokenization. However, unresolved challenges remain: SharpLink’s financial position is still fragile, ongoing volatility in ETH prices could rapidly reduce reported profits, and regulatory uncertainty clouds digital assets. While the news has changed the conversation, the largest risks are still present.

On the other hand, ETH volatility remains an ongoing risk shareholders need to watch closely.

Despite retreating, SharpLink Gaming’s shares might still be trading 16% above their fair value.Discover the potential downside here.

Exploring Other Perspectives

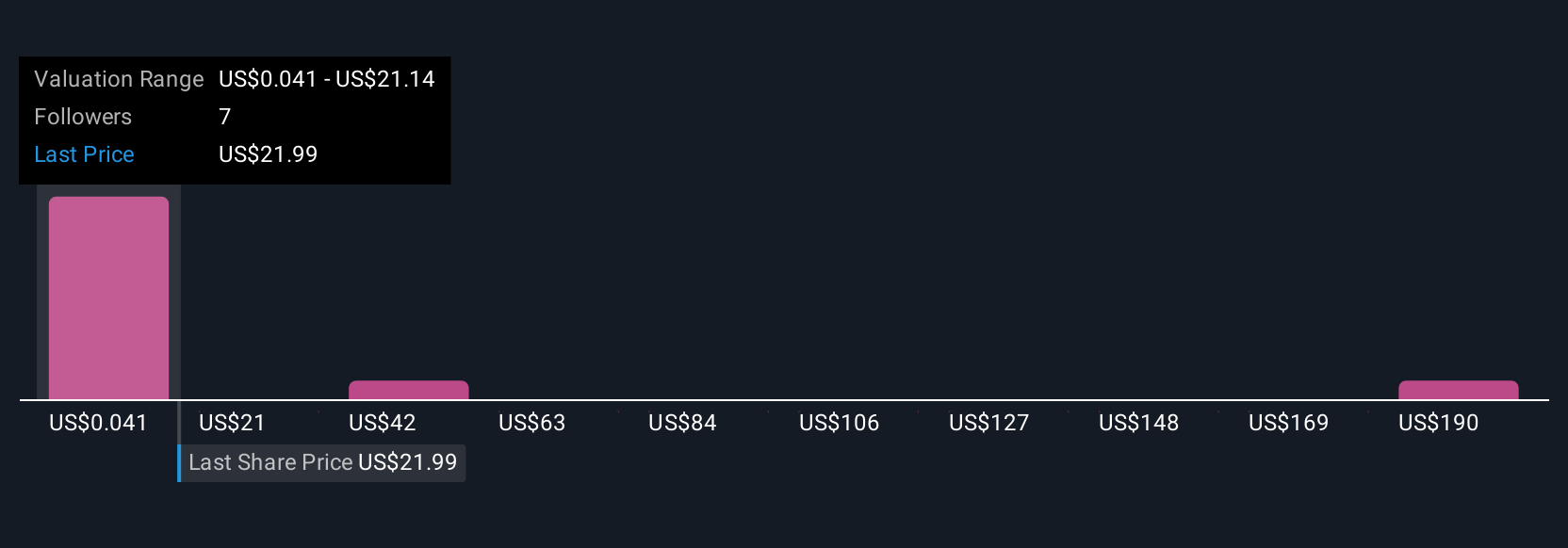

With 17 separate fair value estimates from the Simply Wall St Community, retail investor expectations on SharpLink’s worth span from less than US$1 to well over US$60,000 per share. This remarkable gap in views highlights just how much opinion can diverge, especially while the business faces both massive digital asset gains and persistent financial risks. Explore these alternative viewpoints to see how others are sizing up SharpLink’s shifting future.

Explore 17 other fair value estimates on SharpLink Gaming – why the stock might be a potential multi-bagger!

Build Your Own SharpLink Gaming Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your SharpLink Gaming research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free SharpLink Gaming research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate SharpLink Gaming’s overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post