Is Veracyte’s (VCYT) Confident Double‑Digit Revenue Outlook Altering The Investment Case F

January 22, 2026

-

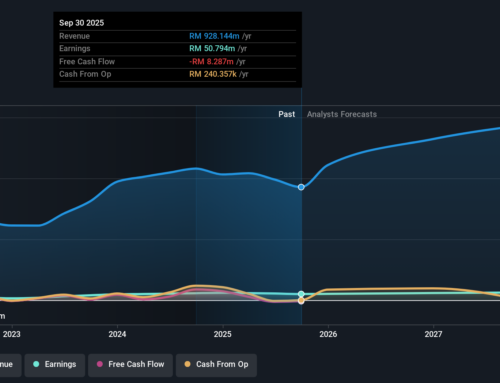

Earlier this month, Veracyte, Inc. issued preliminary guidance for the fourth quarter and full year 2025, projecting total revenue of about US$138–US$140 million for the quarter and roughly US$515–US$517 million for the year, and outlined an expected 2026 revenue range of US$570–US$582 million.

-

This guidance highlighted double‑digit revenue growth expectations across both 2025 and 2026, signaling management’s confidence in the company’s current business trajectory.

-

With recent guidance pointing to continued double‑digit revenue growth, we’ll examine how this shapes Veracyte’s investment narrative for investors.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 31 companies in the world exploring or producing it. Find the list for free.

To own Veracyte today, you need to believe in its ability to keep expanding its genomic testing footprint while turning recent profitability into something more durable. The new 2025 and 2026 revenue guidance, which implies steady double digit growth, largely reinforces the existing bull case rather than transforming it, but it does slightly shift the near term focus toward execution against higher expectations. In the short run, key catalysts remain clinical data readouts, adoption of tests like Afirma and Decipher, and any signs that operating leverage is improving off a high earnings multiple. On the risk side, the stock’s rich valuation, reliance on a few flagship assays, and the presence of one off items in recent results still matter, and the guidance does not remove those concerns so much as put more pressure on management to deliver.

However, one risk in particular may not be fully reflected in the recent excitement. Veracyte’s shares have been on the rise but are still potentially undervalued by 29%. Find out what it’s worth.

Six Simply Wall St Community fair value views for Veracyte span roughly US$24 to almost US$69 per share, underscoring how far apart individual estimates can be. Set against management’s fresh double digit growth guidance and a still demanding earnings multiple, this spread gives you a sense of how differently the same risks and catalysts are being interpreted.

Explore 6 other fair value estimates on Veracyte – why the stock might be worth 44% less than the current price!

Disagree with this assessment? Create your own narrative in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Terms and Privacy Policy

Search

RECENT PRESS RELEASES

Related Post